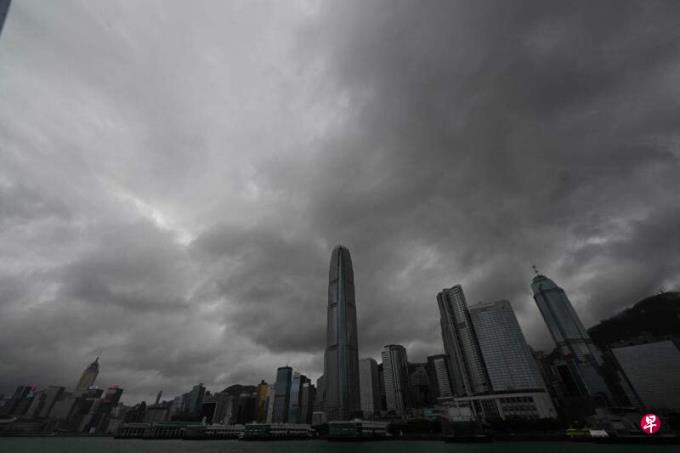

The Hong Kong stock market has continued to be sluggish after the epidemic this year, and it is affecting the local financial industry.It is reported that officials of the Ministry of Finance of China met in Hong Kong on Wednesday (December 13) to discuss how to improve Hong Kong's international financial center status.

Bloomberg quoted unknown people who did not want to name, saying that HSBC Holdings, Standard Chartered, BOC Hong Kong and other institutions were invited to participate in the meeting.The meeting mainly discussed how to improve Hong Kong's status as an international financial center, risk challenges, and how to consolidate Hong Kong's international financial center status by strengthening cooperation with mainland China.

The recovery speed of the Hong Kong economy after the end of this year is slow, and the stock market has experienced historic downturn.According to the latest data of the World Exchange Federation, as of the end of November, the total market value of the Indian stock market was US $ 3.989 trillion (S $ 535.89 trillion), which was 5 billion US dollars than Hong Kong stocks, surpassing Hong Kong stocks to become the seventh largest stock market in the world.

On November 28, , the point of the Hang Seng Index in the market was the first time since 1998. Introducing heated discussion .

The Hong Kong stock market downturn, and the transaction amount continued to shrink.According to data from the Hong Kong Stock Exchange, after the closure of 49 brokerage firms last year wrote a historical record, 30 local brokers have closed their business this year.According to Bloomberg, this year will become the first year for Hong Kong's public -selling shares (IPO) market in 2001, with a total financing of $ 5.1 billion.

Due to the great decrease in IPO activities, Hong Kong's accounting firms have become increasingly difficult.Earlier, Deloitte and Luo Bing Xianyong of the local four major accounting firms reported that some employees required some employees to take a vacation.

Among them, Deloitte requires employees of the non -audit department to put at least 15 days without salary leave within three months, otherwise it will be dismissed and shows that if the financial situation has not improved, the non -salary leave policy will continue.By the end of May next year.

Hong Kong media quoted the news that Luo Bingxian also announced last month that the main force responsible for the EG Department employee of the new shares IPO work and the audit and verification of listed companies must have all annual leave before the end of this year and accumulated overtime leave.If the relevant employees have not been assigned any work in December, they must pre -release the annual leave of 2024 within this month.

It is reported that the number of affected employees by relevant departments is about 200 to 300, mainly positions below the main level.Among them, the proportion of employees this year was cut to less than a month's monthly salary level, with an average of only 0.4 to 0.88 months.

Bloomberg reported that the Law Firm, a legal branch of An Yong, An Yong, another accountant in Hong Kong, will stop operating on January 23.Zhu Jingwen, a managed partner of Law Firm, confirmed the discontinuation of business during interviews with Radio Hong Kong, but did not disclose the reason for the suspension of business. It only stated that employees were dismissal and business after business.

According to the company's website, Lin Zhu Law Firm is a member of the Hong Kong Law Firm, which is the Ernst & Young Global Network.

Hong Kong current affairs commentator Liu Yuhan pointed out in an interview with Lianhe Morning Post that the Hong Kong stock market has performed well this year, mainly because the Hong Kong stocks are closely related to the economy of Mainland China.In addition, Sino -US relations are nervous, and Hong Kong's bridge role in China and Western has also been affected.

But Liu Yuhan believes that recently the financial industry in Hong Kong has begun to have some favorable trends, including signs of rebound in the Chinese economy. Sino -US relations have eased after the meeting with the US President Biden.These are all beneficial to the recovery of Hong Kong stocks.

He said that in order to maintain the status of international financial centers, Hong Kong must maintain the characteristics of freedom of capital, convenient entry and exit, the environment of rule of law, news, and freedom of publishing in order to attract foreign capital to continue to invest in Hong Kong.