The Hong Kong Stock Exchange will implement the arrangement of maintaining the securities market operation in severe weather from September 23 to consolidate Hong Kong's competitiveness as an international financial center.

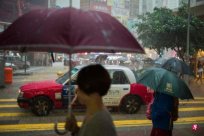

The Hong Kong Stock Exchange currently needs to stop the market under bad weather.Under the new arrangement, investors can send a typhoon signal on the 8th wind ball and above in Hong Kong, and even the black rainstorm warning, if you often buy and sell Hong Kong stocks and derivative products, or through the "Shanghai -Hong Kong Stock Connect" and "Shenzhen -Hong Kong Stock Connect"Mainland A shares and so on.

The Hong Kong Chief Executive Li Jiachao announced the above measures on Tuesday (June 18) that the world's major stock markets, including Shenzhen and Shanghai, can currently maintain transactions under bad weather.As an international financial center, Hong Kong must be aligned with these markets, not to mention that most of the transactions have been electronic, and it is unreasonable that other markets can continue to the market, but Hong Kong cannot do it.

Li Jiachao said that the Hong Kong Stock Exchange carried out public consultation earlier, and the brokers and the banking community accounted for about 90 % of the total market transactions supported the implementation of the market.He believes that if the weather is constantly in the market, it can consolidate the competitiveness of the Hong Kong Stock Exchange and enhance the role of Hong Kong as the portal of the international and mainland markets.

Xu Zhengyu, director of the Hong Kong Financial Affairs and Treasury Bureau, also said that the Hong Kong Stock Exchange maintains the market operation of securities and derivative products under bad weather, so that global investors can no longer be affected by the weather in Hong Kong and lose their chances of transactions or investment.Essence

He revealed that since 2018, the Hong Kong securities and derivative products markets have been closed 11 times due to bad weather. It has already occurred four times last year. Three of them have stopped the market throughout the day.The investment portfolio is facing potential market risks, and it also limits international and mainland China investors to participate in markets between the mainland and Hong Kong through interconnection.

Hong Kong financial people generally support the new arrangements of the Hong Kong government.The Hong Kong Investment Fund Association described that the new arrangement is the long -awaited news of the fund management industry.Li Weihong, a member of the Legislative Council of the Financial Services, also said that as an international financial center, it will continue to carry out transactions in severe weather, which will continue to promote interconnection in all aspects; and global investors do not when managing the risk of trading transactions, nor do itIt will be affected by the market.

However, in the interview with Lianhe Morning Post, Shao Zhiyao, a senior investor in Hong Kong, believes that the days when many of the global stock transactions are in the bad weather will continue to operate. The new measures for the "keep the wind in the market" launched by the Hong Kong government are following the international trend.In terms of direction, it is correct, but the booster effect on the volume of Hong Kong stocks may not be great, and the effect may only be better than nothing.

Shao Zhiyao explained that in recent years, Hong Kong stocks have continued to decline , mainly because investors are not optimistic about the prospects of Hong Kong stocks,So they changed their stock markets elsewhere."Although the atmosphere of Hong Kong stocks has recently improved compared to the past, it has risen to 77 and eight, but compared with U.S. stocks, it is still too far away. Investors will not increase the sale of Hong Kong stocks due to new measures from the Hong Kong Stock Exchange."

He believes that it is worth noting that the new policy has higher requirements for securities banks than before. At presentPerson, this will increase the operating cost of securities banks.

The Hong Kong stock market closed slightly on Tuesday, and the Hang Seng Index fell 0.11%to 17915.55 points, which run counter to other Asian stock markets including mainland China stock markets.