China's re -open border has boosted the optimistic emotions of the outside world for the Chinese economy. Foreign investors have begun to increase China's stocks and bonds.10 months of capital outflow records.

Comprehensive Reuters, Bloomberg, and Shanghai Securities News reported that data released on Wednesday (January 18), Shanghai headquarters of the People's Bank of China, showed that as of the end of December 2022, overseas institutions held 33,900 interbank market bonds100 million yuan (RMB, the same below, about S $ 660 billion), accounting for approximately 2.7%of the total custody of the interbank bond market.

This also means that in December last year, overseas institutions bought approximately 60 billion yuan in RMB bonds.This is also the first time that overseas institutional investors have bought RMB bonds since the end of January 2022.

Reuters reported that during the period of China's strict "dynamic clearing" period of the "dynamic clearance" of the epidemic prevention of epidemic prevention, overseas institutional investors sold 740 billion yuan of Chinese bonds last year.Fund outflow records.

However, the data released by the China Foreign Exchange Administration on Wednesday showed that foreign investors increased their holdings of US $ 7.3 billion (about S $ 9.628 billion) in December last year and $ 8.4 billion in A -share stocks of $ 8.4 billionEssenceIn the first half of January, foreign investors increased another $ 12.6 billion in Chinese stocks and bonds.

It is reported that foreign investors' purchase of Chinese stocks has exceeded the total number of last year in the first three weeks of 2023, and bet on the rapid recovery of the Chinese economy after the control of the epidemic control.

Hedge Fund Carrhae Capital LLP believes that Chinese stocks will win stocks in other parts of the world in the first half of this year.CarrHae Capital's chief investment officer in London, Ali Akay, said: "We still expect that the preferred stocks in the Chinese market will have a lot of room for increase, and the sector that the Chinese market is ignored also has more upward space."

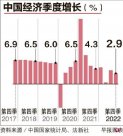

The Netherlands InternationalIris Pang, an economist in Greater China (ING) Greater China, said that because China's economic growth at the end of last year was stronger than expected, and there were signs of indicating that the future retail expenditure would be stronger, the group's expectations for China's economic growth prospect this year have the prospects for this year's economic growth prospects.Improved.But he also believes that China still faces considerable resistance, including the decline of external demand.