Sheng Hong: In the form of tax collection, it is called taxes, in fact, a tax is actually added, because the tax is levied by the state.

It is said that the responsibilities of the collection of social security funds shall be transferred to the tax department by the Human Security Department.of.Frankly, on August 28, the Xinbei District People's Court of Changzhou City, Jiangsu Province ruled that more than 2 million social security funds in a company over the past 10 years.This caused a general panic.Later, it was said that this measure was fully implemented in 2019, and in the context of economic downside, it added a heavy blow to enterprises.In a article entitled why the bosses are unwilling to carry it again?The article quoted a boss in the article that social security will be changed next month, and the personnel cost will directly rise by about 30 %.It was probably that there were too many negative reactions. Later, I heard that the State Council had a handbrake and suspended social tax transfer.

This does it sound absurd.There are many problems with the social insurance system that requires reform, but this is not the direction.The basic goal of the insurance system is to reduce uncertainty, which is in line with the preferences of most people.They would rather pinch 100 yuan in their hands, and do not get 200 yuan from coins.However, insurance also brings problems, such as moral risk (defrauding insurance or intentional negligence), reverse selection (healthy people do not buy), management costs, etc.There are more important thing, bringing price increases, which mainly refer to medical prices.A study completed in 2017. The theoretical analysis, effect evaluation and reform plan of the Chinese medical system found that there is a paradox in the medical insurance system itself, that is, the consumer's self -payment rate under the insurance system is reversed.relation.In other words, the lower the self -payment rate (the higher the insurance compensation rate), the greater the increase in the price of medical prices.In extreme cases, such as the exclusive monopoly, the multiple of the price increase is about the countdown of the self -payment rate.That is, if the self -payment rate is 10%, the price is 10 times the original.

Why is this?This is because after people buy insurance, they will consider paid fees as the cost of sinking. The cost that they really consider when they seek medical treatment are the marginal costs at the time.In addition to the cost of seeing a doctor, it is the self -payment part of the medical cost.If the self -payment rate is 25%, the cost of 100 yuan will only pay only 25 yuan, which is equivalent to the price of medical prices for him, and he can buy more.At the same time, it is more important that people generally think that the more expensive medicine will be much better, and if he buys more expensive medicines, the absolute amount of insurance reimbursement will increase. For example, he will reimburse 150 yuan.Due to the presence of insurance hallucinations, he would think that he made 150 yuan, more than 75 yuan for drug sales of 100 yuan, he is more likely to buy more expensive medicines.The questionnaire survey we studied for this shows that 17.8%of people have a tendency to order for the medical expenses reaching insurance.It is believed that doctors have an act of inducing excessive medical care.

If this kind of calculation change or even behavioral changes caused by participating in insurance are not individual phenomena, but generally exist, such behaviors of many insureds will raise medical prices levels.The disadvantage of this insurance system is even more serious to China.Because China's social insurance system is not a typical commercial insurance system, it is monopoly and semi -strong.A social security system covering the whole country has no competitors, so it cannot be found in market competition, but it will give a monopoly price, and it also has the semi -strong manner of administration.The so -called semi -strongness is not a voluntary transaction between the two parties, and it has strengthened the degree of deviation and negative effects of the monopoly price.As a result, in our questionnaire survey, 42%of people think that even within the scope of self -payment, the price of medicine is at least expensive.

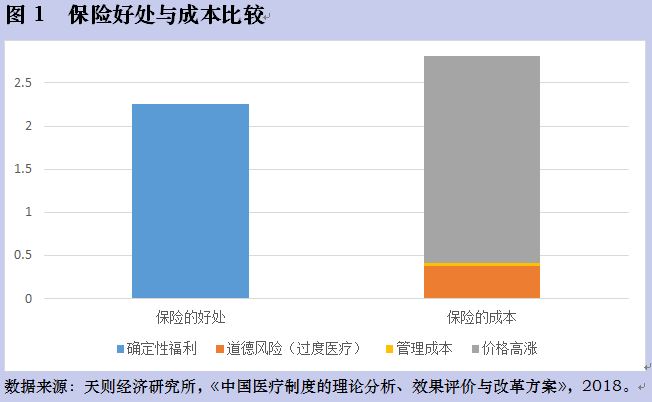

We have constructed an economics and mathematics model. According to the data of China Health and Retirement Longitudinal Study (Charls), we estimate that China ’s medical social insurance has increased by 73%of the medical price level of China, causing consumers to consumersI bought 21%of medical services or medicines, so -called over -medical.In summary, the cost of medical expenses increased by 110%.From a macro perspective, the relative price of China's medical expenses, that is, per capita medical expenses accounted for the per capita GDP, increased rapidly, from 4.03%of the per capita GDP in 2008 to 5.22%in 2015.The most important thing is that the cost brought by medical social security is even higher than the certainty it brings.On the basis of many scholars' research, we estimate that this certainty benefits equal to 2.25%of the per capita GDP.According to data in 2014, China's existing medical and social security system brought about 264 billion yuan in net loss.See below.

In this case, this medical social security system does not solve the fundamental problem to solve the insurance, that is, the problem of reimbursement of medical expenses for major diseases; it has brought a lot of small problems. It is more to solve the minor disease (outpatient)The problem of medical expenses, and this is a problem that does not need to be solved. People can generally bear it, but just turn it into a reimbursement game. In this everyone thinks that they have taken advantage of cheap games, they actually eatLost.When it really needs insurance to work, that is, when facing expensive medical expenses, medical social security uses the upper limit (generally 300,000 yuan) to avoid it.And the current commercial insurance, such as Ping An Insurance, pays 460.5 yuan per year, which can reimburse 500,000 yuan in the highest disease; Taikang Insurance, a person who has no social insurance 36-40 -year -old person pays 1224 yuan/year, you can reimburse at most when he is sick.6 million yuan.You know, under the existing social security system, according to the 9.5%deduction rate, employees who have a monthly income of 5,000 yuan will pay a medical social security of 5,700 yuan a year.

On the basis of severe high medical expenses, insurance costs are still significantly higher.Because of the previous writing, social security is not only monopolized, but also semi -compulsory.Based on various social insurance projects, including pension, medical care, we can also find that social security prices are significantly high.Evidence of the high -priced monopoly monopoly is that the social security fund has always maintained a huge balance. By 2017, it had reached 773.2 billion yuan. From 2008 to 2017, the average balance accounted for 18.3%of the income of social security funds.This means that even if the management cost is about 2%in the case of inefficient use of social security funds, this semi -strong social security pricing is 16 percentage points higher than costs.This huge balance part can be used for low -risk investment, and the value -added part can return funds for insurance expenditure.But we can't find relevant data on the Internet now, so we are outside the perspective of public supervision.

The direction of the reform of the social security system is marketization.In particular, medical and social security should also use market mechanisms to suppress the rise in medical prices and over -medical care, and stabilize the relatively level of Chinese medicine (per capita medical expenses/per capita GDP) at a lower level.Since the self -payment rate in the insurance system is a negative relationship with the price of medicine, since the minor illness (outpatient) insurance is not the purpose of the insurance system, our reform ideas are to remove minor illness insurance, focus on major illness insurance, and and and and also on major illness insurance. And and also on major illness insurance, and also, and focusing on major illness insurance, and and.Improve the self -payment rate.The reform plan proposed on the basis of research is to cancel the insurance arrangement of minor illnesses (outpatient) medicines, and increase the self -payment rate of major disease (hospitalization) insurance to 70%; if some people's major illness costs higher than 40%of the income of the year,, Can be reimbursed by the major diseases and disease assistance funds established by the state. According to the estimation of our model, the scale of this fund is 20 billion yuan.Some people may refute this plan because this seems to greatly reduce people's benefits.actually not.Because existing medical social security is costly, enterprises and individuals must deduct 9.5%of funds equivalent to wages, and in our reform plan, we only need to deduct 3%.Overall, reform will bring 46.7%of medical expenses.

existOn the basis of solving the problem of pharmaceutical prices, the problem of high insurance market prices must be solved.This is to transform semi -strong social insurance into voluntary commercial insurance while promoting competition among commercial insurance companies.Social security semi -strongly incorporates everyone into the social security system, and people do not have the right to choose social security without buying social security. It is impossible to weigh the cost income between buying insurance and not insurance.From a macro perspective, insurance without insurance is the competitors of this monopoly social security. People who do not buy insurance actually cause tremendous pressure in the margin, so that the monopoly social security will not raise the price too high.For example, the US -free population ratio is about 15%(2008). Even if Britain implements a national medical system, private medical institutions still account for 15%of the market.The existence of the non -insurance population not only puts pressure on insurance prices, but also promotes the real price system of the pharmaceutical market, which also provides market information reference for insurance companies to formulate medical costs.Obama's medical reform intended to be covered with medical preservation, but there are many disadvantages in many years, including the disadvantages pointed out in this article, and were finally abolished.

Looking back at the social security transfer.Compared with social security, the tax is completely mandatory. If you do not pay social security, it just violates administrative regulations; if you do not pay taxes, you will violate the criminal law.Therefore, social security transfer is not a technical change, but involves the rights of citizens.Why is it a matter of rights?Because social security is only half -strong, it is still a relatively loose requirement.Many companies do not submit social security because they think that doing so is beneficial to them; and they do not hand over social security and are required by workers.Why is this? This is because of the flexibility of private enterprises. When they encounter economic downturn, they will lay off their layoffs; and the liquidity of workers is also very large. Once they are cut, they will find a job elsewhere, or orGo home to hometown; but social security can't take it away.So they would rather ask for cash without social security.This choice space for enterprises and workers is actually conducive to income distribution and resource allocation.Fortunately, social security is not so compulsory, so it can make companies and workers have such a choice.Therefore, social security transfer is reduced to the reduction of citizens and corporate rights.

What's more, the reality of the past years is that the enterprises and workers who have paid social security have not handled it according to the proportion of social security requirements.Most enterprises only pay social security based on basic wages, and this base is lower than all income.According to Song Xiaowu's estimation, the base of social pension insurance in 2015 was equivalent to 55.7%of the average social salary level.Conversely, once the proportion of social endowment insurance requires the deduction of social security funds like tax taxes, enterprises and workers pay 55.7%more.This is obviously a sudden increase in costs, and almost no enterprise can bear it.If the social security is forced to be mandatory, the enterprise does not have any room for integration, and many companies have to close the door.The further problem is that even if the traffic rate is low, as mentioned earlier, the price of social security has been significantly as high as 16.3%, and the balance of more than 7 trillion yuan has been accumulated in many years, which shows that social security stipulatedThe ratio of social security deductions is high, and it should have been adjusted downward, but the practice of social security tax transfer not only must fix the false social security prices with the law, but also increase the level of 55.7%, and eliminate all enterprises that do not hand over social security.This is really the same as the direction of real reform.

Mencius once referred to the best tax rate (ten taxes) as the way of Yao Shun.In the education of the Christian monarch, Ilasmo said that don't just consider taxation.Therefore, the ancient and modern civilized countries have a very strict and cautious attitude towards tax increase (tax, tax rate).Article 8 of the Chinese Legislative Law stipulates that the basic taxation systems such as the establishment of taxation, the determination of tax rates, and the tax collection management can only be formulated by the legislature.If social security funds are levied in the form of tax collection, whether or not it is still called social security on the surface, it actually increases a tax, because the state for compulsory is tax.We already know that the State Administration of Taxation, the Ministry of Finance, the Ministry of Human Resources and Social Security is just the administrative department and has no legislative power, so their decision has no legal effect.Moreover, Article 80 of the Legislative Law also stipulates that departmental regulations shall not set the rights to reduce the rights of citizens, legal persons and other organizations or increase their obligations, and shall not increase the power of the department or reduce the legal duties of the department.The deployment of these administrative departments through internal work conferences is not even considered by departmental regulations, but they have made a decision to reduce the right to damage citizenship. Obviously, they are the criminals of legislative power and contempt for legitimate procedures.

In the end, the deployment of these administrative departments did not seem to care about the principles of decisive role in the resource allocation of markets and the principles of governing the country and governing in accordance with the law in the resource allocation of the market.Social insurance transfer taxes allow the government to allocate resources more, and violate the formal law and legitimate procedures of the legislative law in the form of departments.This is shocking.This also shows that the above two principles are easy to talk about, and it is difficult to implement.We can also often find that a large number of administrative departments are constantly eating citizen rights stipulated in the constitution through opinions or regulations.This first requires the administrative department to have a sense of constitutional governance, and always be alert to half a step in the constitutional and legislative law.At the same time, the entire society, especially the legal community, timely point out this kind of legislative behavior, remind society and administrative departments to correct such errors in time.According to the legislative law and the above two principles of the Communist Party of China, the so -called social security tax is not paused.It shouldn't start.

(Note: This article only represents the author's personal point of view. Responsible for the mailbox [email protected])