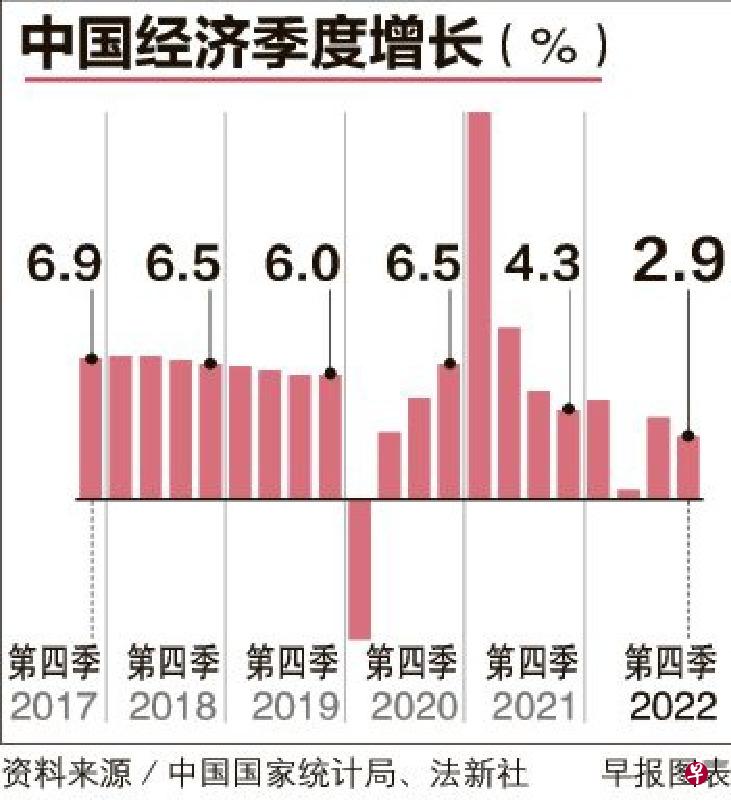

China ’s economic growth by 3 % in 2022, far lower than 5.5 % of the official goals.If it is eliminated by 2.2 % in the early days of the outbreak of the crown disease in 2020, this is the worst manifestation of the Chinese economy since 1976.

China National Bureau of Statistics announced on Tuesday (January 17) that the domestic GDP (GDP) increased by 2.9 % in the fourth quarter of last year, and the growth rate slowed down from 3.9 % in the third quarter.

Affected by factors such as the epidemic and control and the downturn in the property market, China's economic growth has slowed significantly since the second quarter.After three years of "dynamic zero" epidemic prevention policy, after a full turn in December, the number of crown diseases in various places surged, and once again impacted economic activities.

But according to official data, the added value of industries above designated size last year still increased by 1.3 % year -on -year. The total retail sales of social sales products fell by only 1.8 % year -on -year, and its performance was better than market expectations.Kangyi, director of the National Bureau of Statistics, pointed out at the press conference on Tuesday that traffic congestion has occurred in the capital Beijing, and domestic flights have resumed more than 80 % of 2019. The restoration of life order will create better conditions for economic growth this year.

China Vice Premier Liu He said at the same day when he spoke at the World Economic Forum on the same day.Return to normal.

Xie Dongming, director of the Research Director of the Greater China of Overseas Chinese Bank, was analyzed during an interview with Lianhe Morning Post that one of the themes of the Chinese economy this year was the change of wind direction: "last year's anti -wind may become a smooth wind this year, and the smooth wind may become the backwind." Xie Dongming took consumption as an example that the total retail sales of Chinese social consumer goods decreased by 0.2 % last year, and the contribution rate of consumption to economic growth also decreased from 65.4 % to 32.8 %.Correspondingly, residents' deposits increased by 1.784 trillion yuan (RMB, S $ 3.48 trillion), an increase of 80 % higher than the previous year.If the official can trigger this excess savings, it can effectively promote the rise of consumption.

The weak property market drags the Chinese economy

On the other hand, the slowdown in the global economic slowdown has led to a decline in external demand. Exports that have performed well in the past two years are expected to weaken this year.Xie Dongming said that in the first three quarters of last year, the contribution rate of exports to China's economic growth was nearly one -third, but the annual contribution rate dropped sharply to 17.1 %, indicating that external needs to weaken rapidly in the fourth quarter."This year, the probability of foreign demand will change from smooth winds to reverse wind. It must rely on domestic demand and investment to strengthen the effort to drive the economy."

Weak property market is another important factor in dragging down China's economy last year.In 2022, the national real estate development investment decreased by 10 %, the first time since the record in 1999.House sales area and sales decreased by 26.8 % and 28.3 % year -on -year, respectively.

Kangyi admits that the growth rate of 5.1 % of fixed asset investment last year was not too high, the most important thing was to be dragged down by the real estate industry; private investment increased only 0.9 %, and because real estate investment in private investment was relatively high, the property market declined downward pull -down pull -down pull -down drop -down pull -down pull -down pull -down pull -down drop -down drop -down pull down pull down pull down and pull down pull down pull down.The effect is very obvious.

He added that the decline in the decline in real estate investment, commercial housing sales area and sales in December last year has narrowed. In addition, the official recently introduced a series of measures to boost property market, and last yearJudging that real estate is "not greater than 2022" this year's real estate dragging on the overall economy.

Wang Jun, chief economist of Huatai Assets, pointed out that the three indicators of consumption, private investment and real estate weakened last year, reflecting that the market entity was not confident and expected.Whether these three fields can stop and rebound this year, or narrowed the decline, determine how high the economic growth rebound this year is.

Wang Jun judged that although consumption is still difficult to return to the level before the epidemic, there is a high probability that it will gradually recover; private investment will improve significantly, and real estate may be the biggest uncertainties.Deep pit is difficult. "He expects that if various policies are in place, the economic growth rate may be slightly higher than 5 % this year.