The China Foreign Exchange Administration announced the data of banks' foreign exchange settlements and banks in December last year and the entire year of banks.Wang Chunying, deputy director of the Foreign Exchange Administration and spokesman, said that the annual banks' sales and foreign -related revenue and expenditure are surplus, and the supply and demand of the foreign exchange market have remained basically balanced, and said that foreign investors have continued to restore investment in the Chinese securities market in the near future.

According to the website of the China Foreign Exchange Administration, Wang Chunying said on questions on the reporter's question on the relevant questions of China's foreign exchange revenue and expenditure situation that in 2022, the scale of banks 'foreign exchange and banks' foreign -related income and expenditure surplus was 107.3 billion, respectively.And $ 76.3 billion (about S $ 1.32).Recently, under the joint promotion of internal and external factors, the Chinese foreign exchange market has become more stable. In December, banks' foreign exchange sales and foreign -related income and expenditure were surplus, with 7 billion and US $ 23.1 billion, respectively.In comprehensive consideration of other supply and demand factors, the supply and demand of the Chinese foreign exchange market in 2022 maintained a basic balance.

Wang Chunying also said that the foreign exchange market is expected to be generally stable, and the market transaction is rational and orderly.In a complex and changeable internal and external environment, the changing amplitude of the relevant indicators of the RMB exchange rate expected in the long -term and options markets can be controlled. There is no continuous unilateral trend, indicating that the market entity exchange rate is expected to remain overall stable, and the market entity is sold for sale.Huihe's foreign -related income and expenditure behavior is rational and orderly.The willingness to settle on market entities is basically stable, and overall maintains a rational trading model of "settlement at high exchange".In 2022, the exchange rate (that is, the ratio of customers selling foreign exchange from foreign exchange to customers involved foreign exchange income) was 67%, an increase of 1 percentage point from 2021.Enterprises actively use their own foreign exchange payment, and their willingness to hold foreign exchange is more stable.At the end of November 2022, the balance of domestic foreign exchange deposits of market entities such as enterprises and individuals was US $ 639.6 billion, a decrease of US $ 56.2 billion from the end of 2021.

In addition, the inflow of funds such as goods trade and foreign direct investment plays a leading role in stable cross -border capital flow.In 2022, the scale of cross -border funds in China ’s goods trade hit a record high, an increase of 45%over 2021, reflecting the development toughness of China's foreign trade.The net inflow of funds under the capital of foreign direct investment remained high, which was significantly higher than the level of 2019 before the epidemic. According to statistics from the Ministry of Commerce, from January to November, China's actual foreign capital was 178.1 billion US dollars, a year -on -year increase of 12%, indicating that the Chinese economyThe development prospects and huge consumer markets are still attractive to foreign investment.

Wang Chunying also said that recent overseas investors have continued to return to investment in China's securities market.According to statistics from the Foreign Exchange Bureau, in December 2022, foreign investors' net increase in domestic bonds and stocks was 7.3 billion and US $ 8.4 billion, respectively.Judging from the latest market data, the recent foreign investment in the domestic securities market has remained active. In the first half of 2023, the total of about $ 12.6 billion in domestic stocks and bonds was bought.

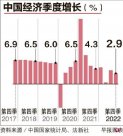

Wang Chunying said that in 2022, affected by multiple factors such as "high inflation" and "tight currency" in major economies, the international financial market has strenuously shocked, and the global stock and bond index fell sharply.New high, euro, yen, and pound major international currencies have reached a new low in nearly two or three decades.The operation of the Chinese foreign exchange market has undergone the test. The RMB exchange rate has been relatively stable among major global currencies, and the flow of cross -border funds in China has become more balanced. This is mainly due to the two major support factors, which is manifested as two "tough enhancement".

On the one hand, the domestic economy, especially the development of foreign -related economic development, has increased, and the steady operation of the international revenue and expenditure has been effectively guaranteed.On the other hand, the toughness of the foreign exchange market has increased and the ability to adapt to the changes in external environment has been greatly improved.

For the situation of China's foreign exchange revenue and expenditure in 2023, Wang Chunying said that in 2023, there is still uncertain factors in the external environment, but the domestic economy is expected to recover overall.Cross -border capital flows will be more stable.

The domestic economic fundamentals are the decisive factor in stabilizing China's cross -border capital flow.China has strong economic toughness, great potential, and dynamic vitality. The long -term good fundamentals have not changed. With the continuous appearance of various policies such as optimizing the prevention and control of the epidemic and stable economic growth, China's economic operation is expected to rise in 2023.The latest prediction data of major international organizations and other institutions show that under the context of the slowdown of global economic growth, China may become the only major economy to show economic growth.At the same time, China adheres to the promotion of high levels of opening up, continuously improves the level of cross -border trade and investment and financing facilitation, and increases attracting foreign capital. It will also continue to create a good policy environment for cross -border capital flow.In addition, recently, the inflation data of major developed economies have fallen, the downward pressure on the economy has increased, and the tightening rhythm of monetary policy may slow down, and related overflowing effects will weaken margins.

Wang Chunying said that the main influence channel of China's cross -border capital flow in 2023 is expected to become more stable.On the one hand, regular accounts will maintain a reasonable scale surplus and continue to be in a balanced interval.On the other hand, the flow of cross -border capital under capital is expected to be more stable.Foreign business direct investment has maintained steadily, and China's foreign direct investment continues to be reasonable and orderly. Direct investment will continue to continue the surplus.In recent years, China's foreign debt structure is optimized, corporate cross -border financing has decreased, and the trend will continue to continue in the future.Under the support of China's economic growth, the attraction of RMB assets has increased, and the risk aversion attributes of RMB, foreign capital will continue to invest in the Chinese securities market steadily.