Qiao Yide: The essence of stabilizing foreign finance is to increase muscle and strengthen the body; the other is to promote blood circulation and fitness, so that the blood of finance is more unblocked and the body of the financial market is more sound.

At present, the Chinese economy is facing a complex situation. Various economic data are half -giving off. Although the start is good, the downward pressure is still very large.At the same time, the Sino -US economic friction has been upgraded sharply and has gradually expanded to science and technology, diplomacy and other fields.This also brings huge uncertainty and negative impacts on economic growth prospects.In this case, people often say that they need to do their own things, which is of course right.To do a good job of yourself, you must first adhere to reform and opening up, and you also need to formulate effective policies to coordinate each other for various situations and risks.This article is only from one side of the economy, that is, how to stabilize the views of foreign finance.

The so -called foreign finance, compared to domestic finance, involves exchange rates, cross -border capital flows, international revenue and expenditure and foreign exchange reserves, etc., is an important part of our foreign economic activities.There is no doubt that it is relatively affected by external impact, and the first is the exchange rate of the RMB.Since the upgrading of Sino -US trade friction last year, the RMB has been depreciating and has depreciated by 8%.In particular, the United States has recently announced that it will increase taxes, and the exchange rate has been depreciating.This is the natural result of the operation of the market economy.In addition, people's expected exports will decline and economic growth may decline, thus the expectations of the RMB may be depreciated.George Saravelos, a German bank exchange rate strategist, analyzed and estimated the impact of various after -increase taxes on various after -tax increases, and made the following table.The specific predicted data may not be important, but he provides us with a quantitative result on the impact of tax increases on the RMB.Of course, whether the renminbi will depreciate to this extent depends on other factors.

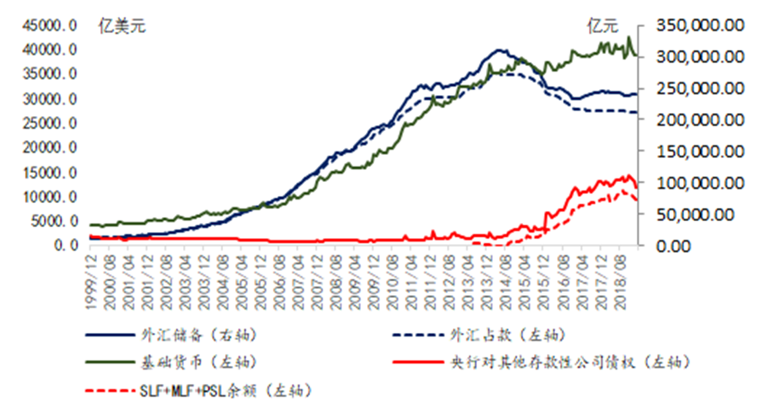

Table 1. Increase the estimation of the impact of tariffs on the RMB (USD/RMB)

Note: Assuming that all China exports to the United States is 550 billion U.S. dollars Source: Deutsche Bank, Bloomberg Finance

It can be seen from the table that the most serious may be that the United States has received a 25%tariff on all Chinese export goods, and the renminbi depreciates to 7.93.This involves a sensitive and different issue, that is, should we take measures to prevent the RMB from breaking the boundary of 7.There are two very different views on whether to keep 7.A very important point that 7 thinks 7 should be used to keep it with various measures. Otherwise, a vicious cycle of capital fleeing a lot of capital and further depreciation of the renminbi may occur.Another point of view is that 7 has no special meaning as any other number. Even if it breaks 7, the exchange rate formation is super -adjusted, and the market mechanism can restore it to a reasonable level.Careful analysis of the hidden logic behind these two opposite views seems to obtain the following explanations.7 Like any integer, it has a certain psychological suggestion in the financial market, especially in the foreign exchange market, and this is also a short -term factor that affects the fluctuation of exchange rate fluctuations.Therefore, it has a different meaning as the average number.If you can take four or two pounds of simple ways, such as financial management departments to speak for expected management, it is not a bad thing to keep 7.However, it should be noted that it cannot solidify this, otherwise it is equivalent to the speculation of short and short.Moreover, it cannot be exaggerated on its effect, and it cannot be used to use a large amount of foreign exchange reserves to protect 7, which is not worth it.As for some people say that it is unacceptable to keep the exchange rate stable at 5%of the GDP to 5%.The rapid decline in economy will affect employment and affect the stability of the entire overall situation.We should realize that it is one thing that does not use the exchange rate to promote exports, but after all, the exchange rate is one of the macro -prudential tools, which is another thing.During the European debt crisis, international revenue and expenditure in Greece and other countries severely deteriorated, and they could not improve international revenue and expenditure by depreciation.This fact should be educated from the opposite side. We should not forget that the exchange rate is an automatic regulator for macroeconomic and international revenue and expenditure, which will work and use it.This is not contradictory to maintain the requirements of the exchange rate in a reasonable range.

The control of the capital account after 2016 has strengthened it. This is a way to prevent RMB from depreciating significantly and preventing sharp decline in foreign exchange reserves.Of course, there is a paradox.When facing a complex environment now, people further recognize the fundamental significance of the internationalization of the RMB, but the capital account cannot be fully open at present, which will undoubtedly hinder the process of the RMB internationalization.It should be recognized that it is not the best window period for RMB internationalization.In this regard, we can only take a cautious attitude in dealing with the long -term mentality in dealing with the current or about to occur, and at the same time, we still strive for more extensive use of RMB under the control of controlling.

At present, pay attention to control and reduce Exposure (open) of foreign finance; foreign investment and foreign lending must strictly follow the Belt and Road debt sustainable analysis framework; comprehensively analyze the financial reliability of the acceptance of the country;Be cautious, pay attention to the quantity, term, and currency of foreign currency bonds; in economic and trade activities, the local currency, especially the RMB is priced.It should be aware that as long as any cross -border financial activity is settled with a US dollar, regardless of whether the financial transaction object is an American institution, it will generally be liquidated in the United States. This will be restricted by US law.Avoid the US dollar valuation and settlement.Of course, the biggest pain point is SWIFT. If SWIFT is closed to us, then foreign financial activities will almost be forced to stop completely, as Iran has encountered.Blockchain can break through this bottleneck, and there is no technical problem. It should be stepped up to study how to apply large -scale business in business.It is reported that more and more foreign banks have joined the CIPS, so Swift's status will not be guaranteed.This statement confuses the two things. SWIFT is a cross -border message system, which transmits payment information, and CIPS is at least only a RMB payment clearing system at least now, that is, even if foreign banks have joined the CIPS, because it is based on it, it is based on it, because it is based on it, because it is based on the useThe indirect contact method is added, so you have to use SWIFT to pass cross -border payment information.The establishment of CIPS is of great significance to the internationalization of the renminbi, but it is a pity that it cannot solve the dilemma faced by the cross -border financial exchanges in the US dollar according to its dominance.

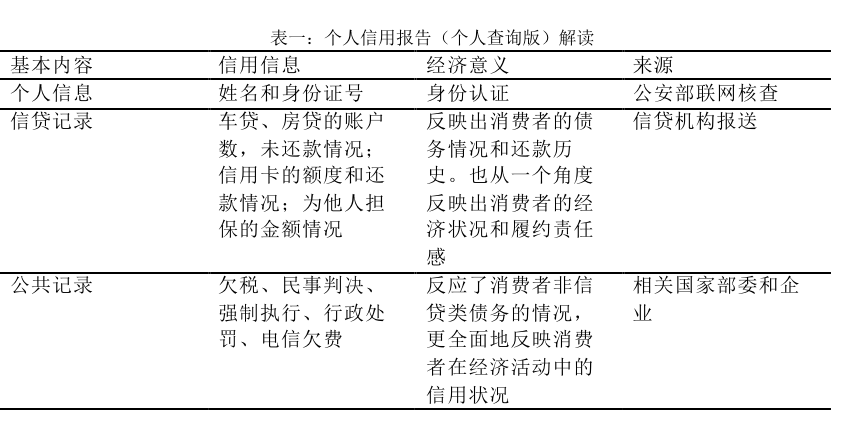

Keeping basically stability of international revenue and expenditure is a core and main goal of foreign finance.There are two main compositions of international revenue and expenditure, namely regular accounts and capital and financial accounts.The current basic situation is that the main part of the regular account's trade surplus has continued to decline in the past 10 years in the past 10 years.Less than 0.4%.It is predicted that China's frequent accounts will soon appear a continuous deficit. There are different views on this conclusion that the U -shaped reversal will occur, but the basic consensus is impossible to have a large surplus in the past.In addition to cargo trade, the deficit of China's service trade has also continued to increase (Figure 1).This is often ignored.

Figure 1. The proportion of Chinese cargo trade and service trade balance and it accounts for GDP

In this case, we must first strive for a regular account to maintain a surplus, and we must strive to expand the diversification of goods exports. At present, the proportion of the total imports and exports in China continues to decline, while the proportion of the European Union, ASEAN and countries along the Belt and Road Initiative is increasing.There is also room for further improvement.In addition, the export of foreign service trade should be expanded to reduce the service trade reverseBad, although the service trade deficit in the first quarter of this year still reached 36.5 billion yuan, it fell by 14.3%year -on -year, which is a gratifying signs.Capital and financial accounts have begun to have a deficit from time to time in the past few years. Although there have been surplus in the past two years, the proportion is very low, reaching only 0.9%.Therefore, it is necessary to strive for cross -border capital inflows. In terms of direct investment, we must conscientiously implement the foreign investment law, further improve the business environment, and allow those foreign companies that may be transferred to overseas due to Sino -US trade friction.In this regard, because Huawei is suppressed by the unfairness of the US policy, some people recommend that they return their teeth with their teeth to retaliate against the US companies in China.When you introduce any policies, I am afraid that it is necessary to ask: Is this conducive to retaining foreign companies, or actually drive fish for Yuan.In terms of attracting foreign securities investment, MSIC has recently expanded the composition of A shares, which has led more foreign funds to enter the Chinese stock and bond market.The international version can be tried in the Shanghai Stock Institute. The issuance of CDR can expand the functions of the free trade zone in the Shanghai Free Trade Zone, allowing more banks to develop OSA business.

Increasing the issuance of government bonds is also a stable way to attract foreign capital.Compared with mature countries, the current proportion of Chinese Treasury bonds in all debts is relatively low, accounting for only 45%.At the end of 2016, US federal government debt accounted for 83%of government debt.Moderate increase in issuance of government bonds is conducive to the implementation of positive fiscal policies, and it is also conducive to the internationalization of RMB.The Bloomberg Barcara Index has included Chinese Treasury bonds into its index on April 1. It is expected that more institutions and countries will purchase Chinese treasury vouchers, and more countries will use it as foreign exchange reserves.According to Goldman Sachs estimation, the amount of foreign funds in the Chinese bond market may be as high as US $ 135 billion in the next 20 months.

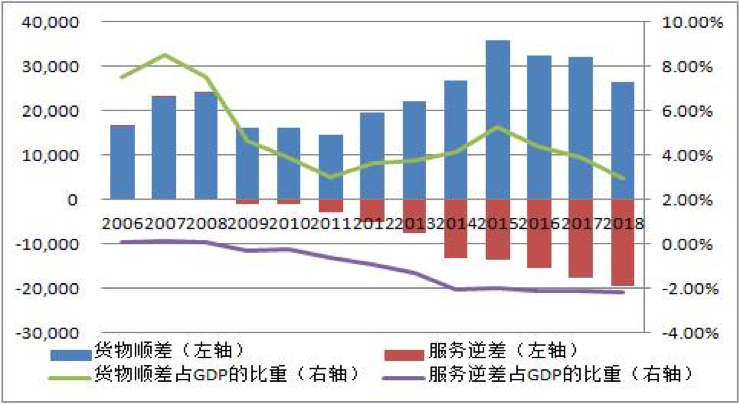

Having a certain amount of foreign exchange reserves is necessary to resist external shocks, because it is conducive to stable exchange rates, stable cross -border capital flows, and stabilizing international revenue and expenditure balance.At present, $ 3 trillion is suitable, and it should be stable, but at the same time, it should not exaggerate its importance.Some people think that the issuance of RMB depends on foreign exchange reserves and the US dollar, which is completely wrong.Renminbi only depends on the government's credit support like all legal currencies.Historical facts and theoretical logic refute this error point.

Figure 2: Comparison of foreign exchange reserves, foreign exchange funds, basic currencies and new currency instruments issued by the People's Bank of China since this century

From the figure above, we can clearly see that foreign exchange accounts are indeed correlated with foreign exchange reserves, but it is not a causal relationship.After MDASH in 2014; after the decline in foreign exchange reserves and foreign exchange accounts in 2015, the basic currency continued to issue normally.It made up for the decline in foreign exchange accounts.In terms of epistemology, the reason why some people think that the issuance of RMB relies on foreign exchange reserves and the US dollar is because they mistakenly believe that there are foreign exchange reserves first, and then issue RMB according to foreign exchange reserves.This is not the case.In fact, the central bank's purchase of foreign exchange has two results: one is the increase in foreign exchange reserves, and the other is RMB (see the author of this article Qiao Yide: How to view stable cross -border finance?, FT Chinese website 2018.09.05).

Of course, stable foreign finance is not an isolated incident. It is a component of stable finance. It depends on the stability of domestic finance and rely on financial supply -side structural reforms. It also depends on the economic operation in a reasonable range.In the case of economic downturn, it needs to be adjusted against the cycle and also requires structural reforms. These are the meaning of the question and no longer repeated.

In short, the essence of stable foreign finance is to increase muscle and strengthen the body, increase the thickness and strength of the financial market, and enhance the ability to fight against external shocks;To improve, so as to better serve the real economy.