On April 11, the Shanghai Stock Exchange issued a supervision letter to Zhongke Shuguang to clearly regulate the supervision requirements on the short -term transaction matters of the company's directors.

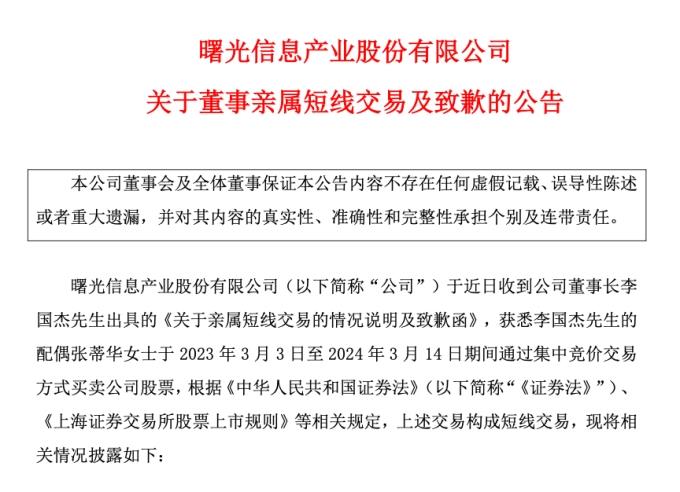

On the same day, Zhongke Shuguang (603019.SH, a market value of 65 billion yuan) announced. Recently, he received a briefing and apology letter from the short -term transaction of relatives by the company's chairman Li Guojie.From March 3, 2023 to March 14, 2024, the company's shares were traded through centralized bidding transactions, and the above transactions constituted short -term transactions.

The announcement disclosed the basic situation of this short -term transaction.After verification, Zhang Tihua held a company stock since March 3, 2023, and bought a total of 334,3296 shares (141 pens) from March 3, 2023 to March 14, 2024. The cumulative The total turnover of the turnover is 153669067.94 yuan ; a total of 3342596 shares of the company's stock (91), the cumulative transaction amount is 154417295.06 yuan ; after deducting transaction commissions, stamp tax and other taxes and feesIncome 589779.30 yuan .As of the date of this announcement, Zhang Dihua still holds 700 shares of the company.

According to the provisions of Article 44 of the Securities Law: "Companies, which are traded by other national securities trading venues approved by listed companies and stocks approved by the State Council, hold more than 5 % of the shareholders, directors, supervisors, and senior managers who hold more than 5 % of the shares of shares., Sell the company's shares or other equity securities within six months after buying, or buy it within six months after the sale, so the income is owned by the company. "Essence"The directors, supervisors, senior managers, shares held by shareholders, or other equity -owned securities, including their spouses, parents, children hold and use the stocks held by other people's accounts or other equity properties, including their spouses, parents, children.Securities.

Zhongke Shuguang said that according to regulations, Zhang Tihua's above -mentioned transactions constitute a short -term transaction, and the income and subsequent income of the company should be owned by the company.As of the disclosure of this announcement, Zhang Tihua has paid the income of 589,800 yuan in the short -term transaction to the company.

Zhongke Shuguang said that Zhang Tihua failed to correctly understand the relevant laws and regulations of short -term transactions, and There is no subjective intentional violations. During the transaction period, he did not consult Li Guojie's opinion or informed the above transaction behavior. It was an investment behavior made by individuals based on the information that has been published by the securities market and independently based on personal judgment.The situation of trading company shares because of the inside information is learned, and there is no purpose of using inside information to seek benefits.

The dawn of Zhongke finally stated that Ms. Zhang Tihua had realized the seriousness of this violation of the regulations and had sincere apologies to investors' sincere effects on the adverse effects of the market and investors due to the short -term trading behavior on the market and investors.EssenceMr. Li Guojie deeply blame his relatives and failed to discover his relatives in time.Mr. Li Guojie and Ms. Zhang Dihua promised to strictly abide by relevant laws and regulations.

Public information shows that the main business of China Science and Technology Shuguang is the research and development and manufacturing of high -end computers, storage, security, and data center products. At the same time, it will vigorously develop digital infrastructure construction and intelligent computing.The main products are high -end computers, storage products, network security products, cloud computing services, data infrastructure construction, computing power service platform, etc.

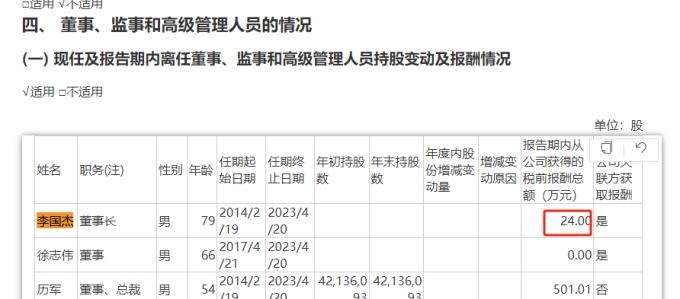

According to the 2022 annual report, Li Guojie, a researcher at the Institute of Computing of the Chinese Academy of Sciences and an academician of the Chinese Academy of Engineering, has been the chairman of the company since 2014. Li Guojie's annual salary of 2022 was 240,000, and he did not hold the company's shares.

In terms of performance, China Science and Technology dawn achieved operating income of 14.354 billion yuan in 2023, an increase of 10.35%year -on -year; net profit of home mother was 1.838 billion yuan, an increase of 19.00%year -on -year.

Edit | Cheng Peng Du Hengfeng

School pair | Tang Yawen

Daily Economic News Comprehensive self -announcement, Zhongxin Jingwei