Wu Zhijian: The regulatory layer relaxes the listing conditions and introduces different mechanisms of the same shares. The purpose is to encourage more innovative enterprises to list in China.

Several scientific and technological companies with the largest and most well -known scales in China, such as Alibaba, Tencent, Baidu, JD.com, are listed overseas, and none of them are listed in China A shares.This makes the majority of domestic A -shareholders regret, which is also a great embarrassment of the stock market supervision.

In order to make up for this shortcoming, the regulatory is not working hard.In October 2009, China GEM opened on the Shenzhen Stock Exchange.At the end of 2013, the New Third Board Stocking System began to apply for listing from enterprises across the country.

However, whether it is the GEM or the New Third Board, the original intention of the establishment of it at the beginning: Nasdaq, which builds China, seems to be far away.

Take the GEM as an example. Since 2009, the GEM has been on the board for almost 10 years.As of July 22, 2019, there were 767 listed companies on the GEM, with a total market value of 5030.4 billion yuan, which was about 1/8 of the A -share motherboard market (Shanghai City+Shenzhen A -share market value was about 40 trillion).Essence

Judging from the historical return, the GEM may not meet the expectations of investors at the beginning.Calculated by the GEM Index (399006).In early June 2010, the GEM index was 1,000 points.As of the end of June 2019, the GEM Index was around 1511 points. The cumulative return has been about 50%in 9 years, and the annualized return is about 4.7%, which disappointed many investors.Of course, the main board of A shares in the same period is even worse.The annual return of the CSI 300 Index is only 3.8%, which is not as good as the GEM index.

Now let's discuss this question: Can the new starting science and technology board become the new Nasdaq?

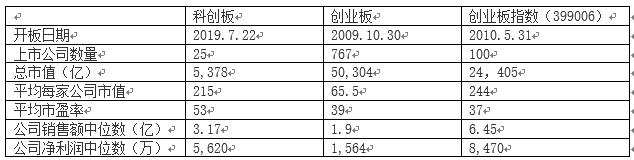

First of all, we might as well compare the similarities and differences between the science and technology board and the GEM.

Note: Data source: choice.The financial data of the science and technology board is based on June 30, 2019, and the financial data of GEM is based on March 31, 2019.Other data is based on July 22, 2017.

Strictly speaking, it is not reasonable to compare the 25 stocks of Koko Chuang Board with more than 760 stocks on GEM.This is because the listing requirements and standards of the two markets are different, and the history is also far from.Moreover, the 25 science and technology board companies that were approved at the beginning should be the best and best candidate companies who apply for more than 100 companies to apply for listing.

From the comparison of the above financial data, we can see that the median sales of 25 science and technology board companies are about 317 million yuan, which is higher than the median sales of GEM companies: 190 million yuan.The profit of the 25 science and innovation board companies is about 56 million yuan, and it is also higher than the median (about 15 million) of the profit of GEM enterprises.

However, if we compare the 25 members of the GEM Index (399006) in the 25 members of the GEM index (399006), it will be much stronger.For example, after the science and technology board closed on July 22, the total market value was about 530 billion yuan, and the average market value of each enterprise was about 21.5 billion.The total market value of 100 companies in the GEM index is about 2440.5 billion, with an average of about 24.4 billion yuan per company, which is very close to science and technology board companies.

However, the 100 companies in the GEM index are much lower than that of the Creative Board enterprises.For example, the average price -earnings ratio of 100 companies in the GEM index is about 37 times.The average price -earnings ratio of science and technology board companies is about 53 times, which is 40%higher than that of the 100 companies in GEM.

The fundamentals of 100 companies in the GEM index are also obvious than science and technology board companies.For example, the median sales of 100 companies in the GEM index are 645 million, which is about twice the median sales of science and technology board enterprises; the average profit is more than 84 million, which is higher than the average profit of science and innovation board enterprises.About 50%.

The science and technology board is strongly supported by the government, and its just opened board has attracted enough attention.The successful stories of couples like Huaxingyuanchuang have excited countless readers and investors.For them, buying a science and technology board stock is not only a stock, but also a Chinese dream that starts to get a hard work and get rich.

However, we also need to understand deeply that the more attention to investment products, the price is often more likely to stay away from the fundamental and rational scope.According to the performance of some foreign stock market technology stocks after listing, a few days after the start of those stock IPOs, the price fluctuated very much.Sometimes rising, sometimes a row.Some stocks rose 30%to 40%on the first day of the opening. After a month or two, it fell below the issue price.This situation is very common.

At present, there are only 25 stocks in the science and technology board, which is very small for investors.These companies, regardless of the industry and fundamental aspects, collectively rise, itself shows that this rise mainly comes from the overall rise of the science and technology board, not the company's own fundamentals.When the seawater rises, the big fish, small fish, ducks and water plants are rising.But only when the seawater falls, we will see the difference.

If investors are optimistic about technology innovation companies, and want to invest, a more secure way is to buy a product similar to the GEM index fund/ETF.From the perspective of diversified, valuation, and fundamental aspects, such investment methods are more secure, and they can also enjoy the benefits of rising stock prices in science and technology enterprises.

As for whether the science and technology board can get out of the strange circle of the GEM and the New Third Board, break through the siege, and become Nasdaq, which represents the innovation industry in China. At present, the conclusion is too early.The stock market supervision has introduced more loose listing conditions to allow more flexible design mechanisms for the same stocks. The purpose is to encourage more promising scientific and technological innovation companies to list in the country and obtain the funds of the company's development., Baidu, JD.com and other tragedies of overseas.

However, it takes time to test whether these reform measures can be effective.For example, we need to observe: How is the supervision of the supervision of the company's governance, and is there any effective listing and delisting mechanism, will it become a potential money market like A shares?What investors are involved?How is liquidity?What is the cost of friction?etc.To find out the answers to these questions, we need to read at least two or three years or even longer.Let's wait and see, expecting the science and technology board to give birth to a number of new Chinese technology giants.

(The author is the CEO of Wufu Capital, Singapore. This article only represents the author's point of view. Editor -in -chief email: [email protected])