A number of foreign companies developed in China have been withdrawn successively, and the total direct investment in foreign countries has been questioned, causing the Chinese government's promise to open to the outside world.What factors have impacted foreign confidence?Which type of company is the most affected?How attractive is the Chinese market for foreign investment?

After three years, the China International Import Expo has fully resumed offline holdings this month.However, the exhibition that declared China's determination to be open to the outside world was snatched by several news that occurred in the same period.

On the one hand, the media exposed the three large American companies decided to withdraw from the Chinese market, including the fund management giant Vanguard, the poll giant Gallup, and the parent company cloud computing of business software CitrixCloud Software Group.

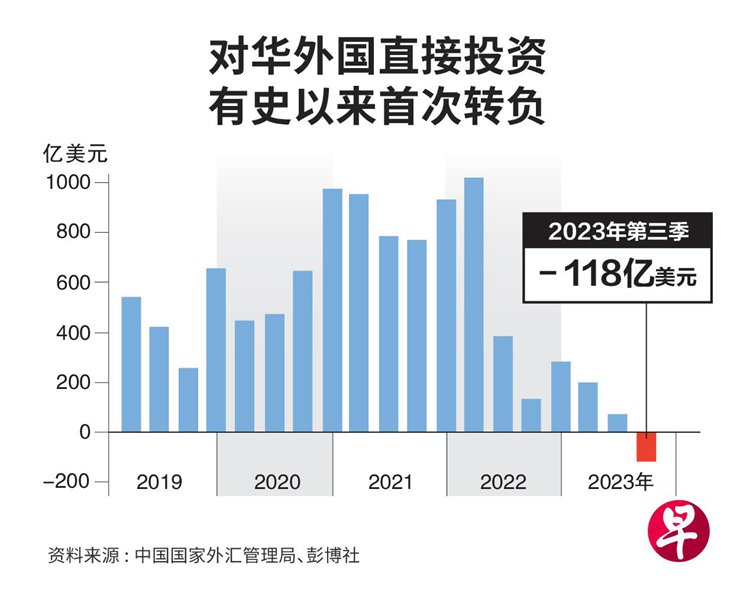

On the other hand, the data released by the China Foreign Exchange Administration on November 3 shows that the total amount of overseas direct investment (FDI) that reflects the investment in China (FDI) recorded at the third quarterIt is Singaporean), which is the first negative value since the record in 1998, showing that more direct investment in China has more direct investment than flowing in.

Earlier, the data released by the Ministry of Commerce in October has shown that in the first three quarters of this year, China's actual use of foreign capital decreased by 8.4%year -on -year.Statistics of the Wall Street Journal show that as of the end of September, foreign companies withdrew profits from China for six consecutive quarters, with a total amount of more than $ 160 billion.The data of the foreign exchange bureau makes the market more concerned. Is this the beginning of a large -scale escape from foreign companies?

Chen Long, a partner of PLENUM, an analysis of the partner of the Consulting Company, analyzed the United Morning Post. At present, China's interest rate is far lower than most regions of the world.Income, "this is normal financial operation."

Chen Long pointed out that, in addition to financial considerations, in the past two years, epidemic control and control has led some multinational companies to have no new investment projects, which are reflected in this year's investment.The country is a possible reason for the decline in investment.

The China Business Environment Survey report released by the American Chamber of Commerce in March this year shows that 24 % of the interviewed U.S. companies are considering or have begun to move the supply chain out of China, which is higher than 14 % a year ago.A briefing released by the Central Bank of China on November 6 states that 40%of the multinational companies are expected to migrate in China in the next few years.

The most direct impact of overseas direct investment is to make the weakened RMB exchange rate further under pressure.Due to the weakening of investors' interest in Chinese stocks and bonds, the exchange rate of the RMB against the US dollar against the US dollar has continued to decline this year, and it fell in early September to the lowest level since the global financial crisis in 2007.

If foreign capital continues to flow out, it will have a longer -term impact on the Chinese economy.Official statistics show that although foreign companies account for less than 3%of the total number of Chinese companies, 40%of foreign trade, more than 16%of tax revenue and nearly 10%of urban employment have created 40%.The official media Xinhua News Agency said: "Multinational companies have brought capital, technology and management experience to China, and are one of the main drivers for China's economic development ... It has become an important part of China's open economy."

After China's economic growth was far lower than the official goal last year, Beijing repeatedly threw olive branches to foreign companies this year.The meeting of the Political Bureau of the Communist Party of China held in April emphasized that it is necessary to put the attractive foreign investment in a more important position and stabilize the basic market for foreign trade and foreign capital; the State Council also introduced 24 measures to increase the attraction of foreign capital in August.Chinese officials announced at the opening ceremony of the “Belt and Road” International Cooperation Summit in October that the restrictions on foreign investment access restrictions in the manufacturing industry in the manufacturing industry were fully eliminated.

Anti -spy method and data control impact on foreign companies confidence

But the other policies and actions that officials have also implemented at the same time not only triggers the market's questioning of the above -mentioned open commitments, but also worried that foreign companies in Chinese companies that the Chinese Communist Party's decision -making level attaches great importance to national security, which has higher than the demand for foreign capital.

The revised version of the anti -espionage method that took effect in July this year expanded the scope of the definition of espionage, and did not make clear definitions on the prohibited transmission of "related information with national security and interests".This makes some foreign executives worry that the commercial activities and topics in China may become the restricted area.

It is a raid search and action restrictions that many foreign companies and employees have suffered since March.Dyedonal investigation companies Mintz Group, consulting company Bain and Capvision, and advertising company WPP company Qunyi and other foreign companies in China have been searched by relevant official assault searches, and many employeesWas arrested.The US consulting company Knanhua and Japan's village in Japan were also banned from leaving mainland China.

Most of the objects of this series of operations are American companies. This year, it has been announced that the withdrawal from the Chinese market is also mainly based on American companies.The tension between the two largest economies in the world has become the biggest risk challenge in Huamei Enterprises.A April survey of the American Chamber of Commerce in China showed that about 27%of respondents preferred the investment layout in other countries instead of China, which was much higher than 6%last year.

Michael Hart, president of the US Chamber of Commerce, admits in an interview that member companies have a long -term promise in China. In most cases, they still see business opportunities in China. "But almost everyone is affected by concerns about Sino -US relations"" ".He added that the restricted international travel before may cause the US headquarters to come to China that came to China is not so optimistic about China's prospects.

As the new version of the Anti -Spy Law was implemented at the same time, there was increasingly stringent data supervision.Personal information exit standard contracts that come into effect on June 1st, requiring the information provider of more than 1 million person information for personal information, must also sign standard contracts with overseas receiving parties to evaluate the purpose and risks of personal information outbound.The provincial online information department of the local area will be filed.

According to the survey of the Chinese EU Chamber of Commerce last month, one -third of the members of the interviewed members pointedWan Xinyuan) stored data in China.Another 11 % of companies believe that the relevant costs can reach trillions of euros.

The service industry with a higher degree of data on data has become the most impact on new regulations.Data from the Ministry of Commerce of China also show that the actual amount of foreign investment in the service industry in the first three quarters of this year was RMB 630.23 billion (S $ 120.49 billion), a year -on -year decrease of 15%, and the decrease was the largest in various fields.

But not only the service industry is affected.Wang Miao, vice chairman of the Chinese EU Chamber of Commerce Fashion and Leather Action Group, disclosed in an interview that in order to meet the requirements of data cross -border transmission, his leather goods company has set up data centers in China and Europe last year.In expenses, suppliers and systems need to be replaced, and it takes a lot of time to train employees."This is a huge project, which is a heavy burden on everyone."

Chen Long pointed out that strengthening data supervision is in line with global trends, but there are many definitions in the new regulations that are not clear, such as what is important data and what kind of numberAccording to illegal risks, etc."Enterprises hope that the rules can be clarified and refined as soon as possible to reduce uncertainties."

Jens Eskelund, Chairman of the European Chamber of Commerce, said in an interview that the increasing risk and a more unstable operating environment prompted European companies to re -evaluate investment and operating strategies in China.Enterprises are not seeking to withdraw, but to further localize, and through the methods of transferring investment, China and global business are decoupled to establish operating toughness.

Yan Ci bluntly said: "The overall confidence in China as an investment destination has dropped to the lowest level since the record, and more and more member companies are seeking to invest in other more predictable and reliable markets."

Policy adjustment brings a transfer

As the "foreign capital escapes China" is very loud, Chinese officials quickly adjusted relevant policies.The Internet Information Office issued a specification and promoting data cross -border flow regulations on September 28 (draft for comments) to exempt supervision requirements for some outbound situations, and it is clear that those who have not been informed or published as important data are clearly applied for outbound security assessment.

The EU Chamber of Commerce regards the opinion draft as a positive signal, arguing that this indicates that the Chinese government is listening to corporate concerns and is willing to take measures to solve it.The Chamber of Commerce called for further clarification of the content of the opinion draft and implemented as soon as possible.

On the other hand, the high -profile Sino -US dollar meeting was held on Wednesday (November 15), San Francisco, and the heads of state of the two countries agreed to promote and strengthen dialogue cooperation between China and the United States.This discussion described by the US President Biden as the "most constructive and results" so far has made foreign companies in China regain confidence in the recovery of Sino -US relations.

He Mai Ke emphasized that confidence is important for economy and investment."Want our member companies to ask: Are we popular? Will we be treated fairly? Can we fight for all customers including state -owned enterprises and governments? Do the media environment be friendly to us and our country? If the answer is certainIt is more likely to usher in investment.

The local government enthusiastically invitement must "please come in"

"Every entrepreneur come this time, look good in Shandong, there is any idea that we only put it out, we must provide precise services."

At the meeting of Singapore -Shandong Economic and Trade Council held last week, Shandong Province Zhou Naixiang repeatedly emphasized that local governments at all levels will provide tailor -made personalized solutions for Singaporean companies who come to invest.The representatives of the Singaporean enterprises told the United Morning Post that the Jinan, Yantai and Qingdao government all issued invitations to local inspections, and arranged for a special person to follow up, "much more enthusiastic than in previous years."

The Ministry of Commerce of China launched the "Investment of the Year of the China" this year to accelerate the process of attracting investment that delayed the delays during the three -year epidemic period.Multi -local governments including Shandong Province, while "going out" to participate in the exhibitors overseas, also "please come in" by holding a promotion meeting locally.

According to data from the State Administration of Market Supervision of China, in the first three quarters of this year, South Korea, the United States, and Japan are the main sources of foreign companies in China. Economic and developed southeast coastal provinces are still a popular destination for foreign companies.New foreign -invested enterprises in Zhejiang, Guangdong, and Fujian have increased by 112.5%, 41.4%, and 29.3%year -on -year.

Under the impact of factors such as epidemic prevention and control and weakening of the property market, local governments generally face the dilemma of fiscal tight and high debt, attracting foreign investment as an important starting point for boosting local investment.However, for foreign companies that isolated from the Chinese market for three years, the unclear economic prospects make them even hesitant to make investment decisions.

After the epidemic of Shanghai last month, Shanghai's first offline mayoral international entrepreneurial consultation meeting was held. A total of 30 highly transnarius executives from 12 countries attended.A Middle Eastern Enterprise executive told the United Zard that although the organizer invited the company's president to join the Municipal Consultation, due to insufficient confidence in China's investment, the executives decided to "wait for a year to talk about".

A Singapore investment bank representative said that the three -year epidemic disrupted China's economic structure and growth trend, and also made foreign companies that have not set foot in China for a long time have a sense of "seeing flowers in the fog".The company also needs to take a while to find the highlights of the Chinese market after the epidemic to make investment decisions.

Michael Hart, president of the American Chamber of Commerce in China, pointed out that despite the end of the epidemic, the slowdown in China's economic growth is still worrying, and companies are also cautious about new investment.Some small and medium -sized enterprises members who have been severely damaged by the three -year epidemic have stopped business and some are still recovering their vitality. Most industry players have not yet prepared for expansion.

Analyst: If you can stabilize the growth of China, you can continue to attract investment

Xie Dongming, director of the Research Director of the Greater China of Overseas Chinese, analyzed in an analysis in the interview that the recovery momentum after China's economic epidemic was unstable and caused a certain impact on market confidence.But compared with short -term data, foreign investment investment is more concerned about long -term prospects.In the fields of manufacturing and new energy, the Chinese market still has a significant advantage. "If you can stabilize growth, you can continue to attract investment."

Eagle New Energy Group is one of the few companies that rapidly expand the Chinese market during the epidemic.In an interview with the group's chief executive officer, Fu Yuanling disclosed that under the strong help of the Chinese government's strong help with new energy, the Group has achieved an average annual high -speed growth of 500 % to 1000 % in China in the past three years.

Yige entered the Chinese market in 2020, and now more than 90 % of the group's business is in China.Fu Yuanling said that although the uncertain factors in business in China have increased, this huge market is still very attractive to foreign companies."Otherwise, why do big companies such as BASF and Bayer even continue to expand investment in China by Micron, which have been reviewed by China?"

Fu Yuanling predicts that the number of employees in China will be doubled in the next three years to reach about 200 people.He is also optimistic about the future development potential of this market."In the past 20 years, I haven't seen another country developing like China at a high speed; although China's population dividends are decreasing, the investment in infrastructure construction and education in the next 20 years will lead the world. This will provide us with long -term and huge long -term and huge onesOpportunity.