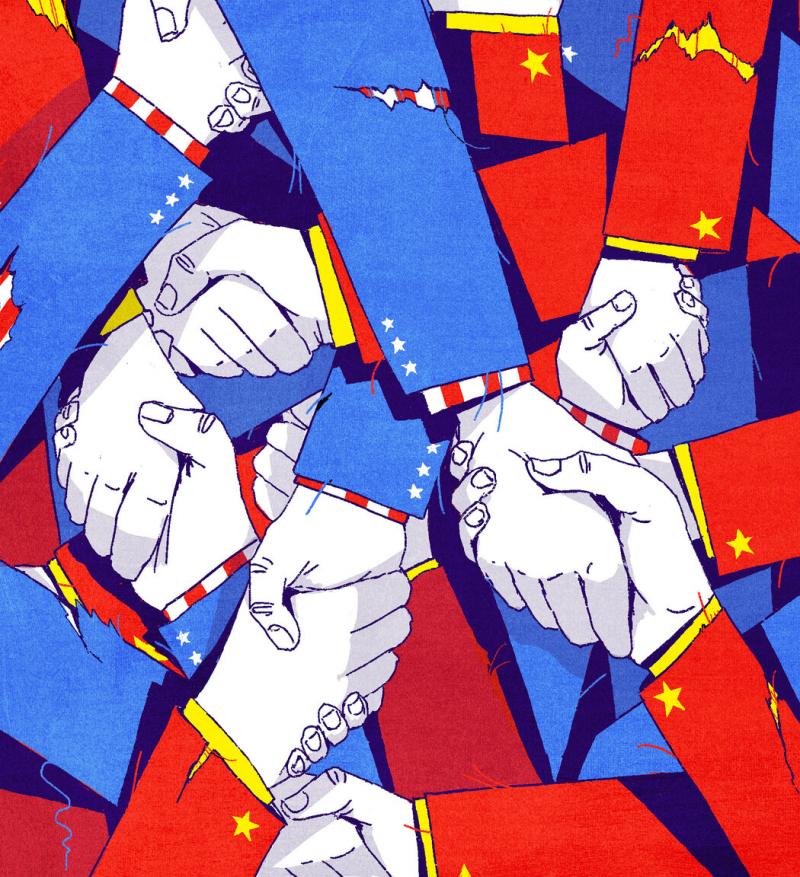

If you follow the news, you will know that the relationship between the United States and China is very tense, and the business relationship between the two largest trading parties in the world has been deteriorating.

However, despite so many ominous news about the United States and China that may be "decoupled", you may be surprised that the financial links between the two countries are still so strong and close.

A large part of many large American companies rely on China, and products also depend on Chinese suppliers and factories.The economy of the two countries is closely connected. As a China Tong, I think this is a good thing.This means that even if the relationship between the two countries further deteriorates, the two countries still have the willingness to avoid serious conflicts.

Think about it, although nearly 60%of the US listed companies in the S & P 500 index come from domestic revenue, their largest overseas sales source is China.This is based on the estimation of the financial data company's FactSet. The company said that in the 12 months of December last year, sales from China accounted for 7.1%of the revenue of the S & P 500 index listed company.The second largest source of foreign countries is Japan, accounting for 2.6%; followed by Germany and Britain, each accounting for 2.2%each; and another 1.8%.

Dell Copland, a politicalist at the University of Virginia, said in an interview that such data is critical to evaluate US -China relations."In international relations, the expectations of future profits are a key factor, but it is often ignored," he said.Copland has a world of commercial security -AMAFE for Commerce: American Foreign Policy from The Revolution from Revolution from Revolution to China.

"History shows that when a major country suddenly cuts off business and resources -make the future business prospects look dull -the possibility of the outbreak of war will greatly increase," he also said."Fortunately, so far, the United States and China have not yet happened. More conflicts or even war are not inevitable. There are still many business opportunities in the future.Think of thought. "

Reasons against China

Enterprise profit can only provide a perspective for this complex issue.But they can open people's vision, because they seem to run counter noise with conflict with China and the United States.

From tariffs to technology ban, to concerns about TIKTOK, the Bayeng government has been fighting China, saying that it abuses long -term business relationships, directly or indirectly subsidizes local industries, illegally obtains American intellectual property rights, and threatens the United States fundamentallyNational security.American intelligence agencies estimate that China has "the ability to directly compete with the United States and its allies". If no one is opposed, China can "change the global order based on rules" and make order benefit themselves.

This year is the year of elections in the United States. The new US policy on the United States is based on the transformation of the Trump administration.Today, Trump's consultants said that if they were elected again, he would be committed to completely "decoupling" with China, although his statement was inconsistent: he recently questioned whether it is necessary to ask Tiktok's Chinese owner to sell the app for the application.Or turn off the application in the United States, but during the president, he tried to force the sale of the application.

China responded plainly to the recent measures of the United States.However, if the United States continues to promote the joint business front, it aims to prevent the exports of Chinese factories from exporting a large number of low -cost products such as electric vehicles, solar panels and steel in many countries, causing domestic electric vehicles, solar panels, and steel.Essence

The barriers of thousands of holes

The most targeted tariffs -such as 100%tariffs imposed on Chinese electric vehicles -for those products that have not imported to the United States.An analysis of the Oxford Economic Research Institute of Independent Research Company shows that this means that President Biden's new tariffs will not cause much changes to the overall situation.

The company's chief American economist Ryan Switt wrote in an email that the average tariffs on trade with goods from all countries "only 1.6%before Trump launch a trade war, but nowRise to 3.1%. "He said that before Biden's latest tariffs, the average US tariffs in the United States were 2.7%, and the new tariffs would "permanently increase the effective tariff rate by 0.14%."

But he expects that as companies find a way to avoid "Trump/Bayeng tariffs rising", effective tariffs will drop to less than 2.3%in the next 10 years.The premise is that the tariff war will not deteriorate.

In order to better understand this, you can refer to the data calculated by the World Bank: In 2017 before the start of the Sino -US conflict, the global average tariff was 2.6%.Therefore, although the United States no longer reduces trade barriers and reduces consumer costs, it is not a global alien.At present, as the US company's income report shows, there are still a large number of business opportunities between the two countries.

The Battle of the Chip

Surprising me is that even companies that design, manufacture and create advanced silicon chip tools continue to obtain considerable income from China.

Recall that in 2022, the United States began to implement export controls on such companies in countries using American technology to limit their sales to China.At the same time, through the chip bill, the United States began to subsidize the construction of domestic semiconductor foundries, which actually replicated similar efforts in China.

I interviewed Chris Miller, a historian at Tavz University Fletcher College. He was the chip war -the world's most critical technology battle (Chip War: The Fight for the World's Most Critical TechNology)This book.

He said that the restrictions of the United States have been calibrated, so even some advanced chips have been shipped to China."The United States is really targeted at a chip that is vital to artificial intelligence. Other chips can pass."

Nvidia is the main designer of artificial intelligence to become possible chips, but it is prohibited from transporting its most advanced products to China.This weakens its business in China.Huang Renxun, CEO of Nvidia, said at a call conference call last week that "because of our technology," Nvidia's business in China has declined.FactSet estimates that in 2023, China is the third largest market for Nvidia, accounting for 16.6%of its total sales, and 22%of the United States 44.3%and Taiwan.

In fact, all the semiconductor companies I have studied -Nvidia, Broadcom, AMD, Intel, TSMC, Samsung, Lam Research, KLA and Tokyo Electronics — have obtained considerable income from China in 2023.China is one of the top three markets of these companies and ranks first in most cases.For example, Intel's 26.8%income comes from China.

The case of Asmai, the Netherlands, explains the problem.The company produced by the company is used for the minimum and most advanced chip circuit.The company's chief financial officer Roger Dashan said at a call conference call in April that the US ban may reduce the company's sales in China by 10%to 15%.

Nevertheless, he said, "We still think that the sales level in China this year will be strong." FactSet estimated that in 2023, Acemai's 25.8%revenue came from China.The income from the United States accounted for only 11.4%.

Look at Apple again.This is not only because China accounted for 17.8%of the company's revenue in 2023, second only to the United States.More importantly, Apple often transports a large number of small, advanced, and most advanced semiconductors in China."This is the allowance of the regulatory rulesInside, you can consider it when you formulate policies, "Miller said.

The iPhone 15 in my pocket contains a four -nanometer chip, designed by Apple in California, manufactured in Taiwan, transported to China assembly, and then returned to New York consumers like me.The iPhone 15 Pro has used a three -nanometer chip, and Apple is preparing to use TSMC's more advanced nano -chip.All these technologies exceed China's business capabilities.Apple did not respond to the request for comment.

Last week, China conducted a military exercise in the waters near Taiwan, and issued a "serious warning" to Taiwan's independence.China is still showing that it can cut off the channels for obtaining advanced silicon chips, and this chip has become the power fuel of the global stock market.

The peak of globalization may have passed, but this is originally up and down.The important thing is the long -term trend.

The peaceful coexistence of the United States and China meets the interests of everyone.In the process of pursuing profits, companies around the world are still looking for ways to achieve this goal.