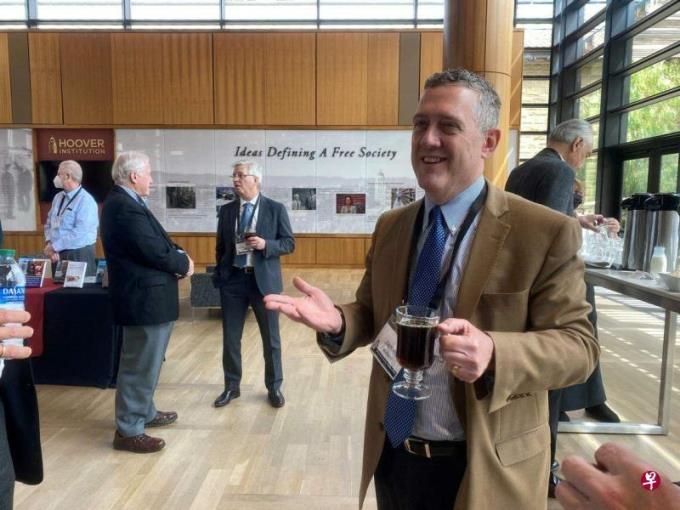

(Washington Composite Electric) Brad, San Louis Fed, the Federal Reserve of the United States, said that the United States may have to increase interest rates to cool down inflation.He will continue to wait and see, and then decide whether to support continuing to raise interest rates in June.

Brad on Friday (May 5th) after attending the event at the Minneshlis Economic Club, told reporters: "Our radical policies in the past 15 months curb the rise of inflation, but it is unclear whether we go (The inflation rate drops to 2%). "

He stated that he would evaluate the upcoming economic data, but he must see "the substantial decline in inflation" to be sure that there is no need to raise interest rates.

Brad said that he believes that the Fed can still achieve soft landing and help the inflation rate return to 2%of the target without leading the economic decline.

He said at the activity: "Yes, the economy may fall into a decline, but that is not the baseline scene ... I think the baseline situation is slow economic growth, the labor market may be slightly weak, and inflation has decreased." Brad pointed out that the employment report on Friday is better than expected, and the vacancy of jobs is still much higher than the level before the epidemic.

He said: "The labor market is very tight, and it takes some time to cool down ... I think we must be patient and understand this in this regard."

The Federal Reserve on Wednesday (3rd) raised interest rates from 25 basis points to 5%to 5.25%, which was the highest level since 2007, and hinted that it may suspend interest rate hikes at the June meeting.

Chicago Federal Reserve Bank President Gusby pointed out in a visit to Fox News that the interest rate decision for judging next month is too early, but he believes that the credit pressure that the banking industry has recently facedMonetary policy was originally achieved.

Gusby said that this should "make you suspend" interest rate hikes, because the tightening of credit conditions may slow down the economy."We know the condition of credit, as we see now, it has been related to economic recession. The effect of credit tightening and tightening monetary policy are similar."

"No matter what tightening measures you need to take, you must consider ... the impact of the banking system."

Gusbi and Brad voted at the Fed Conference on Wednesday to support interest rate hikes.According to Brad, most people in the committee hope that interest rates are higher than 5%.