(Washington Composite Electric) The leaders of the Central Bank of Europe and the United States have repeatedly emphasized that the urgency needs to suppress inflation in the near future means that high interest rates will remain longer.In particular, the Fed Chairman Powell stated that the Fed may raise interest rates again when the US economy has strengthened and continued to push up inflation.

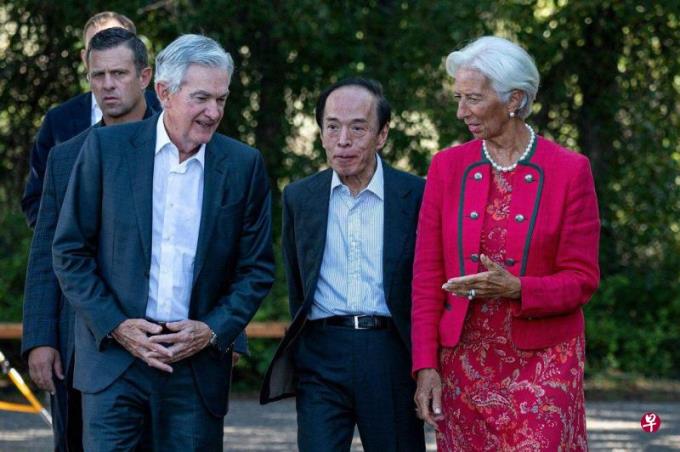

Powell Friday (August 25) said at the Jackson Hall Global Bank Annual Meeting at Wyoming: "We are going to raise interest rates further at the right time, and intend to keep the monetary policy at a limited level until there is no until there is anyConfidence inflation rate continues to decline by setting targets. "

He emphasized that achieving the goal of the inflation rate to 2 % is the duties of the Fed. Although inflation has fallen from the peak, it is still too high.He promised that at the forthcoming monetary policy meeting, the Federal Reserve was based on the latest data evaluation of economic prospects and risks, and carefully considered whether to raise interest rates.

Powell said it is difficult to know how much the current benchmark interest rate is higher than that of "moderate" interest rates, so it is difficult to evaluate how much restrictions on the Fed's growth and inflation.Moderate interest rate refers to a mild interest rate level, neither irritation nor restoring economic growth.

Powell also pointed out that since this year, the growth of GDP in the United States (GDP) has exceeded expectations and is also higher than long -term trends. Recent consumer expenditure data is particularly strong.Although the data of core personal consumption expenditures (PCE) in June and July is encouraged, this is only the beginning of rebuilding confidence, because it is uncertain how long the lower inflation data can last.

As for the labor market, he said that there are still many vacancies in the United States, and the actual wage growth is still accelerating.If the tension of the labor market is not alleviated, it may also be responded through monetary policy.

Investors believe that the Federal Reserve ’s interest rate hike is less than 20 %

At present, the US federal fund interest rate target range is at a level of 5.25 % to 5.5 %.After Powell delivered the above speech, the three major indexes of the US stock market fluctuated.Investors in the futures market believe that the probability of the Federal Reserve in September is less than 20 %, but the probability of raising interest rates in November or December rose to about 50 %.

Former US Treasury Secretary Samers predicts that the Federal Reserve may need to raise interest rates at least once, because the slowdown in economic growth in the United States is not large, and some predictions even think that the growth rate will exceed 5 % this quarter that will exceed 5 % of this season.Essence

Xie Bodeson, chief economist of Pantheon Macroeconomics (Pantheon Macroeconomics), believes that Powell's tone is to alleviate inflation clearly and "do not have any luck to the inflation prospects."

The European Central Bank governor Lagarde also emphasized at the global central bank's annual meeting that in order to achieve the key goals of the central bank, Europe will maintain a high interest rate for a long time, and the inflation rate should be pressed to a 2 % midterm target.

She warns that higher investment demand and larger supply restrictions may lead to greater price pressure, and not all economic fields can afford it.What's more, the labor market is tight, and the speed of raising wages in enterprises has also increased price pressure.

On the other hand, Gionerkiya, president of the International Monetary Fund (IMF), predicts that when most major central banks are busy tightening credit last year, after most major central banks are tightened, the global monetary policy will beThere will be differentiation.This is because the economic growth of individual economies is different. For example, the United States is faster than the European Union, which will affect monetary policy.