The news of the US investor, known as the US investor, cleared the TSMC stocks of the Clear Stock Stocks, cast a shocking bomb for the investment community.

Buffett's investment company Berkshire Middot; Berkshire Hathaway Monday (May 15) revealed that the company no longer holds this global wafer in the first quarter of this year,Any foundry giant.

Buffett built a tank in the third quarter of 2022 to buy 60 million TSMC ADR (American DEPOSITARY Receipts) for $ 4.1 billion (about S $ 5.5 billion).

Buffett had previously lacked interest in technology stocks. Even in the face of popular technology stocks, as long as he did not have his appetite, he would not consider buying.But in recent years, Buffett's attitude seems to have changed, and it has begun to buy many technology stocks such as Apple, Amazon, Hewlett -Packard.

However, in just three months after buying the Stock Power Stock, Berkshire began to sell a lot.As of the end of the fourth quarter of last year, the company had sold 86%of TSMC ADR, holding a position to about 8.29 million copies, with a market value of about 620 million US dollars, and at the same time increased its holdings of Apple stocks.Apple is currently the highest -holding amount of Berkshire's position, worth more than $ 150 billion.

In the eyes of the outside world, Buffett is good at investing in value and likes to hold company stocks with investment value for a long time.Buffett once said that you only buy things that you are willing to hold even if the market stops for 10 years, which means that short -term investment is not his investment philosophy.In less than half a year when buying TSMC stocks, Lightning Clear Warehouse, which runs counter to Buffett's investment philosophy, causing investors to pay attention.

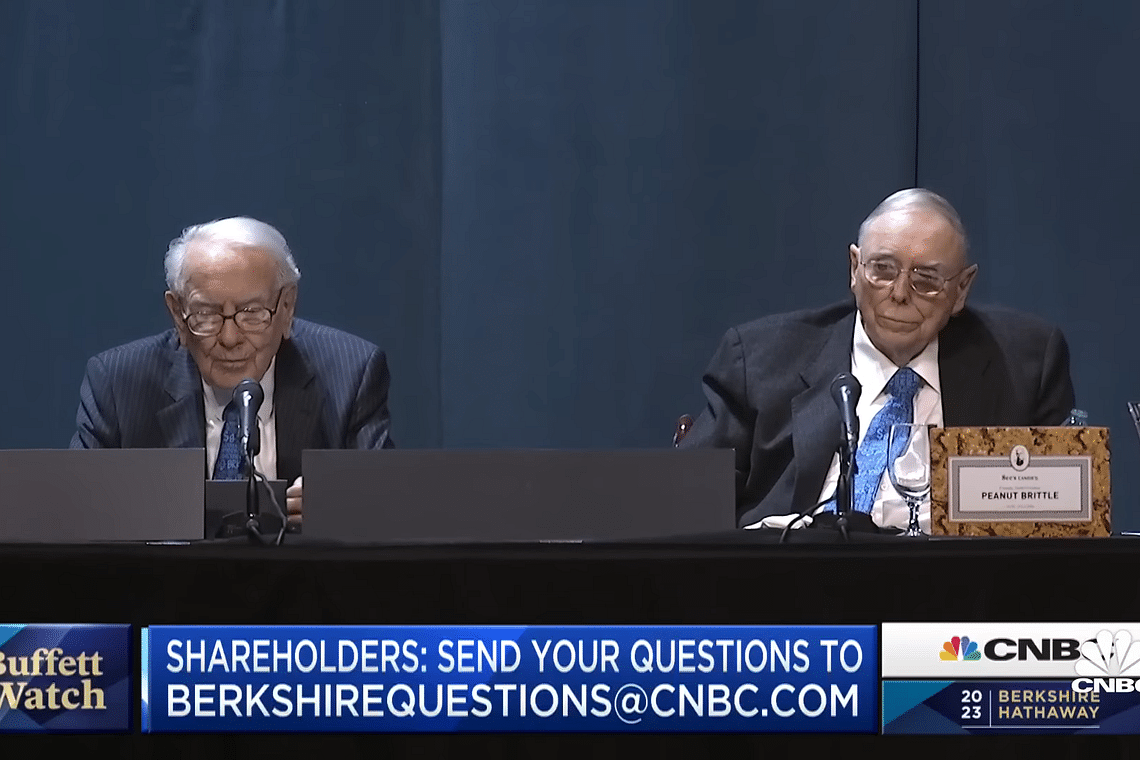

In this regard, Buffett said frankly the reason why he did this at the shareholders meeting held by Braska on May 6: I don’t like its place (TSMC), and I re -do it for it.Evaluation.

Buffett also said that compared with Taiwan, the deployment of assets in Japan makes him feel more comfortable; he also hopes that he does not have to sell stocks of Taiwan Stocks, but I think this is reality.

Buffett (left) said at a meeting on May 6 that he felt more comfortable than deploying assets in Japan than Taiwan.(Video screenshot)

However, Buffett still highly evaluated TSMC, saying that it is a very amazing company, and it is one of the best and most important companies in the world; there are very good people and very good competitiveness and everything else. I hope to be inThe United States sees it all.

The implication is that Buffett does not think that there is any problem with the operation of TSMC. The location and geopolitics of TSMC are the problem.

Buffett said in an interview with the Japanese Economic News in April this year that geopolitical tension was a consideration for Berkshire's sales of TSMC.

However, after the news of Berkshire's Clear TSMC stock on Monday was exposed on Monday, other well -known investment companies including Tiger Global Management Fund and Coatue Management Fund, etc., purchased TSMC stocks sharply, reflecting the different views of investors in the prospects of TSMC.

The Guo Guoshan has become a crime of Huaiji?

Founded in 1987, TSMC was led by Li Guoding, then Taiwan Economic Minister, and Zhang Zhongmou, who were invited to return to Taiwan from the United States.Since its establishment, TSMC has focused on chip production and is committed to improving its own semiconductor technology.

TSMC was led by the then Taiwan Economic Minister Li Guoding (first from the right) and Zhang Zhongmou (sitting on the right) who was invited to return to Taiwan.(Internet)

Unlike other semiconductor companies, TSMC does not engage in chip design, and only focuses on chip foundry. Many companies are therefore willing to outsourcing the chip to TSMC because the chip design will be plagiarized by TSMC.

Under this advantage, coupled with TSMC's leading in technology research and development, TSMC signed a supply agreement with well -known semiconductor companies in the world with Apple, Nvidia, Qualcomm, and other well -known semiconductor companies in the past 10 years.Foundries.

According to the statistics of the Ministry of Economic Affairs of Taiwan, in 2021, the semiconductor produced in Taiwan accounted for more than 60 % of the global markets, and the supply of seven -nano -advanced chips required for artificial intelligence, 5G and high -performance calculations was as high as 70 % in the world.In the smallest and fastest micro -chip competition, TSMC also far ahead of competitors such as Intel and Samsung.At present, TSMC has developed a 2 -nanometer process, and is expected to mass production in 2025.

As TSMC moves towards the global semiconductor company giants, the competitive situation between China and the United States and the tensions between the two sides of the strait are also heating up.In the forefront of Taiwan's tension, TSMC's role weight is becoming more and more important.

In 2022, TSMC was invited by President Biden to open a new plant at Phoenix, Arizona, and Biden also attended the new factory's on -board ceremony in person.In November last year, when TSMC founder Zhang Zhongmou attended the Asia -Pacific Economic Cooperation (APEC) Summit, he also talked to mainland China, the United States and Japanese leaders. It can be seen that TSMC's special status.

US President Biden (third from right) attended the boarding ceremony of the TSMC Arizona Factory on December 6 last year.TSMC Chairman Liu Deyin (second from right) and TSMC President Wei Zhejia (fourth from right).(Reuters archives)

TSMC was described as the gods of protecting the country in Taiwan, but with the upgrading of geopolitical contradictions, the potential conflict risk of the Taiwan Strait increased.

In addition to Berkshire, investment institutions such as Belle, Morgan Chase, GQG Partners, and Capital Group have joined the ranks of cutting warehouse TSMC stocks based on geopolitical risks and other concerns.

At the same time, in order to decentralize the political risks of the sediment, TSMC, which originally determined that the most efficient production in Taiwan, had to disperse risks to set up factories in the United States, Germany, and Japan.This also means that the production cost of TSMC will increase, which is not conducive to the growth of corporate profits.

Lin Hongyi, the fund manager of the Fund Investment Corporation, said in an exclusive interview with Bloomberg earlier this month that he was concerned that the expansion plan of TSMC could lead to increased production costs and reduced efficiency, thereby weakening his return on investment.

However, the challenges faced by TSMC are not just geopolitics.

TSMC's development bottleneck

A report published last Thursday (May 11) of the New York Times stated that in the past 10 years, TSMC has become one of the most geographical significance companies in the world with the talents of engineers.Today, TSMC is facing the problem of talent shortage.

Not only did the birth rate decreased, the population decreased. The management of TSMC's militaryization and demanding work culture also scared away many Taiwanese engineers, prompting them to apply for other competitors who can provide better benefits, such as Google and Acemai.Many senior management of many Taiwan semiconductor companies have begun to worry, and the population growth in Taiwan may not be able to keep up with the growing talent demand for new generation of engineers to grow up in the first half of the conductor industry.

It is reported that TaiwanBay's talent crisis is successfully intertwined with TSMC. If the talent problem continues, TSMC's leader in the world may be shaken.

Employees of TSMC's South Branch are ready to get off work.(Internet)

On the other hand, global electronics demand is weak, and excess inventory is also containing TSMC's growth momentum.

TSMC disclosed in April this year that due to the continued weakness of the terminal market, the client inventory was further adjusted. In the first quarter of this year, the revenue fell by 18.7%, and the net profit decreased by 30%, the largest quarterly decline in the past four years.

TSMC also predicts that the company's annual revenue this year may record hundreds of points to fall.TSMC's last annual revenue declined in 2009.

Morgan Chase, UBS, Goldman Sachs, and Citi also predict that TSMC's revenue will continue to decline in the first half of this year, and it is not expected to recover until the start of 3 nanometer products.

Affected by the pessimism of the market, TSMC's stock price lost its growth momentum since it hit an eight -month high in February this year. It did not return to 530 yuan (NT $ 23.18) or more until Wednesday (17th).TSMC maintained annual capital expenditure goals last month, indicating that after the determination to consolidate the leading position in the field of advanced semiconductors, investors still pay close attention to signs of recovery.

As a company with leading global semiconductor technology, TSMC's importance in the semiconductor industry is self -evident. In addition, TSMC, as a leading company in Taiwan, is destined to be in the fate of its geopolitical center.

With the deterioration of Sino -US relations and the intensity of the Taiwan Strait, TSMC was forced to survive in the gap between geopolitics, and investors also became trembling when investing in TSMC.Geopolitics will eventually push TSMC, and no one can say it yet.