The Chinese stock market and the foreign exchange market ended in the first half of the year, reflecting the pessimistic expectations of investors in the Chinese economy, and concerns about lack of official economic stimulus.Analysis predicts that as the Chinese government's probability of large -scale stimulus policies is not high, the capital market will still hover at a low position in the short term.

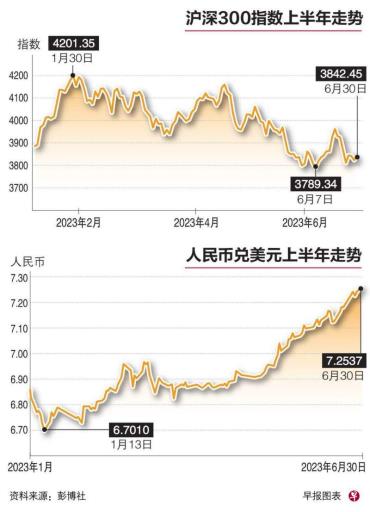

On the occasion of the stock markets in the United States, Japan, South Korea, and Taiwan, a two -digit increase in the first half of the year, the Shanghai and Shenzhen 300 indexes that reflect the market in mainland China fell slightly by 0.75%in the same period; the Hong Kong Hang Seng Index fell 4.37%, andIt is one of the worst stock indexes in the world in the first half of the year.

According to the statistics of the CSI Index Company, the Chinese A -share market in the first half of the year has a cumulative transaction of 11.12 trillion yuan (RMB, the same below, the same, 20.7 trillion yuan), a decrease of 2.5 % compared with the same period last year.

In terms ofIn terms of exchange market, in the first half of the year, the exchange rate of the RMB against the US dollar fell 3106 points, a decrease of more than 4.4%.

When China had just stepped out of the epidemic at the beginning of this year, the stock market and the foreign exchange market rebounded strongly.However, as the economic recovery has slowed down, the fatigue of the capital market gradually revealed in the second quarter.

The Shanghai and Shenzhen 300 Index returned to 4,200 points at the end of January this year, a new high in the past six months.However, after mid -April, a number of economic indicators such as exports, retail, and unemployment have deteriorated, which caused the stock market to vomit the previous four months in just one month.Two weeks ago, the official will introduce the news of the large -scale stimulus policy to drive the market to return a brief rebound, and it has continued to slip to this day.

According to the data of the People's Bank of China, the average daily transaction volume of the Shanghai and Shenzhen cities rose steadily in the first four months of this year, and in May, it fell 16.5 % and 20.3 % in May, respectively.According to the statistics of Bloomberg News, the second quarter of this year's overseas investors sold 2.7 billion yuan of mainland stocks, which was the first quarter of funds for the first quarter since September last year, showing that investor confidence weakened.

The exchange rate of the RMB to the US dollar continued to fall in fluctuations after rising to the 6.7 mark in January this year.By mid -May, the two -year -old dollar "broke 7" on the shore and offshore RMB. Since then, the depreciation has been accelerated. At the end of May, it fell below 7.1 and fell below the 7.2 mark a month later.

Facing the market shock, China officially introduced some consumer policies. The People's Bank of China also cut interest rates again after 10 months, but these measures did not meet external expectations, but instead made investors confident.Wang Qing, chief macro analyst of Dongfang Jincheng, pointed out that after the policy reduction of interest rate cuts in June, other stable growth policies have not been launched. The difference in policy expectations is the main reason for the continuous depreciation of the RMB last week.

Analyst: The Chinese stock market is expected to the end of the year to the beginning of the year at the beginning of the year

Many analysts surveyed by Bloomberg expected that the Chinese stock market will bottom out in the second half of the year, but it is difficult to return to the peak of the beginning of the year.The weak Chinese economic data surpass geopolitical risks and potential American recession risks has become the main concerns of analysts.Citi Group analysts lowered their expectations for the Hang Seng Index, and believed that the market prospects in the second half of the year rely on the official package of stimulus policies.

Wang Jun, chief economist of Huatai Assets, analyzed in an interview with Lianhe Morning Post that because of the budget adjustment, the government usually does not introduce large -scale stimulus supporting facilities in the middle of the year.In addition, the market's expectations for a package of stimulus policies are getting lower and lower, and the fatigue of the two cities of the stock exchange may last for a while.

Wang Jun said: "In the good thing, the current pessimistic factors have been fully reflected in the market. As long as the global economic recession is not expected to be serious in the second halfObtaining more than 5 % of growth, the growth target of about 5 % throughout the year is not a problem. "

Fu Fangjian, an associate professor of Li Guangqian Business School of Singapore Management University, also believes that there will be no rapid rebound in the short term of A shares and RMB exchange rates, but the space that continues to decline is also limited, and it is expected to fluctuate in the interval.

"The next two observation points are (US Treasury Secretary) when Yellen visit China, whether the two parties will reach a substantial agreement; the second is whether Chinese officials will increase consumer stimulus and promote domestic demand recovery. If this is this.Breakthroughs in both aspects will be a major benefit to market confidence. "