Shen Jianguang: How to effectively reduce the burden on corporate corporate, reduce corporate financing costs, and improve the medium and long -term expectations of enterprises is vital to the current Chinese economy.In the second half of the year, monetary policy will continue to be structurally loose.

In the intricate internal and external environment, the Chinese economy recorded a 6.3%growth in the first half of the year. In June, some data such as the rebound of the total social retail product, and the growth rate of real estate investment exceeded market expectations.Some opinion believes that the data recovered in June indicates that the Chinese economy has achieved moderate stability, and the economy may show a periodic recovery in the second half of the year.But has the Chinese economy really going out of the trough?

The author believes that the current global economic trend has declined, the growth momentum is insufficient, and the trade protectionism has not been stigmatized, and the external environment is still full of variables.In June, the growth rate of economic data was lower than the same period last year, and foreign trade conditions were not optimistic in the first half of the year.Generally speaking, under the pressure of internal and external pressure, the Chinese economy is still in the passage of the trend, and the foundation of the economic rebound is not stable.

June data rebound sustainability doubt

In June, the total growth rate of social retail products reached a 15 -month high, but it was difficult to continue in the future.In the short term, the promotion of the National Five Vehicle Promotion Clear the boos on automobile consumption is very obvious. In June, the retail sales of automobiles rose sharply to 17.2%year -on -year, a new high since October 2011, and the zero growth of the community was as high as 1.6 percentage points.In addition, online consumption has maintained a high level and has also contributed to the increase in zero -growth growth.However, considering the effect of car clearance promotion and e -commerce shopping festivals as a short -term phenomenon, it is expected that the zero growth rate is expected to maintain high increase in the future.In fact, after the rebound of car sales in June, it has fallen in early July; the early promotion means the overdraft of future demand, and the car sales will still be under pressure in the second half of the year.

The added value of industries above designated size recovered slightly, but the overall industrial production situation was still weak.From the perspective of demand, the recovery of consumption in June has a certain drive, and the low base effect of the same period last year can also explain this rebound to a certain extent.However, in the second quarter, the industrial production situation was still weak as a whole. Since July, high -frequency data such as coal consumption and blast furnace operating rate have declined since July.Waiting for negative growth.

Investment indicators are still weak, and they mainly rely on real estate support. Infrastructure and manufacturing investment has not improved.From January to June, the national fixed asset investment increased by 5.8%year-on-year. Among them, real estate investment still maintained a double-digit growth rate, continuing the support of investment;Recently, supervision has obviously tightened the real estate financing policy. Under the pressure of debt repayment, the enthusiasm of real estate companies will cool down, and the probability of continuing real estate investment will continue to fall.Infrastructure investment increased by 4.1%year-on-year, and no significant boosted was not obvious under the budget constraints, but in my opinion, considering the lagging effect of local debt volume issuance in June, the probability of subsequent infrastructure recovery is relatively large;Although manufacturing investment continues to rise, it is still at a low level. If the company expects that there is no improvement, the weakness will continue.

On the whole, the economic data in June only rebounded, and the possibility of stimulating factors was unsustainable. Therefore, it was only a month of data to determine that the Chinese economy had already gone out of the trough and was not mature. Under the pressure of economic downward, the inflection point of the Chinese economy has not yet arrived.Essence

The risk of financial market risks

Growth has not yet stabilized, and the pressure of financial prevention risk has not been alleviated.At the end of May, the impact of Bao Shang Bank's takeover incident on the market is undoubtedly far -reaching.Its direct influence is to break the expected and impact currency market of the same industry, which once caused the liquidity layer between large banks and small and medium -sized banks, non -bank institutions; but in my opinion, the incident of Baoshang Bank will not be a case.Behind it is the problem of high risk of small and medium banks that may accelerate the surface.

This kind of concern makes sense.On the one hand, the expansion speed of small and medium-sized banks in recent years has always been greater than large banks such as state-owned banks and shares. According to the data of the CBRC, the total liabilities of the city commercial bank have the fastest expansion.The overall agricultural and commercial banks are also higher than the average level of shareholders and state -owned banks; according to the data of the Shanghai Institute, the rural commercial banks have expanded at a high speed in recent years.On the other hand, in recent years, the profit and risk control capabilities of small and medium -sized banks have shown a deteriorating trend. For example, official statistics show that the overall net interest margin of rural commercial banks has declined significantly in the first quarter of this year.Out of other types of banks.After taking over the contractor, the regulatory authorities also stated that some agricultural commercial banks and urban commercial banks are facing serious credit risks and on the edge of technical bankruptcy. Such institutions should clean up the market in accordance with the principles of marketization.

In this case, how to standardize the problems of rectification of small and medium -sized bank operations and corporate governance levels, and prevent risk concentration of exposure and change, especially small WeChat is the most important part of the current implementation of counter -cyclical regulation and monetary policy dredging and transmission mechanism.Credit contraction with small and medium risks exposed requires key prevention.

In addition, the risk of real estate is not ignored. In March and April, the housing market Xiaoyangchun and the popular land market transactions quickly attracted the attention of the regulatory level. On May 17th, CBRC No. 23 will be regulated to the financing side of the real estate enterprise. At the end of June, at the end of JuneOver the past few places, the financing of real estate companies, especially real estate trusts.This round of real estate regulation seems to be normalized, and the old road will not go anymore, and under the downward pressure, the road to growth in real estate will no longer be reproduced.

Exit decline will be the main risk of the economy in the second half of the year

In addition, the current Sino -US trade dispute has not been completely resolved, the global economic slowdown, and the rise of trade protectionism. Under the multiple unfavorable factor, China's future foreign trade will still face large downward pressure, especially the Sino -US trade black swan incident in MayThe influence has already appeared, and the risk of decline in foreign trade is the main impact of the economy in the third and fourth quarters.In June, China ’s exports for USD were decreased by 1.3%year -on -year. In the first half of the year, the cumulative export of US exports reached 8.5%, which has become the main drag on China's exports.

It is worth noting that trade friction does not affect China's trade with Southeast Asia, but has further strengthened the trade connection between the two parties.In the first half of 2019, China rose against the growth rate of ASEAN countries, and the cumulative export of ASEAN countries increased by 7.9%. Among them, the export of Vietnam grew by more than 10%.The beneficiary of friction.From the statistics of the General Administration of Customs of China, ASEAN in 2019 is even expected to surpass the United States and become China's second largest trading partner.

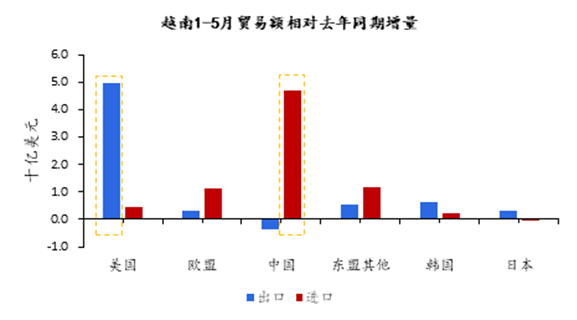

However, the author believes that the re -export trade should be the primary reason for China to export ASEAN exports.Observing the trade increase compared with the same period last year from January to May 2019, it can be found that Vietnam's imports from China increased by 4.71 billion US dollars, while the same period of exports to the United States increased by 4.94 billion US dollars, which indicates that there may be a considerable scale of Chinese products that have passed through the size of Chinese products.Vietnam exports indirectly to the United States.

Figure 1 Vietnamese exports to the United States and imports to China Synchronous

Source: Vietnam Statistics Bureau, JD Digital Technology

So, can Southeast Asian countries become a stable growth point for China's exports?In fact, the surge in China's exports to Southeast Asia is more likely to be a short -term phenomenon and has caused the United States to alert.On July 2nd, the US Department of Commerce imposed 456%of the penalty tariffs on Vietnam's steel products, which was a clear evidence.The author believes that as the United States has strengthened the supervision of Vietnamese goods exports and included Vietnam in the exchange rate manipulation list, this transfer export phenomenon is destined not to last.Flowing global demand decreases and protects the LordAgainst the background of righteousness, the trend of global trade atrophy is unavoidable. Under the expectation of the decline of the transfer and export phenomenon, the downward pressure on China's exports in the third and fourth quarters may further increase.

On July 10, the Premier Li Keqiang of the State Council hosted a executive meeting of the State Council to determine measures to further stabilize foreign trade, including improving the policy of fiscal and taxation, continuing to reduce the total level of import tariffs, improved export tax refund policies, and accelerated tax refund progress. Multiple measures were internal and external.Under the impact of the sluggish foreign trade prospects, a certain policy guarantee is provided.After the G20 summit, China and the United States restarted trade negotiations, avoiding the risk of further deterioration of Sino -US trade disputes in the short term.However, the future export situation will largely depends on the progress of China -US negotiations and the trend of global economy.

Policies and reforms must be accelerated, and negotiations at the end of the year are worth looking forward to

Generally speaking, under the background of the increase in economic data fluctuations in the first half of this year, although the rebound of industrial and consumer data in June exceeded expectations, it was not surprising.The impact of tariffs, the Chinese economy has not fully got out of the trough, and the internal and external pressures faced by the economy in the second half of the year are still large.

Throughout the world, in 2019, major economies are close to the apex of the cycle, and the growth momentum is weak.Leading indicators such as durable goods orders and PMI have experienced downward trends; and European economic growth is slow, Brexit is unreasonable, and monetary policy space is limited; Japan's growth is also close to stagnation, and weak foreign needs may directly drag down China's future exit.From the perspective of the global economic barometer, South Korea's exports, which have fallen rapidly since 2019, may indicate that the global economy will slow down in the future and even enter the recession range. The global environment facing China's exports is not optimistic.

In this context, through the stable growth and employment of counter -cyclical regulation policies; increase opening up to the outside world, and promote the implementation of various reform measures. At the same time, striving for negotiation and avoiding the decline in foreign trade has become the best choice for the current Chinese policy.

In the short term, how to effectively reduce corporate burdens, reduce corporate financing costs, and improve the medium and long -term expectations of enterprises is essential for the current Chinese economy.Considering that the recent inflation pressure and the global interest rate cut cycle may be opened to give more room for monetary policy, the author expects the monetary policy in the second half of the year will continue to continue the structural and loose trend;At the same time as the effect, it has introduced more supporting supporting policies such as stimulating consumption and shortcomings of infrastructure supplements.

At the same time, the APEC conference in November this year will be an important time to determine the future situation. If the Sino -US trade dispute can be slowed down, China's macroeconomic economic policy can accelerate the implementation and promote structural supply -side reforms, such as interest rates and tracks.The reform of the three land, the fiscal and taxation system, etc., to accelerate the opening of the outside world is still the method of solving structural problems and improving growth momentum. It objectively helps the Chinese economy to stabilize next year.