The years are like shuttle, and it is another year.For the blockchain industry, this is a year when the wind rises and ups and downs.

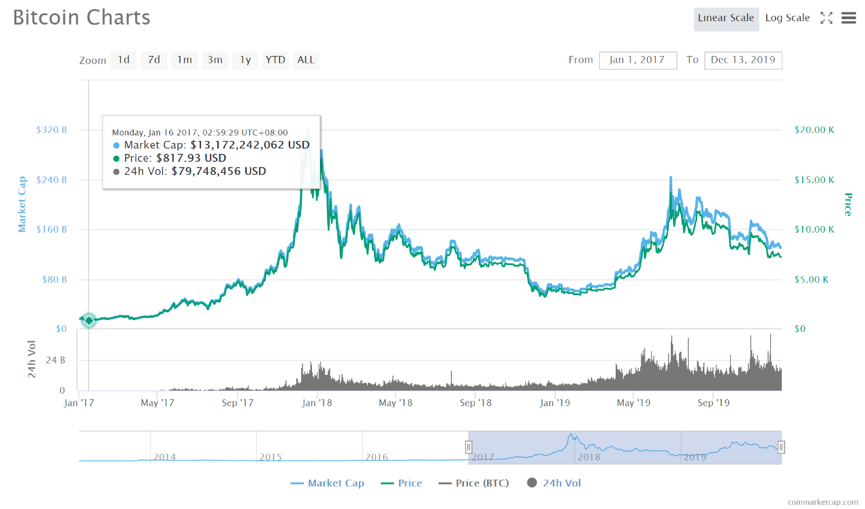

As a barometer in the blockchain industry, Bitcoin is abnormal this year, and has lost the sense of annual direction that has been maintained for 10 years.Bitcoin in 2019 is not as rockets as rockets in 2017, nor is it like 2018, but in 2018, it has been rising and ups and downs with major events that affect the industry, and constantly changing bulls and bears.Starting from 3,000 points at the bear market at the beginning of the year, Bitcoin has rebounded in the model of IEO and Staking.In the meantime, Libra's white paper appeared on the scene, ignited a new round of digital currency boom in the world, and pushed Bitcoin to a 13,000 -point annual high.However, LIBRA's progress was not smooth, and digital currencies were weak. Bitcoin fell to about 7,000 points.Subsequently, the Chinese leaders' study of the blockchain re -revived the market's confidence, and pulled Bitcoin to 10,000 points in one fell swoop.However, after the hustle and bustle, calm investors realized that the state's attitude towards blockchain and digital currencies was completely different: the state supports the blockchain with radish and smashed the digital currency with the other hand.Bitcoin also quickly returned to the starting point before the skyrocketing, and hovered around 7000 points to seek the next new direction.

There is no doubt that the 2019 of the blockchain and digital currency is the year of the incident. Therefore, it is necessary to review and evaluate the events and impacts of the global blockchain and digital currencies this year, thereby helping us cross the beef bear and clarify our thinking., See the future.

Libra white paper came out

The highly anticipated Libra finally announced the white paper in June, announcing to the world the grand plan for creating a global inclusive financial system with digital currency.Libra users will cover all aspects of life such as shopping, travel, taxi and other lives.If it can be achieved successfully, Libra will become the greatest miracle in the history of financial financial. Even if it fails, Libra is an unprecedented financial experiment.Because of the huge influence of libra, its every move towards the global attention, and it is destined that Libra will not be smooth.After the Libra White Paper was announced, central banks and regulations around the world questioned and opposed, which caused the founding members to retreat one after another. The U.S. Congress held many Libra hearing.Although the Libra is unfavorable and suffering a lot of setbacks, its influence is far -reaching and extensive, because it first questioned and challenged to sovereign currencies: Can multinational companies use digital currency technology to issue currencies?Can non -sovereign alliance digital currencies be accepted by today's financial system?Regardless of the ending, Libra has driven the boom of digital currency and has become the main upward driving force for the digital currency market in the past year.

Forecast: libra will have to bow to reality. It is likely to achieve a single currency stable currency in stages and regions. For example, use in the Facebook system, or gradually launch Librausd and Libraeur.

China ’s importance and influence on blockchain

In the external context of Sino -US relations, Sino -US confrontation from trade towards technology and finance, and in the internal environment of the domestic economy entered a new normal and weak growth point, the Chinese government uses blockchain as an important breakthrough in its core technology independent innovation.Vigorously support blockchain technology, and encourage them to apply in digital finance, the Internet of Things, intelligent manufacturing, supply chain management and digital asset transactions.

Forecast: The education, training and consulting needs of blockchain are bursting out. A large number of individuals, the company's institutions and government agencies are eager to obtain comprehensive, objective and neutral blockchain knowledge and suggestions to help them realize the blockchain+of the business.With the strong support of the policy, the underlying technology of the public chain and the alliance chain will make great progress.BaaS of large domestic Internet companies will gain a broad market, and its investment enthusiasm for blockchain technology and applications will also be ignited.

The evolution of BAKKT online and the Bitcoin derivative market

The discounts on the disclusted BAKKT exchanges under the Intercontinental Exchange, which has finally launched a physical settlement Bitcoin futures trading product for more than a year.However, only 72 Bitcoin and $ 600,000 of Bakkt opened the market on the day of the market. It was in sharp contrast to the star halo of the star who loved Bakkt, and also made competitors laugh.However, BAKKT will end up with expectations and show its true strength with action.In just 3 months, BAKKT's Bitcoin futures transaction reached a new high of $ 124 million. At the same time, Bitcoin options were launched, Bitcoin custody for institutions, and multiple businesses for personal Bitcoin.Now it seems that everyone still underestimates BAKKT's ambitions. She not only wants to show the derivative market, but also wants to divide some shares in the competitive spot market, not only covering institutional customers, but also to grab personal customers.With its advantages in licenses, funds and resources, Bakkt's potential is inestimable.While BAKKT proves its strength, the existing derivative trading market is also undergoing severe changes.Due to the excessive competition in spot, the existing head exchanges have carried out derivatives trading business.OKEX has a long history in derivatives. Bitmex is the unparalleled king of derivatives. Huobi and Binance also launched contract transactions one after another, and the performance is also very bright.

Forecast: The derivative market will continue this year's momentum, further grow, and the differentiation of the exchanges is becoming more and more obvious.BAKKT has become a stand -alone regular army, constantly expanding institutions and personal markets. OK, Bitmex, Huobi and Binance belong to the field army. Not only are they facing competition between the same camp, but also the continuous eclipse of the external BAKKT strong enemy.We look forward to seeing more derivative products, lower costs, and higher quality services.

Jianan Yunzhi's attempts to list and digital currency in the capital market

Jianan Yunzhi was listed on Nasdaq, and finally took the first step to digital currency entering the traditional capital market.The capital market has always been very cautious about the listing of digital currency -related companies. The main reason is that the risk of regulatory compliance is uncontrollable. In addition, the company's highly related digital currency market prices have led to high risk of fluctuations in the company's own value market.There have been many digital currency -related enterprises, including Jianan Yunzhi and Bitmain, trying to go public in Hong Kong.Later, Huobi and OK chose to acquire the twists and turns of the Hong Kong Shell Company's backdoor listing to reach the capital market.Today, Jia Nan Yunzhi has become the first share of digital currency, thanks to China's attitude towards mining and mining machine production industries, reducing the risk of compliance. At the same time, the derivative market of digital currencies has become more prosperous.Effective fluctuations provide good tools. Of course, the most important thing is Jia Nan Yunzhi's full preparation for listing. The company's framework and accounting and financial reports meet the Nasdaq's standards.Although Jianan Yunzhi's stock price performance was quite unsatisfactory after listing, the listing itself was of great significance.It provides an effective model for the subsequent mining machines that are preparing to be listed, and also make the capital market really feel the ups and downs of the digital currency industry.

Forecast: Digital currencies enter the traditional capital market. It is undoubtedly the first step, but the most difficult for mining machine companies is that the exchanges are more uncontrollable in supervision of regulatory compliance, and hackers and technical iterations are even more unpredictable.risk.If the exchange can also be listed, the subsequent digital currency third service companies, such as consulting, media, and rating agencies, are hopeful to get the blessing of the traditional capital market.In the future, the mining machine will be listed one after another, and the exchanges will still need long preparations. The first -market exchange will only be produced in the middle of Coinbase or Bakkt. The reason is very simple. In traditional financial institutions,In the eyes, only they are qualified regular army.

China's stricter of virtual digital currency supervision

Supervisory will be late, but will not be absent, especially for digital currency.China's supervision of digital currencies suddenly strictly stricken after leaders' support of the blockchain: closed 6 newly discovered virtual currency trading platforms in China; more than 200 platforms that were used abroad and processed by the serverMore than 10,000 electronic payment accounts; closed more than 300 related WeChat mini programs and public accounts.Financial regulatory agencies from Beijing, Shanghai and Shenzhen have also launched an illegal investigation of virtual digital currency.

Forecast: Any prediction of supervision is futile, because there are too many uncertain factors, but the overall direction is traceable.In fact, China's regulatory policy has not changed. They all follow the 94 ban issued by many ministries and commissions in 2017. However, in terms of implementation intensity and scope, as required, it has become more and more stringent.It will maintain a high pressure.Of course, from the three important policy releases and subsequent market trends in 2013, 2017 and 2019, the period of the impact of supervision on the industry does not exceed 2 months, that is, the medium and long -term development direction of the industry is more.Most of them are determined by the industry itself without changing because of supervision.

China Central Bank Digital Currency DC/EP

The history of digital currencies of the People's Bank of China can be traced back to the Central Bank Institute of Digital Currency, which was established in 2014.In 2016, the institute comprehensively expounded the prototype and goals of the central bank's digital currency, and did not attract much attention at that time.Until 2019 Libra triggered the discussion of stable currency from all walks of life in the world, central banks from various countries have also accelerated the research plan of the central bank's digital currency CBDC, and the People's Bank of China is a well -deserved global leader.It can be seen from the central bank's publicly mentioned that the central bank's digital currency plan can be seen that the upcoming central bank's digital currency is a digital currency and electronic payment system (DC/EP).It is a dual -layer operation system, which maintains relatively anonymity and technical neutrality. The goal is to build another currency and payment system that parallels in the existing system.It is reported that the four major state -owned banks and three telecommunications will pilot DC/EP in Shenzhen and Suzhou.

Forecast: It is expected to see the initial landing of DC/EP in 2020, but many people will be disappointed.It is not because the central bank does not do well enough, but that the expectations of DC/EPs from all walks of life are too great. Fantasy DC/EP can bear the responsibilities that far beyond its ability, such as the internationalization of RMB, such as replacing the existing payment system.

DEFI's rise and decentralized difficult road

The core of Defi is to provide an open -bearing -decentralized financial platform with encrypted digital assets on the chain, with smart contracts as technology, programmable and combined, and combined.2019 is the first year of Defi (Decentralized Finance). Various DEFI products and business models have sprung up in one year. The asset mortgage platform MakerDao, the lending platform COMPOUND, the trading platform DYDX, the contract agreement UMA, etc.The total amount of assets also increased by doubled at the beginning of the year, with a scale of 670 million US dollars.

Forecast: DEFI will continue to develop, but gradually face the bottlenecks of users, activity, asset categories and total.DEFI currently relies on Ethereum too much, and the Ethereum upgrade next year will have a huge impact on DEFI.However, Defi will not have regulatory compliance risks in the short term, because first, Defi is currently small, second, most of the Defi are currency transactions, and they are not connected to traditional financial markets or physical assets.In it, the transparency and fairness of Defi meet the requirements. Relatively speaking, centralized exchanges are the focus of supervision.

Binance suffers from hacking

The offensive and defensive disputes between hackers and exchanges exist on the first day of the exchange.Because digital currencies are difficult to track, and most exchanges have not yet been regulated by national regulations, it is difficult for digital currency to be recovered through law enforcement agencies after being stolen, and hackers are generally out of the way.High return and low risk formation in sharp contrast, attracting countless hackers, and thus security has become the top priority of digital currency exchanges.There have been many sensational exchanges in history by hackers.However, relatively speaking, the security incidents in 2019 are less than before.Binance was stolen 7,000 Bitcoin and $ 40 million in security incidents, which is considered a more prominent security incident this year.However, Binance chose to handle it publicly, using the user security asset fund (SAFU) the full compensation for user losses, winning the user's trust.

Forecast: Hacker stealing exchanges frequently occur, but most of the exchanges choose not to make public.Binance's choice of public and use the full compensation of the Security Fund should be imitated by the Grand Exchange in the future.However, after all, the technology has one foot height. When the magic is one foot high, strive to obtain a legal license, and the country is protected by the country, which is the ultimate weapon of the exchange to resist hackers.

Professor published an academic article proved that the price of Bitcoin was manipulated by Tether

The manipulation of the digital currency market is the most concerned issue for supervision, and it is also the most important reason for supervision to incorporate the digital currency market into supervision.John Griffind, a professor of finance at the University of Texas and Amin Shams, a professor of financial professor of the Ohio State University, published a topic in the top academic journal is IS Bitcoin Really Un-Tetheled (Bitcoin really has nothing to do with Teda)?In this paper that caused uproar, the two professors used blockchain and market data from March 2017 to March 2018. Through a variety of rigorous methods and different angles, the price of Bitcoin was manipulated by Tether.Tether is the current central bank of the digital currency world. The USDT issued by it has actually become the US dollar of the digital currency world. It has been widely used in various trading scenarios. Now the daily transaction volume of USDT has far exceeded Bitcoin.

Forecast: Economists are becoming more and more interested in the digital currency market, because digital currency provides an excellent experimental place for academic research. In the future, the research of digital currency pricing, market structure, risk and supervision will explode.Scholars' reports have a strong influence on supervision, so supervision will be more cautious about the digital currency market.Tether and Bifinex behind it are already the target of regulatory attention, and lawsuits will continue in the future.According to reports, many law firms have begun to prosecute Tether and Bifinex in three states.

Sun Yuchen Shuang Buffett Lunch

Sun Yuchen in Bo Farm used the highest price MDASH in history; MDASH; $ 4.56 million successfully bid for Buffett lunch, but at the last moment, he said that he was treated in the hospital due to sudden kidney stones in the hospital. The lunch meeting with Buffett caused widespread concern and media reports.Subsequently, Sun Yuchen sent Weibo to say that he was deeply guilty about his excessive marketing and enthusiastic hype, and expressed sincere apology to the public, media and regulatory agencies.Of course, apologies and apology, Sun Yuchen, who is quite controversial, is still often in headlines and hot events. Whether he actively created or he has been on, such as Wang Sicong and Luo Yonghao repay his debt, set up a dream fund QR code to sprinkle money, and even evenRecently, Weibo was blocked.

Forecast: The well -known figures in the Chinese currency circle appear in the world in this way, which is surprising.No one can predict how Sun Yuchen will appear in the headline next time. The only thing that can be determined is that he may be late, but there is no shortage of hot spots.

History will not repeat the details, but the process will be surprisingly similar.

Many people in the industry are worried about the arrival of the industry's cold winter. I suggest that they look back at the industry's trough from 2013 to 2017. Most blockchain and digital currency companies have not fell before spring.And the company that comes over,Today is the leader of the industry.

The so -called cold winter is not a disaster, it is a must -have in the process of growth and maturity in the industry.Those practitioners who are truly powerful, the pursuit of the production and dream of the blockchain do not have to panic at all, and those frozen to death in the cold winter are crooked jujube.

Bao Jianfeng came out of the ground, and the fragrance of plum blossoms came from bitter cold.If winter comes, can spring be far behind.

(Author is a financial commentator, senior researcher at the Institute of Fintech Research Institute of Renmin University of China. This article only represents the author's point of view. Editor -in -chief email: [email protected])