Shenghong: Reducing the fair rules of the Sino -US trade difference is that China and the United States will implement equivalent tariff rates and other non -tariff arrangements. China can first reduce the tariff rate to the US level.

President Trump suddenly levied tariffs on US $ 200 billion in Chinese products to 25%. The Chinese government immediately responded to tariffs on tariffs on $ 60 billion. In addition to a fierce response from the stock markets of the two countries, we heard a shouting.EssenceIt seems that the trade war officially started.Both sides claim that they can win in this battle.This situation seems to have known each other.We have seen a lot in human history.Edward Bull, the author of the Roman Empire's decline of death; Yoshimoto once said, saying that history is just a record of human crimes, stupidity, and unfortunate encounters.The biggest crime is war, which leads to stupidity that leads to war. The result of the war is unfortunate encounter.When a war is over, people often find that compared with the disaster caused by the war, the cause of the war is often just a trivial matter.For example, World War I..The so -called stupidity is to calculate the error.Generally, it is overestimated its own winning rate.As a result, the loser thought he could win in advance, and the winner thought he would not pay too much.

President Trump was wrong to impose tariffs on Chinese products.He said that increasing tariffs has no negative impact, but only increased the income of the US government.As President of the United States, he does not seem to have the concept of coinage tax.I have pointed out that if the dollar is also considered a commodity, the United States has no trade deficit.The US dollar products are the highest profit margins in all export products in the United States.If the technical cost and institutional cost of US dollars are issued by 20%, the profit margin is as high as 80%.If Trump wants to increase a 25%tariff on $ 500 billion in Chinese goods, with a view to a $ 200 billion in trade deficit, the US government gets $ 75 billion in tariff income (part of which is paid by U.S. citizens), andHowever, the $ 200 billion coinage tax was obviously worthless.What's more, the coinage tax income is an additional income in the national revenue. This income can be used to flatten the US military expenses higher than the world average.Reducing the trade deficit is to reduce the tax income of coin, which is the resources that reduce military expenditure.

Some people think that the dollar obtained by foreign people through trade is their claims to the United States, not US income.This may be a place where Trump and its economic adviser to be blurred by the coinage tax.As long as we replace banknotes with gold and silver, we know that currency is a product.Its utilization is convenient trading, so it has independent value, which can be seen from Bitcoin's independent value.As long as people believe that this independent value will be acknowledged, there will be less than enough currency or even banknotes.The advantage of gold and silver is that the coinage tax of banknotes is extremely high, and through human monetary policy, it will not make the domestic currency supply insufficient even if a large amount of outflows.In fact, the US dollar exported by the trade deficit, and returned to the United States by purchasing U.S. financial assets, especially the form of US Treasury bonds, so that this coinage tax income can be in the form of the US government to subscribe to enterprises.Military industry.

At the other end, some people in China have made calculations that are conducive to China.For example, Mr. Gao Lingyun, the Institute of World Politics and Economics of the Chinese Academy of Social Sciences, pointed out that 90%of Trump's tariffs were borne by Americans, and the Chinese only assumed 10%.Even if this algorithm is right, it is obviously just a static calculation with a simple contrast.And we know that the calculation of the Chinese as a producer and the Americans as the consumer is different.For consumers, you can buy less or not buy it if you are expensive, and you can also buy similar products produced by other countries.The more tariff costs undertaken by American consumers, the higher the price of Chinese consumer goods they buy, because there are price elasticity, the less the number they buy.This will become more significant over time.The decrease in the total demand for Chinese products will reduce the orders of Chinese producers.The misleading of static estimation is that it only sees short -term reactions. For example, China's trade surplus in the United States in 2018 will not decline, but it will not be able to see negative long -term results for the time being.In fact, by the first quarter of 2019, China's exports to the United States have decreased by 8.5%compared with the same period last year.

As a producer, 10%of 25%is 2.5%, which is fatal for manufacturing companies with a normal sales rate of less than 5%.It can completely offset China's large -scale tax reduction effect (2%) this year.In recent years (2012 ~ 2016), the net asset yield of China's manufacturing industry minus the risk -free interest rate and reasonable risk premium, with an average of about -2.6%(Sheng Hong, the government's share expansion, the profit margin is exhausted. 2018), Capital is no longer profitable.Considering the decrease in total demand, the equipment idle rate will be increased and the unit cost will be increased.In the long run, a large number of Chinese companies and foreign -funded enterprises in China must consider reducing or even closing their production capacity in China, and transferred to other countries.Similar products produced in these countries will eventually replace Chinese products in the US market.The market that is permanently lost is a major customer asset loss, and its amount must be estimated to use the summary of the future sum of the future profit of the annual profit.For example, if the profit lost each year is 10 billion US dollars and the discount rate is 4%, the discount value of its future income is about $ 25 billion.If various elements, such as labor and land, calculate the loss at the added value. The value -added rate of the manufacturing industry is 30%, and it is $ 60 billion, and the customer asset loss will be as high as 1500 billion US dollars.

In fact, the trade bonus brings trade dividends is a simple common sense of economics.This trade dividend is divided into producers' surplus and consumer surplus to share with producers and consumers.Reducing a transaction will reduce the corresponding producer and consumer surplus.In a market that is not disturbed, existing trading partnerships are the best relationship.If a seller wants not to sell or a buyer for a weapon for the trade war, it is impossible to damage the other party without being lost.Because they can only find the second -best partners because they leave the traditional trading partner, that is, the seller can only be sold at the original price, and the buyer can only buy at the original price.So when we see what kind of weapons we can win in the trade war, we must understand that even if we can win, we must fail than not fighting.This has not been calculated, and the other party retaliated and the losses caused by each other repeatedly.More importantly, we must not take this as a basis to stimulate our fighting passion and advance the conflict that may be resolved peacefully to the state of war.

It should be said that with the complexity of the economic system and the complexity of human society, human beings have no ability to calculate all the losses that may bring in a trade war.Hayek once said that the direct consequences of intervention in market order are instant and clear in most cases, but the more indirect and far -reaching consequences are largely unknown, Hell; hellip;, we can never realize the all costs that must be paid by this intervention method to achieve specific results.Compared with non -trade, distorted trade or restricted trade, the value of free trade is not only static producers and consumer surplus, but also the in -depth deepening of division of labor and professionalization caused by the expansion of the market brought by trade, The market information system formed in the market information system for producers investment decisions and the inspiration of innovation inspiration, the business model, technical means, and production process caused by trade competition, and the changes for the change of contract methodsIt will bring our unexpected efficiency improvement, reduced costs and market expansion.Therefore, when free trade is distorted and limited, the losses we have suffered cannot be calculated.If someone says that it can be calculated and claims that a certain party can win, it is probably not because of patriotism, we must maintain high vigilance.

Although we cannot quantify and compare the losses of the trade war, we do know the most basic and simpler principle of judgment. This is that free trade is better than not trade, distorted trade and restricted trade.This means that at least between roughly equivalent trading partners, for any party, free trade will bring benefits; without trade, distorted trade, and restricted trade will bring bad places.The best trade negotiations must be to work in the principle of following free trade, rather than the specific gains and losses to calculate what means to take the trade war.The next strategy is based on the so -called calculation.Therefore, the ultimate purpose of this Sino -US trade negotiations should be to improve the existing trade relationship and move towards the direction of more fair free trade.The tariffs waved by Trump should only be used as a means of promoting negotiations and correcting distortions, and should not be the purpose.

But unfortunately, it seems that the big stick has fallen now.It will bring two disadvantages.First, it makes Sino -US trade relations farther away from free trade, which not only increases tradeLimitation also makes the market more distorted.In China, it is a non -state -owned enterprise that is truly capable of exporting and competing with other companies in the world market.This is not only because of the low efficiency of state -owned enterprises, but it is impossible to compete with other companies in the world, but they can also survive in China, in addition to huge subsidies, they also have the monopoly rights of the domestic market.Even in this case, the nominal net asset yield of state -owned enterprises is significantly lower than private enterprises without these subsidies. For example, the net assets yield of non -state -owned industrial enterprises in 2013 were 15.64%, and the yield of net assets of state -owned enterprises was only 8.73%.This shows that the inefficiency of state -owned enterprises completely offset the benefits of subsidies and is more than.Relying on this inefficient, most state -owned enterprises cannot work hard in the international market.

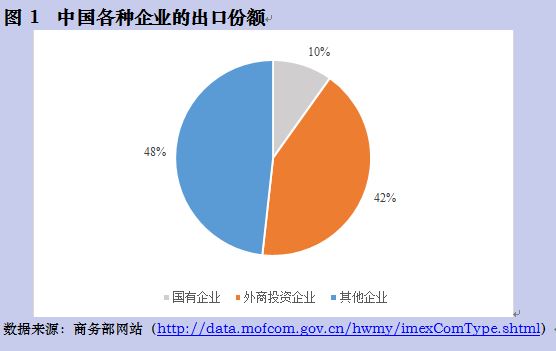

Therefore, those who truly cause high trade deficit in the United States are mainly Chinese private enterprises and foreign -funded enterprises.According to the Ministry of Commerce, from the data of March 2019, state -owned enterprises accounted for only 10%of the entire export value, and the remaining 90%of the exports were created by private enterprises and foreign -funded enterprises.As a result, most of Trump's tariffs are added to the heads of private enterprises and foreign -funded enterprises without government subsidies.This is not a correction of market distortions, but is being punished companies that follow market rules and make the market more distorted.It is also necessary to consider US $ 60 billion in US commodities that have been imposed by the Chinese government's countermeasures, and their producers are also innocent.If only 20 billion US dollars of US $ 260 billion is a commodity of state -owned enterprises, this is equivalent to the unfair trade of $ 20 billion (7.7%) in order to punish and corrects the unfair trade of 20 billion US dollars (7.7%).Accompany the tie.This is unfair and stupid.

Second, it may transfer the central point of trade negotiations, so that the attention of both parties is on the tariff war, and further revenge each other based on this.The original purpose may be forgotten.The general tariffs on Chinese goods have caused general losses of private enterprises and foreign -funded enterprises. They will get up to oppose this measure and become the political driving force for the negotiation game of the monopoly interests of state -owned enterprises in order to defend national interests.It is precisely because Trump's tariff sticks have not hit state -owned enterprises, so they are not afraid of this tariff war, but they are hiding under the shell of national interests.The overall interests of the country are conducive to them.And those private enterprises and foreign -funded enterprises that follow market rules are their hostages. Once the tariff sticks are smashed, they are hiding in the middle of the hostages and will not be directly injured.They even snickered.On the other hand, in order to punish the unfair trade of a handful of enterprises, Trump generally hurt Chinese enterprises, especially private enterprises, so that they are so excited and have their enemies.EssenceInstead, this hinders China and the United States to reaching an agreement to correct unfair trade and follow the principles of free trade.Furthermore, the countermeasures caused by this are more likely to bring the two sides into the vicious cycle of mutual revenge, so that it may be possible to forget what to negotiate for.

Why do you talk?As mentioned earlier, the purpose of the negotiation is free trade, which should be specific to the principles of fair trade and the rule of law.Following the rules of fair trade is to eliminate all unfair phenomena, including subsidies, restrictions, infringement of intellectual property rights, franchising, monopoly and other policy discounts, etc., while the rule of law is used to use the country's compulsory and fair judgment trade disputes.Fair trade is voluntarily in most cases, and in a few cases, the mandatory maintenance of the rule of law is required.Therefore, the rule of law is also an important system of fair trade.Not only that, the principles of fair trade and the rule of law are the basic consensus between China and the United States and its government.Needless to say.The Chinese government emphasizes that the market plays a decisive role in the allocation of resource allocation, and emphasizes the principles of free trade to the outside world. They are parallel with the principles of fair trade.The Fourth Plenary Session of the 18th Central Committee of the Communist Party of China emphasized that the construction of the rule of law, the government of rule of law, and the society of the rule of law. Although there are many problems that violate the rule of law in reality, in principle, we must work hard in the direction of the rule of law.Therefore, this is the basis of the principle of Sino -US trade negotiations.We can measure the principles of fair trade and the principle of rule of law in trade negotiations and the agreement text to be reached in trade negotiations.

Liu He pointed out that an important difference in this round of Sino -US trade negotiations is that after China requests that the negotiations reach an agreement, the United States should cancel a tariff of 25%and US $ 200 billion in US $ 60 billion in goods in China.This is obviously a normal requirement.And as mentioned above, this measure actually violated the target of the negotiation MDash; MDASH; fair trade, and adding tariffs to innocent Chinese non -state -owned enterprises is a blow to the principles of fair trade itself.In the same way, according to the Wall Street Journal, the United States requires that the trade deficit with China before 2020 will reduce US $ 200 billion, which is also violating the principles of fair trade.If this requirement becomes an agreement between the government, in order to implement this agreement, or to increase purchases by government institutions or state -owned enterprises, or forced private enterprises to purchase, this will not be a market behavior of cost income calculations. AlsoIt will greatly reduce the efficiency of resource allocation, and even bring false demand information to American companies.In this process, the weight of government agencies and state -owned enterprises in the Chinese economy will also increase, and they may also require government subsidies because they want to execute administrative orders purchased.This is obviously not fair trade.

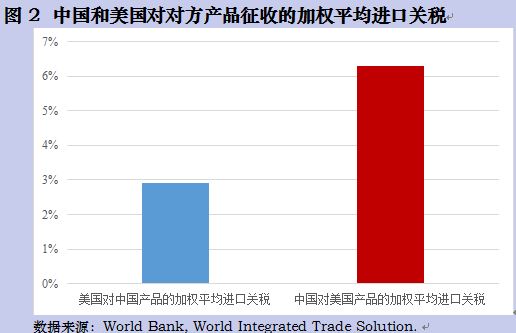

Of course, from the current development stage of China, China is in a period of strategic transformation. As I have proposed, China will transform from Chinese manufacturing to the Chinese market and open a larger domestic market to contribute to the world economy.At the same time, due to the giant country effect, that is, according to the new trade theory of Professor Crugman, in free trade, larger countries will have advantages, and China has the biggest advantage as the largest country; although China is in terms of competitiveness in technology and systems, ChinaIt is still ranked behind (13th in 2018, according to the Lausanne Management College of Switzerland), but there is a trade surplus between the previous countries or regions (such as the first American).This shows that China has the strength to achieve equivalent or even unilateral freedom.Therefore, the fair rules for reducing the trade difference between China and the United States are the tariff rates and other non -tariff arrangements for China and the United States.A zero tariffs are implemented.Therefore, the Sino -US trade agreement can reach this principle of equivalent to replace the hard requirement to reduce the difference of 200 billion US dollars in 2020.

Considering the asymmetry of China -US taxation rate so far, the average tariff rate of the United States' weighted Chinese goods is 2.9%, while China is 6.3%(2016).The trade difference will gradually shrink.After this problem is solved, there is only structural problems, and the scope of the problem is greatly reduced.Not only that, in terms of structural issues, China and the United States have less confrontation, and at this time, the principle of peering can play a more role.The structural problems raised by the United States include the protection of intellectual property rights, the problem of opening up domestic market, the issue of state -owned enterprise subsidies, the problem of free flow of Internet data, and so on.All these problems are also structural issues in China.

For example, for the intellectual property system, companies of different properties have different performances.Non -state -owned enterprises mainly depend on the intellectual property system. Their valid patents account for about 97%of all patents; and the valid patents of state -owned enterprises only account for 3%(2016, the National Bureau of Statistics). They depend on the so -called national scientific research funds.About 800 billion yuan each year.I once pointed out in a core technology article in the rule of law that it is precisely because the national scientific research fund system lacks effective incentives and restraint systems. The use efficiency is low, and the scientific research results applying for patents only account for 20-30%. Therefore, state -owned scientific research institutions and state -owned enterprisesThe system focuses more on the introduction of technology.Because a large number of state -owned enterprises are in a monopoly industry, only they have the ability to compulsorively require foreign -funded enterprises to transfer technologies at low prices, such as high -speed rail technology.The reform of China's scientific research system is to reduce the government's scientific research funds for the state -owned scientific research departments of 5,000 to 600 billion per year for application research, use more funds for basic research, so that state -owned scientific research institutions for application research rely on the intellectual property system moreEssenceTherefore, Chinese society needs to further improve the intellectual property system and strengthen the protection of intellectual property rights.This is consistent with the requirements of the United States.

Another example is government subsidy.In China, government subsidies are also structural subsidies to state -owned enterprises.According to our conservative estimates, the land rent subsidy obtained by state -owned industrial enterprises in 2013 was 6223100 million yuan, resource rental subsidy was 115.3 billion yuan, interest subsidy was 951.9 billion yuan, and price subsidy was 329.8 billion yuan, a total of about 2019.3 billion yuan (Tianze Economic Research Institute, the nature, performance and reform of state -owned enterprises (second edition), 2015, 2015, 2015, 2015, 2015, 2015, 2015To.After deducting this huge subsidy, the overall net asset return of state -owned industrial enterprises in 2013 was 3.8%negative.Based on the estimation of 5.2 trillion yuan of net assets of state -owned enterprises (finance and non -finance) that year, at least 3.3 percentage points of my country's economy was dragged down (two economies of Shenghong, China, 2017).Not only that, the existence of state -owned enterprises is a violation of the market economy principles, so that the government cannot become a truly fair referee and make the market economy system unable to finally be established.Therefore, solving the problem of state -owned enterprises is an important goal of my country's society's current reform.In the Third Plenary Session of the Eighteenth Central Committee of the Communist Party of China, the CCP also emphasized the reform of state -owned enterprises.The primary task of state -owned enterprise reform is to cancel various subsidies and become fair competitors in the market.This is consistent with the requirements of the United States to cancel subsidies.

Another example is the issue of administrative monopoly, which is also a problem that Chinese society has been solved for a long time but difficult to solve.Some state -owned enterprises have long monopolized oil, banks, telecommunications, railways, salt and other fields. According to our estimates, the welfare losses caused by these administrative monopolies in 2013 were as high as 2273.4 billion yuan (Tianze Economic Research Institute, China administrative natureReasons, behaviors and breaks of monopoly (second edition), 2015).Not only do they bring huge efficiency losses, but they also allocate unfair wealth.Monopoly interest groups are important obstacles to China's further marketization and rule of law.Although the establishment of these monopoly rights does not have a corresponding legislative basis, even if the previous governments want to break the monopoly, such as breaking the oil monopoly and bank monopoly proposed during the period of Premier Wen Jiabao, two non -public 36 emphasis on opening the market that has been monopolized to private enterprises to private enterprises has been emphasized to private enterprises., Shorten the negative list of market access, and the 19th National Congress of the Communist Party of China clearly proposed to break the administrative monopoly, but due to the little practical progress of the monopoly interest group.This is still the case in China, and it is regarded as an international issue, which is regarded as a problem that China's market does not open to foreign companies.This is actually a structural issue in China, and is the goal of reform.This is consistent with the pressure of the United States to open up the domestic market in China.

The problem of free flow of information on the Internet is also a structural problem.Although China's network security law stipulates that the rights of citizens, legal persons, and other organizations use the right to use the network in accordance with the law, hellip; hellip; and ensure the orderly and free flow of network information in accordance with the law.However, the relevant administrative departments set up a firewall in violation of Article 35 of the Constitution and the Cyber Security Law. In addition to suppressing the attempts to expose corruption and criticize the abuse of power, it is to choose to prevent overseas companies from entering the Chinese market.It benefited from the competitors of these overseas companies in China.Such as restricting Google, Twitter, Facebook, Yahoo, YouTube, Instagram, WordPress, Hello; Hellip; and Cloud Computing Services, etc., are the corresponding enterprises in the country and consumers in the injured in unjust protection.And these enterprises, especially the platform monopoly enterprises, not only use the convenience of providing network services, but also invade the privacy of citizens and enterprises, but also closely close the websites, Weibo, WeChat public account, live broadcast, etc.Online media with commercial value, violated Article 40 of the Constitution's intention to invade and closed, has accumulated communication resources and has become a necessary communication tool.The beneficiaries restricting the free flow of data are only a few monopoly and indiscriminate interest groups. Most Chinese enterprises, citizens, and even government agencies are victims.

This is not equivalent to domestic and international.One country protects the intellectual property rights of domestic enterprises and also protects the intellectual property rights of foreign enterprises; and another country cannot effectively protect the intellectual property rights of domestic enterprises, nor can they respect the intellectual property rights of foreign enterprises; one country provides subsidies to some domestic enterprises to subsidize subsidiesThese enterprises not only compete in the domestic market, but also export to another country. Another country does not provide subsidies to all domestic enterprises, and enterprises with government subsidies are exported to foreign countries.Some enterprises are open and do not open to other domestic enterprises, and they are not open to foreign enterprises; the domestic market of another country is open to all enterprises, and all non -critical areas markets are open to foreign companies;Entering will also limit the entry of foreign enterprises; the Internet of another country has no restrictions in China, and there is no restrictions on foreign countries.The structural inconsistency between these China and the United States is actually a problem with China's domestic unfairness.The United States proposed structural reforms in negotiations. The Chinese government proposed supply -side structural reforms in 2016. Its content is mainly to promote marketization and reduce government intervention to solve structural problems.In this seemingly incredible field, China and the United States have a consensus foundation and mutual needs.The solution is the principle of structurally equivalent.

For example, on the premise of equal tariff rate, enterprises that enforce another country's transfer technology with the advantages of monopolizing domestic markets, another country must restrict it into the country's market;Tariffs to offset the advantages brought by subsidies; these subsidies include enjoying free land, low -interest loans, and use fees for mining areas.Aiming at the monopoly rights obtained by monopolizing the domestic market, especially depending on the monopoly obtained by administrative orders, so that other companies and other countries cannot enter the monopoly enterprise, another country can also take to prohibit them from entering similar markets in the country; targeting them; targeting it for it; for targeting it; for targeting itBlocking another country in the country's domestic market, another country will also prohibit such enterprises from entering the country's Internet market.As long as this structurally -to -peer principle is taken, we find that trade negotiations only need to discuss the tariff rate and non -tariff measures. Other issues can be placed outside the trade negotiations.EssenceIn this way, you can avoid universalThe tariff war avoids the innocent enterprises that follow the rules of the market, and put pressure directly on the subject of unfair trade. The effect is immediate.While structural problems are resolved, it will also have a benign impact on Sino -US trade differences.

The best way to implement the problem that the United States emphasizes is the rule of law, which is consistent with the direction of rule of law determined by the Fourth Plenary Session of the 18th Central Committee of the Communist Party of China.Since the reform and opening up, China has gradually established a relatively reasonable legal system through long -term legislative work. It has been resolved corresponding to the above -mentioned structural problems.Its biggest problem is that it cannot be implemented effectively.In the above -mentioned decision, it emphasizes the improvement of the system that ensures the right to exercise judgment and procuratorial rights independently and fairly in accordance with the law, and has made specific provisions that party and government leaders must not interfere with and intervene in judicially.This has the point of co -efforts between China and the United States.The principle of the rule of law is nothing.This is much better than swinging customs sticks in a white and red soap.The law and legitimate procedure can only be activated in the lawsuit, and can they have a demonstration role in the society.Therefore, it is necessary to solve the problem in the lawsuit of the case in the judicial system. This will not harm most of the innocent people and is more targeted.If considering the insufficient legal capabilities of a single enterprise, the US government can also set up an overall legal aid plan to help enterprises.In China, advancing and implementing the rule of law also require specific cases of lawsuits.Therefore, not only should this arrangement be regarded as an alternative to tariff measures, but it is also regarded as the help and promotion of the construction of the rule of law in China.

Finally, the principle of structurally equivalent should also be reflected in the compassion and respect of each other in text.Seeing the U.S. negotiating text disclosed by the Wall Street Journal, if it is true, it seems that it shows a certain emotional and improper full name judgment.This is the details, but it may ultimately hinder the reach of the agreement.Because we have determined that unfair trade is not a general issue, but a structural issue. It is wrong to judge the full name of a certain country.The real war is not between the United States and China, but between the two principles, between the free fair trade and the distorted, restricted trade, between trade or war, so the agreement text should not be at all.There is no respect for a country.What is really not worthy of respect is distorted and restricted trade, and war.Therefore, all the above -mentioned principles can be balanced.If any party subsidizes trade and investment is prohibited and punished, the monopoly of any party must be broken, and the infringement of intellectual property rights must be stopped and compensated to the invaders.wait.This is fair in principle, but in specific circumstances, it may have greater constraints on specific entities that violate fair trade rules.This is just as the law is fair, but the role of the offenders and the law -abispers is different.

Once the overall tariff confrontation is replaced by the principle of structurally, the scope will be 7.7%or one -thirteen.This not only greatly reduces the cost of confrontation, it is easier to compromise, and the agreement is easier to achieve, solving problems that should be solved.Otherwise, the corpses are all over the field, and blood is also white.If the punishment is not punished, the illegal person is free, and the problem still exists.People don't know why.In the face of those who advocate the trade war at all costs, people will ask why they cannot use one or one thousandth of a thousandth of a thousandth of the cost of paying a price to achieve a significant reduction in the current losses and benefiting future generations.protocol?And this part of the price is those who should pay, that is, those who do not follow market rules pay.We can't support Chinese people who do not follow the rules of fair markets and at the same time infringe on other Chinese people.When structurally coupled with the principle of peering, the so -called compromise is not a sacrifice, but only the necessary cost of achieving better results, just like the cost of any investment.Because the principle of peering itself is a priceless treasure of human beings.For China, the principle of peering can not only solve international disputes, but also solve the problem of reform that China must solve.The prospect it shows is the road that has been continuing for more than forty years of reform and opening up, which has shocked the world again.

Recently, I saw Mr. Ma Xiaoye's clarification of the principle of peering.What I want to emphasize is that the principle of peering is not the invention of Americans. China has long traditions.Confucius said, do n’t you do what you do, do n’t you do it, is n’t it the principle of peer?If you are unwilling to other people's high tariffs, do not add high tariffs to others; you do not want intellectual property to be violated, and do not infringe the intellectual property rights of others;Enter your own market; you don't want others to get subsidies and get advantages, and you cannot get subsidies to obtain an advantage.Mencius said that the monopoly is a cheap husband, so the concept of breaking the monopoly has also been in China.In the theory of Salt and Tie theory, the theory of Xianliang Literature, the emperor did not say how much, the princes did not say anything, and the doctors could not be mourned. They said that government departments could not do business. Therefore, state -owned enterprises should reform and finally withdraw from history.In terms of structural reforms, China and the United States not only have principled consensus, complementarity in interests, but also cultural overlap.Thinking of this, I feel that there is nothing in the world; if there is no wisdom, there will be no way to war.Edward Bull; Did Yoshimoto say wrong?

(Note: The author is the director of the Institute of Heaven. This article only represents the author's personal point of view.