(Bloomberg, Washington) The record amount of U.S. Treasury and institutional bonds sold in China in the first quarter of China, highlighting that under the continuation of trade tensions, China is adopting a diversified layout away from US assets.

According to Bloomberg's latest data on the Ministry of Finance, Beijing sold a total of US $ 53.3 billion (S $ 71.7 billion) US Treasury and institutional bonds in the first quarter.Belgium, which has always been regarded as the place where the Chinese custody account is located, also sold $ 22 billion in US Treasury bonds during this period.

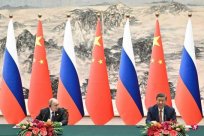

There are signs that the tension between the world's two major economies may deteriorate, and China's investment in the United States has re -attracted investors' attention.The Biden government announced earlier that tariffs were imposed on a series of Chinese imported goods.His predecessor Trump once said that if he was elected again, more than 60%of tariffs were imposed on Chinese goods.

Stephen Chiu, chief Asian foreign exchange and interest rate strategist of Bloomberg industry research, said: "Although we are close to the Federal Reserve’ s interest rate cut cycle, China is still selling these two assets. It should have a clear intention, that is, far from the US dollar away from the US dollar.Assets, realize a diversified layout "

He said that with the restart of the Sino -US trade war, China's selling speed of American securities may accelerate, especially if Trump re -holds the president.