The aid request of a low -income country forced the IMF to face an urgent problem: To what extent is the debt dilemma of developing countries caused by China's loan?

For more than a year, the International Monetary Fund (IMF) has been warning on the rising debt level of low -income countries.Today, the talks with Pakistan's emergency assistance, as well as aid requests from Angola, Zambia, and other countries, forcing the fund to face an urgent problem: how much is the debt dilemma of developing countries caused by China's loan?

The question is that no one has the information required to answer the information MDASH; mdash; thereby ensuring that the Beijing side will do his best in the official creditors' debt records.

In the past ten years, China has filled the gap left by Western donations, providing non -conditioned funds for political allies and projects that promote its business and geopolitical interests.

Without official data, even the scale of loans is difficult to evaluate.Researchers at Johns Hopkins University of Hopkins said that their work was more like hellip; hellip; instead of describing. They estimated that from 2000 to 2017, the Chinese government, banks and contractorsProvide about $ 143 billion in loans to the African government and its state -owned enterprises.There is almost no information about the loan period, cost and conditions.

This is a huge challenge for IMF.Evaluating the sustainability of debt is the core of the IMF function.If you make a mistake or be evaluated without information, it will damage the reputation of the IMF.A former senior official of the fund said.

The first major test faced by IMF is determined to solve this problem is Pakistan's assistance request: the talks will restart in January. Previously, a staff member interviewed this week did not reach an agreement.

The fund's reputation is at stake: they must explain that the last time they assisted Pakistan in 2016, why this returning guest was in trouble again.However, due to the opacity of Chinese loans, it is difficult to determine whether the country's debt is sustainable.

For an emerging market, Pakistan's sovereign debt is very high, about 70%of GDP (GDP).Half of which may be in China. China has promised to provide funds for projects worth about $ 60 billion, and regard Pakistan as the cornerstone of Belt and Road Initor (BRI). The initiative is planned to be more than 80Fund and build infrastructure in a country.

The former IMF official said that even if there is no debt reduction, Pakistan's finances may be sustainable, but the premise is that there is no large -scale hidden liabilities, such as the guarantee for state -owned corporate loans.In addition, the conditions for Chinese loans must be determined. Analysts said that Chinese loans are usually issued at the highest commercial interest rate rather than preferential interest rates that are usually used in bilateral development assistance.

Last month, when asked about the Pakistani issue, the IMF president Christina Bull; Christine Lagarde insisted that the IMF would require the nature, scale and terms of its debt to be absolutely transparent.This requirement is one of the crux of the recent talks.

However, the differences between China and the fund's approach reveal the greater inconsistency between the two competing global development visions.

IMF represents the consensus of Washington, emphasizing multilateral initiative, public procurement and financial transparency.China's approach in the Belt and Road Initiative is mainly bilateral, the project details are not disclosed, and the contract is mainly awarded Chinese state -owned enterprises.

Considering the possibility of applying for IMF assistance in other countries, the situation is critical.

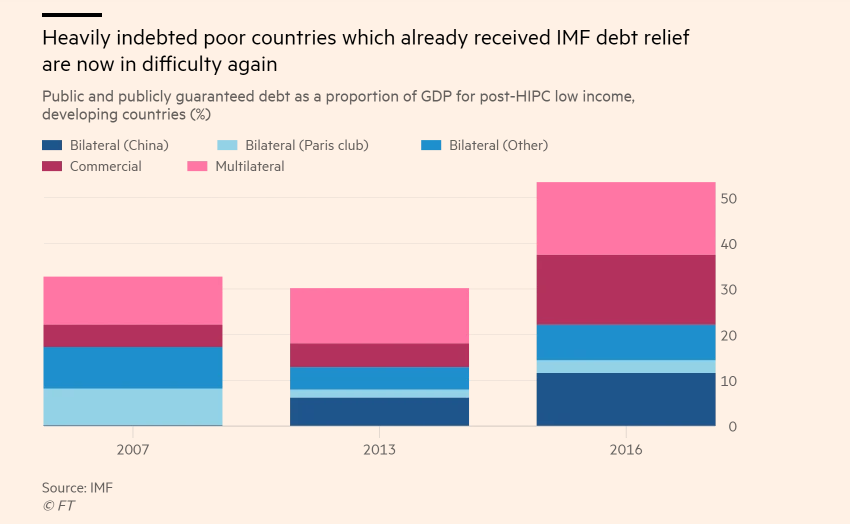

Last month, IMF warned that more than 45%of low -income countries are likely to or have already fallen into debt difficulties. In 2016, this proportion was one -third and one -quarter in 2014.Several countries in the south of Sahara have asked IMF to help: China's loan is one of the obstacles to the progress of negotiations with Angola and Zambia. Angola has been in contact with IMF in August this year, and Zambia has negotiated for several months.

Many other countries in China who choose to be the Belt and Road Initiative are also financially unsafe in finance.Data from Moodyrsquo, a credit rating agency, shows that the median rating of 78 countries is BA2MDASH; mdash;

Researcher at Peterson Institute for International Economics and former IMF official Ted Truman believes that more countries may request IMF aid in a few years.He said: We all believe that (if you owe a lot of debt in China), Venezuela will need IMF assistance to restore vitality sooner or later.

The U.S. government has clearly stated that it will not support the IMF assistance project that may only help the recipient's debt repayment in Beijing.

Debt reorganizations for official creditors are usually IMF rescue conditions, but China is not a member of Paris Club, which is responsible for coordinating debt reductions.

The nature of Chinese loans makes things more complicated.

Former IMF officials, currently worked with the Gabriel Sterne of the Gabriel; Gabriel Sterne, who worked at Oxford Economics (Oxford Economics), said that reorganization of Chinese loans is not easy. These loans are usually commercial banks and other participants with businessTerms issued.He said: Sooner or later, he will come to Hello; Hello; if the situation worsens, whether China will cooperate, it is completely unclear.

Harvard professor Carmen Bull; Carmen Reinhart pointed out that China often favors mortgage loans (such as oil mortgage loans provided to Angola and Ecuador), which is a challenge because their terms may affectPriority for creditors.

It turns out that when the borrower encounters difficulties, China is sometimes willing to issue new loans or delay repayment.It may now want to act flexibly MDASH; MDash; part of the reason is to avoid further conflict with the United States, partly because it is worried that many loans may not be repaid.

Last month, Wang Cori, a China Export Credit Insurance Corporation, rarely warned that Chinese developers need to strengthen risk management.He said that CITIC has lost $ 1 billion MDash; MDash; Ethiopia has recently re -negotiated the project's clauses on the railway connecting to Asia and Gabiti.

However, the western governments now want to see the formal commitment to share the burden, and then support the IMF's relief to any country owed to any of the huge debt in China.Truman said that Pakistan's crisis is a test of the system.If they shrink, they will fall into chaos.

Translator/He Li