According to Reuters on November 23, Japan Risui Financial Group is seeking to set up a securities company in China.

According to Chinese media reports, the latest disclosure of the website of the China Securities Regulatory Commission shows that the agency has received application materials submitted by the securities department of this large financial holding group in Japan.

Reported that Ruisui hopes to enter the capital market with a large profit in China, the largest capital market after the United States and Europe.

A spokesman said: "Ruisui believes that it is necessary to set up our securities company in China to achieve further growth in this critical market. We have set up a bank office in China 40 years ago.More than 30,000 Japanese companies have carried out business in China.

According to Reuters reported on November 23, the first fixed -income public offering fund launched by Fidelity International in the Chinese market has raised about 5 billion yuan from investors, further deepening the company in the company inThe participation of this more than $ 30 trillion public fundraising market.

The company said that the bond fund raised the funds in about three weeks.

It is reported that more than 150 fund managers in the Chinese public fund industry, including Berlaide Fund, Schroder Fund, and Morgan Asset Management.

Huang Xiaobi, managing director of Fidelity China, said that considering the fierce competition in the local market and the limited performance records of Fidelity in China, "the scale of financing is quite encouraging."

She said that Fidge will expand its product line in China and use the group's global advantages in pension management and sustainable investment.

It is reported that Huang Xiaobi also said that Fidelity is very patient in terms of business expansion, because the company is laying a foundation for multiple asset allocation in China and seeking to obtain a permission to help investors in the country and focus on focusing on overseas investment and focus on focusing onThere is a place in the pension market.

In addition, according to the Hong Kong South China Morning Post website reported on November 22, experts said on the 22nd that as the improvement of China's economic prospects brought about the return of foreign investors to the return of foreign investors, the transfer of foreign capital to slowing down and stable stabilitystage.This statement shows that the result of domestic charm of attracting investors' return across the country is becoming more and more confident.

It is reported that at the annual conference hosted by Financial and Economics, Tross Jiang Xiaojuan, president of the China Industrial Economic Society and the former deputy secretary of the State Council, said that the trend of foreign capital transfer was generally slowed down.

She said that since March of this year, multinational companies have returned to China intensively to seek cooperation, and order return has become an obvious trend.She also said that companies are more aware of the competitiveness of Chinese manufacturers.

The expert pointed out that if these companies really resist cooperating with China, they will not make such a decision.

She said: "China is an economy at the mid -to -high -end level in the global manufacturing industry, and foreign -funded flow is the normal process of competition in the global market."

reported that Chinese societyZhang Ming, deputy director of the Institute of Finance of the Academy of Sciences, also spoke at this event in Beijing, arguing that investment trends may change next year.

He said: "The Chinese economy itself is rebounding, and our institutional environment is also further optimized, so starting from next year, foreign direct investment inflows may improve."

This is thisExperts believe that many multinational companies do not replace the market, and those markets also have their own problems.

It is reported that Wang Tao, director of UBS Asian economic research and chief Chinese economist, said on the 22nd that the decline in foreign direct investment was caused by factors such as supply chain migration and rising interest rates in the United States.But these did not significantly weaken China's growth potential.

She said, on the one hand, it is necessary to cope with structural adjustments and continue to promote reform and opening up; on the other hand, we must stabilize the economy in the short term to ensure that the Chinese economy will achieve sustainable medium speed growth in the long run.

Wang Tao believes that in the long run, the average annual growth rate of China's economy will still be above 4%in the long run. Therefore, China still has the largest contribution to global economic growth and continues to be the world.Second largest economy.

She said that a rapidly growing vast market is still very attractive to investors and enterprises.(Compilation/Wang Diqing Yin Xia Zhang Lin)

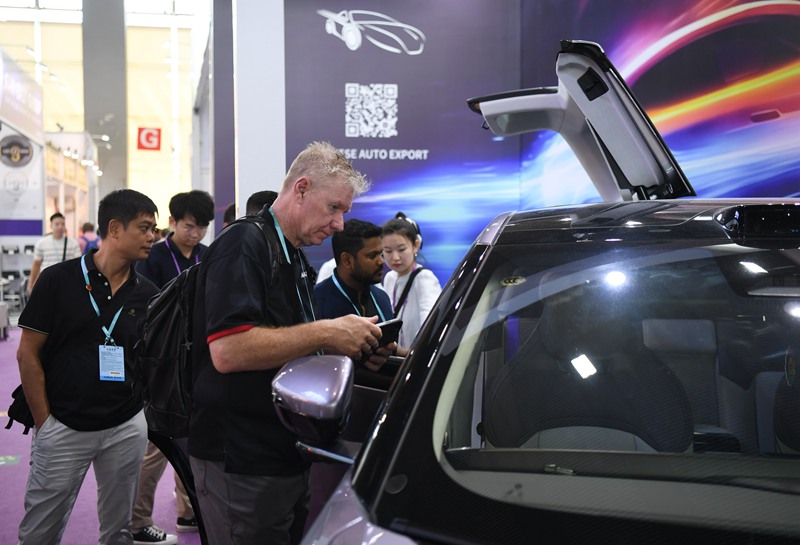

On October 16, 2023, foreign buyers watched the Canton Fair China New Energy Vehicle booth.(Xinhua News Agency)