From steel, batteries to electric vehicles, the manufacturers that are incomplete in China's domestic market have also been resisted by many countries when they export.Does Chinese products have dumping?Who said the "overcapacity"?Can the "replacement of the old" action help China to digest excess capacity?

Since April, "overcapacity" has become a new field for China and European and American countries.

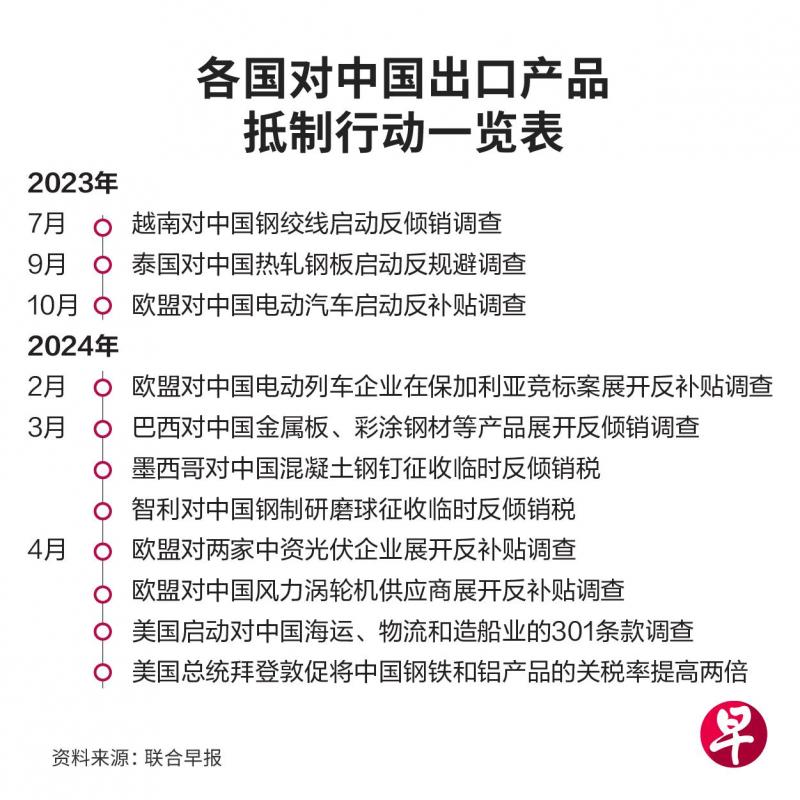

From the US Finance Minister Yellen to Germany, the Prime Minister of Germany, all expressed concerns about China's excess capacity when he visited China this month.At the same time, the European Union launched an anti -subsidy survey on a number of Chinese new energy companies, and the United States launched a survey of Article 301 of China's shipping, logistics and shipbuilding industries.

In just one month, disputes around the overcapacity have expanded from new energy products such as electric vehicles, solar panels and lithium batteries to traditional industries such as steel and aluminum.Although the definition and scope of the dispute over the excess capacity has its own words, the analysis generally believes that the overcapacity of this round of capacity has begun to deteriorate the crisis of the Chinese real estate industry in the past two years.

The Chinese property market will shift investment to advanced manufacturing

In order to offset the downturn of the property market, the Chinese government has shifted investment to advanced manufacturing and promotes the production and export of new energy products.The downlink of the property market has also exacerbated the slow sales of steel and building materials to promote more steel manufacturers to turn to foreign markets.

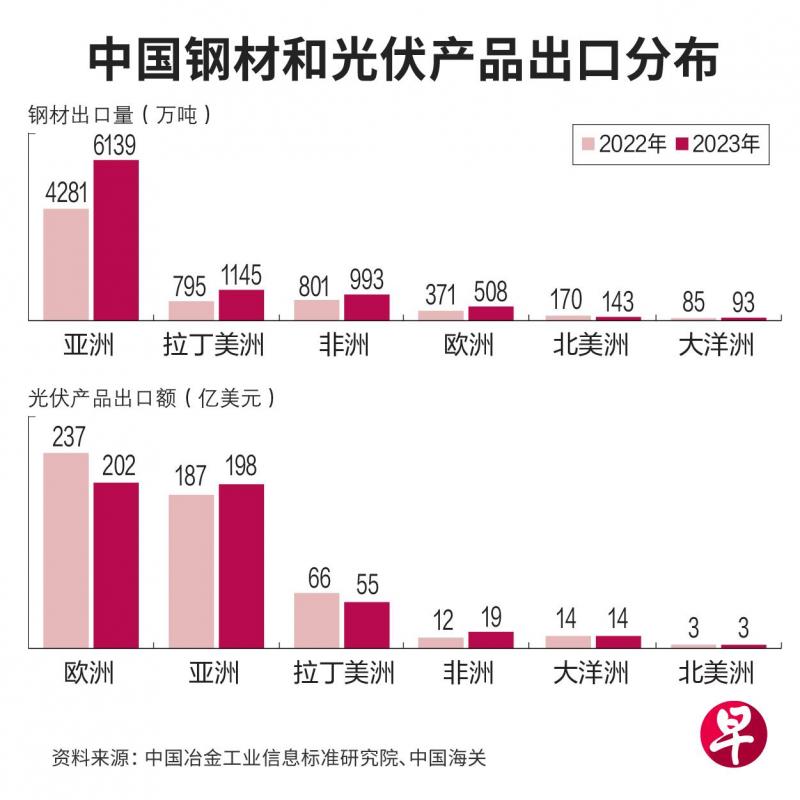

Last year, China's steel export volume exceeded 90 million tons, the highest level since 2017; the average unit price of exports fell 32.7 % to $ 936.8 per ton (S $ 1276).The trend of increased price and decline continued until the first quarter of this year. The export volume of steel increased by 30.7 % year -on -year, and the average unit price of exports slipped by 33.4 % to $ 788.5 per ton.

Ma Tao, deputy director of the International Political Economics Research Office of the Institute of World Economics and Political Sciences of the Chinese Academy of Social Sciences, pointed out in an interview with Lianhe Zaobao that Chinese steel production is mainly to meet the needs of domestic economic development.About 5%, far below the proportion of exports of steel in Japan and South Korea, accusing China of failure to be fair.

However, Japan's crude steel output last year was 86.83 million tons, while South Korea was less than 70 million tons, and it was not even as export of Chinese steel.China, which occupies half of the world's steel output, even exports only 5%, is enough to have a huge impact on the global market.

According to the statistics of the China Metallurgical Industry Information Standards Research Institute, last year, there were 112 announcements such as anti -dumping and anti -subsidy of China's launching steel products in China, an increase of about 20 year -on -year.In addition to developed economies in Europe and the United States, developing countries such as Brazil, Mexico and Chile have also begun to counterattack "Made in China."

One of the largest steel manufacturers in Chile (CAP) announced last month that China Iron and Steel, which is 40%cheaper, will shut down a local steel plant, causing more than 20,000 workers to unemployment.Employees of Iron and Steels subsequently went to the Chilean capital of San Diego to protest, asking officials to resist unfair competition from Chinese steel.

The World Bank warned earlier this month that China ’s attempt to shift investment to advanced manufacturing under the background of real estate and consumption weakness may cause unbalanced capacity and demand at home and abroad.Excess capacity in electric vehicles and other fields has begun to affect neighboring countries such as Thailand.

Aaditya Mattoo, chief economist in East Asia and Pacific, said that the electric vehicle industry may fall like a solar panel."Of course, these subsidized products will face resistance. The world's ability to absorb 'China Intellectual" is not as good as the past. "

Compared with steel, the overcapacity in the field of new energy is even more intense.In the face of European and American accusations, Chinese officials initially emphasized that Chinese new energy companies did not rely on subsidies, but relying on continuous technological innovation, improving the production chain system, and full market competition to achieve rapid development.A spokesman for the Chinese Ministry of Commerce also said on Thursday (April 25) that from a global perspective, the new energy market is not overcapacity, but a shortage of production capacity.

Jayant Menon, a senior researcher at Jayant Menon, Singapore's Yosov Isa Easa East South Asia Research Institute, analyzed that China is seeking to offset the downturn of domestic demand by increasing exports, but this phenomenon is not extensive, but is specific to specific, but with specific specific existence, but with specific specific existence, but specific to specific, but specific to specific, but specific to specific, but specific to specific, it is different from specific.The industry is highly related.

Mei Nong pointed out that due to the downturn of the property market, the construction materials fields such as steel and cement that excess supply will definitely go through a painful period of structural adjustment.Exporting products such as electric vehicles, solar panels and electrical equipment are relatively small due to domestic economic influence.

Local industry player: China's new energy product advantage is the entire industry chain instead of low prices

Eagle new Energy Group, which is engaged in the development and management of new energy power stations, has more than 90 % of the business in China. It also exports semi -products such as solar cells in China from Europe and Central Asia.

Fu Yuanling, CEO of Yige, bluntly stated in an interview that China's new energy products did not win at low prices, but relying on the advantages of the entire industry chain for many years.He said that from photovoltaic and wind power to electric vehicles, there are currently no countries that can control the production of full chain like China."A country can not import products from China, but there is no way to use semi -finished products produced in China at all. The cost of completely decoupling is very high."

However, as European and American countries continue to pressure China's new energy exports, Fu Yuanling is also worried that it will be more and more difficult to export business in the future.He said that although many Chinese players have avoided tariffs through overseas factories, there are more and more export restrictions in the past two years.Taking the strictest United States as an example, not only to check where the products come from, but also trace the origin of raw materials. Even the final beneficiaries of the factory cannot be Chinese.

"The establishment of an industry barrier to support the emerging industries in the country is common in developing countries. However, the United States is already a mature developed economy. It is difficult to say that the market is not acceptable."

A dispute over market worries caused by excess capacity caused a trade war

After many years of attacking Chinese companies benefited from government subsidies, the United States and Europe have also begun to imitate Beijing to introduce industrial policies.The United States passed two successive methods in 2022Cases strengthen support for semiconductor and renewable energy industry.The European Union also launched a $ 270 billion green agreement industry plan last year, increasing the competitiveness of green technology.

On the other hand, China, which has been blocked one after another, has also begun to take countermeasures.The Chinese Ministry of Commerce determined that there was a dumping of imported US propionic acid products on April 19, announcing that it would levy a 43.5%security deposit to the product.The market is worried that the trade walls caused by the dispute over the overcapacity will be upgraded to a new round of trade war.

Jens Eskelund, Chairman of the Chinese EU Chamber of Commerce, warned that as the wave of protectionism rose, China and Europe faced a "slow -action train accident", and the trade friction between the two parties could evolve into a comprehensive trade war.

In the meeting of the South China Branch of the EU Chamber of Commerce in the middle of this month, Yan Ci said that some trade concerns about China and Europe are reasonable, but if the leaders of the two parties do not strengthen the dialogue, there may be uncomfortable decoupling. "I thinkThe situation is imminent.

The attitude of Yaxian State has different exports to China

Southeast Asia, which is the main export market in China, has not yet developed large -scale trade frictions with China, as the main export market in China.

Although the Biden government claims to increase the taxation rate of Chinese steel double to 25 %, in fact, last year, China only exported 845,000 tons of steel to the United States last year, accounting for less than 1 % of the total export.In contrast, nearly 30 % of Chinese steel exports to Southeast Asia, and five of the top 10 exports are Asianian (China -called ASEAN) countries. Vietnam has replaced South Korea to become the largest export market in China.

At the same time, Thailand and the Philippines are among the 10 largest export destinations in China's new energy vehicles, and Vietnam is the fifth largest exporter of Chinese lithium -ion batteries.

Lin Dawei, a senior researcher at the East Asia Research Institute of Singapore, pointed out in the interview with Lianhe Morning Post that the economic structure and development focus of Asia's member states are large, so their attitudes towards Chinese export products are also different.

Lin Dawei analyzed that Indonesia and Thailand want to attract China to local investment factories, while Cambodia and Laos hope to use the high -quality Chinese products and technology to accelerate green transformation, as well as some regional countries that are closer to the United States.Resist Chinese goods for geopolitical considerations.

Vietnam, which has close trade with China and the United States, is "two ends."Many Chinese companies set up factories in Vietnam to allow products exported to European and American countries to avoid high tariffs, and most raw materials are still imported from China.On the other hand, selling new energy vehicles to the "Vietnam Tesla" VINFAST of the United States is also behind Chinese suppliers. Chinese battery giant Guoxuan Hi -Tech is VINFAST's power battery supplier.

Yaxian Supply Chain is in China as the centered scholar: It is expected that no major changes will happen

Mei Nong believes that one of the important features of China and Asia's trade is that most of the exchanges are closely related to the global supply chain, just like most trade between the United States and the European Union.

He pointed out that Asian'an is not China's ultimate market, and trade with China is an important part of the overall production and export of this region."The Asianan supply chain is still centered on China. In the foreseeable future, this situation is unlikely to change major changes."

However, last year Vietnam and Thailand officials also launched anti -dumping and counter -surveys of Chinese steel products at the requirements of local companies.Lin Dawei predicts that with the adjustment of regional national industrial policies, Chinese enterprises may gradually shift to local production and exchange for policy preferential and government support in a mutually beneficial manner.

Taking Thailand that has vigorously promoted new energy vehicles as an example, only electric vehicles produced in Thailand can enjoy tax discounts and consumer subsidies.At present, China SAIC Group, Great Wall Motor and BYD have car manufacturers in Thailand.

Can the old replacement solve the overcapacity?

Although Chinese officials have repeatedly emphasized that excess capacity is a manifestation of the role of the market mechanism, and the imbalance of supply and demand is "often the normal", but the official has also listed overcapacity as the main challenge of the current Chinese economy.

The Central Economic Work Conference held at the end of last year was proposed "overcapacity in some industries" after five years, which means that this is one of the difficulties and challenges that promote the recovery of the Chinese economy to overcome.The government work report in March this year reiterates the above views and requires strengthening the overall layout and investment guidance of key industries to prevent overcapacity and repeated construction of low levels.

Even if you do not look at the risk of trade, excess production capacity to the domestic market means that the price of product prices and the increase in corporate debt risks may impact employment and residential income.The official has launched a series of "replacement of new new" action solutions this year. It is hoped that it will be upgraded through industrial equipment and new home appliances. While expanding consumer demand, it can relieve overcapacity in the fields of steel and electric vehicles.

The State Council of China issued a promotion of large -scale equipment updates and consumer goods in March this year. The new action plan for consumer goods was replaced by the old -fashioned new action.Consumer products such as kitchen and bathrooms are replaced by old.

Fund support for changing new measures

The National Development and Reform Commission of China estimates that the market size of 5 trillion yuan (S $ 958.8 billion) will be leveled by the old -fashioned policy.However, due to the lack of implementation details, market participants are also difficult to estimate the effectiveness of the policy.

Lang Xuehong, deputy secretary general of the China Automobile Distribution Association, frankly said in interviews with the media: "After the document comes out, everyone is most concerned about fiscal expenditure. In this regard, the amount of funds that the country can take out is not clear, especially in particular, especially inHow much money can the central government come out. "

Zhao Chenxin, deputy director of the National Development and Reform Commission, promised at the policy blower two weeks ago that central investment, central financial funds for equipment renewal and new "must have financial support, and support will be strong."Based on their own financial resources, they will allocate certain financial support.But he did not disclose details such as specific amounts.

Peng Yanyan, director of the Consumer Products Industry of UBS, pointed out in the Lianhe Morning Post that the Central Government did not introduce large -scale fiscal policy for consumption after the two sessions (National People's Congress and the CPPCC Annual Meeting).expect."If the local governments are paid, in addition to the good financial conditions such as Beijing, Shanghai, and Shenzhen, the financial resources of other provinces and cities may not be able to support large -scale new measures."

Industry insiders: Leading companies should take the lead in controlling production rhythm on demand

CRU GROUP forecast of commodity research institutions in the commodity research institution will drive 800 to 9 million tons of steel demand in the next four years.However, according to the estimates of the China Metallurgical Industry Planning Research Institute, the demand for steel that has decreased due to the decline in building demand this year has reached 20 million tons; even if it is calculated that the growth of machinery and automobiles has increased, the demand for steel throughout the year will still decrease by 16.1 million tons.

China Iron and Steel Industry AssociationPresident Luo Tiejun pointed out in the industry forum this month that the current steel industry is facing a highly conflict between the strong supply capacity and weakening demand and entered the "prisoner's dilemma"; the key to resolving the contradiction is, Truly realize industry self -discipline. "