The Hong Kong stock market, which is one of the most active trading markets in the world, is experiencing a cold winter due to low fundraising and low transaction volume in the past six months.

Hong Kong securities trading licensee, Shao Zhiyao, who has more than ten years of experience in financial career experience, told the United Zard that he had few business with his peers in the past six months.

In Hong Kong, a company must be listed on the Hong Kong Stock Exchange, and employees who need to hold the Hong Kong Securities Regulatory Commission license to participate in sponsor and underwriting.Those who hold the list of sponsored licenses have always been scarce talents.When they all complained that there was no business, there were few listed projects in Hong Kong.

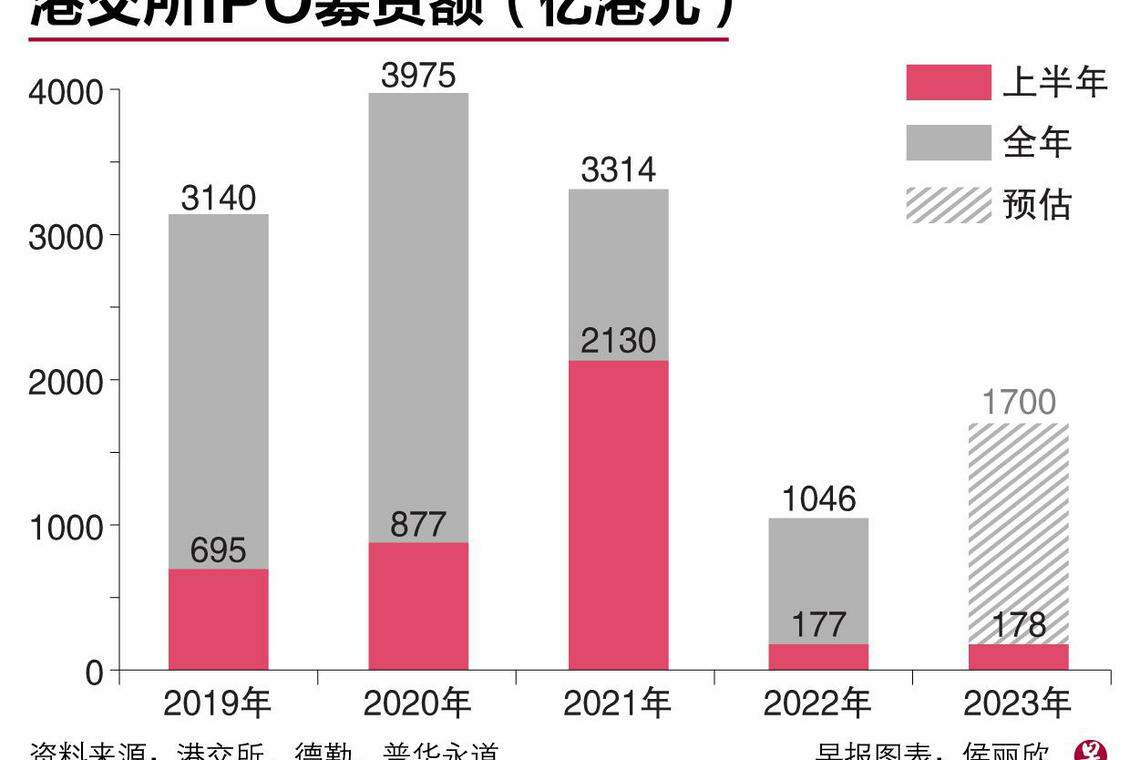

According to the first public sale (IPO) market report released by Deloittes and Hong Kong at the end of June, 31 new shares in the first half of this year boarded the Hong Kong Stock Exchange and raised $ 17.8 billion (about S $ 369.85 million), which was year -on -year.Fall nearly 10%, ranking sixth in the world.

/>

/>

On the contrary, in the past 13 years, Hong Kong has appeared in the world's largest IPO fund -raising amount in the world in the past 13 years. Even if it fluctuates in other years, it rarely falls out of the top five.Deller reports that the Hong Kong IPO fund -raising amount is currently at a low level in the past 10 years, which is slightly higher than last year.

New shares transactions are also unsatisfactory. Of the 31 new shares listed in Hong Kong in the first half of the year, 15 shares were broken on the first day of listing.The willingness to enter the market is greatly reduced.

In this case, there are sounds that the financing capabilities of Hong Kong stocks have faded, and the status of the Hong Kong International Financial Center is no longer renamed.

Shao Zhiyao, the responsible person in the Hong Kong Securities Investment Corporation Huaye Financial Holdings, bluntly stated that the financial center should be flowing in and out of the East and West, but now Hong Kong cannot see such flow."In the past, Hong Kong had risen or plummeted, buying or selling, but now there is no wave, no vitality."

It is difficult for Hong Kong stocks to get rid of the impact of the ups and downs of the mainland economy

The downturn at the current financial market in Hong Kong is closely related to the difficulty of China's economy.

The total market value of mainland China accounts for 77%of the total market value of Hong Kong stocks.Among the new shares of the Hong Kong Stock Exchange in the first half of the year, mainland companies accounted for 88%in the same period last year to 90%.Such a composition makes it difficult for Hong Kong stocks to get rid of the ups and downs of mainland China.

Aletheia Capital Chinese Strategic Analyst Chen Changhua pointed out in an interview with Lianhe Zaobao that when you look back at the Hang Seng Index in the past year, you will find that because of the lift of the epidemic restrictions, the market ignited the hope of economic recovery at the end of last year.It rushed to 22,000 points in a short time, but soon fell all the way because of the weakened economic recovery of China's economic recovery, hovering around 19,000 points.

Chen Changhua said that since this year, the economic recovery of mainland China has been slow, and three important indicators of real estate, consumption and exports have been weak, and the government has stimulated poor policies, which directly affects the profit expectations of listed companies in the Hong Kong Stock Exchange.

Under the expectations of low economy, the problem of low transaction volume that Hong Kong stocks have been criticized for a long time are also prominent.In the second quarter of this year, the total transaction amount of the main board in Hong Kong was HK $ 606 trillion, a year -on -year decrease of HK $ 1.58 trillion, a decrease of 20.68%.

The downturn and the decline in financing of Hong Kong stocks and the decline in financing, which in turn affects the willingness of mainland Chinese companies to go public in Hong Kong, and worsen the situation of the Hong Kong Stock Exchange.

The Deloitte report shows that from January to May this year, the number of companies in the Hong Kong Stock Exchange was approved, but the number of companies without listing increased by more than 40 % year -on -year.This means that even some companies are not listed even if they have approved approval.

delisting companies are also increasing.According to the Securities Times, there were 15 companies delisted throughout the year last year, and 12 publishing announcements were issued in half a year this year.One of the mainland companies stated that the delisting is because it is difficult to reflect the company's fundamental aspects. While damaging the reputation, it also pays a high cost to maintain the listing status without losing money.

Foreign -funded and international investment banks have gradually faded from Hong Kong stocks.

On the other hand, a large number of foreign capital evacuated in Hong Kong has also caused the low -level HSI to linger, the transaction volume of Hong Kong stocks has declined, and the internationalization of Hong Kong stocks fade.

The report released by CITIC Securities in May shows that since 2021, foreign investment has reached a total of HK $ 1.05 trillion.After the recent large -scale outflow, after February of this year, foreign capital over 140 billion Hong Kong dollars flowed out of Hong Kong stocks.The report pointed out that foreign capital outflows have reached historical highs.

Analysts pointed out that Hong Kong's GDP scale of less than 3 trillion Hong Kong dollars a year was not enough to support a stock market close to 40 trillion Hong Kong dollars.The speed of the current inflow of mainland funds into Hong Kong stocks is not enough to fill the vacancy of the outflow of funds from European and American funds, making it difficult for Hong Kong stocks to be disadvantaged, and the financing capabilities are deteriorating.

As for the main reasons for the large amount of foreign capital, the experts interviewed believed that under the influence of geopolitical, the consideration of China's asset risks is the main factor.

The Hong Kong stock market has always been an important entry for overseas institutions to invest in Chinese assets, but today international investors have less and less demand for Chinese assets.Chen Changhua said: "Whether the Chinese economy declines, and whether China and the United States are comprehensive decouragement are the two concerns of foreign capital. But there are no good news in both aspects."

Over the years, international investment banks have become fewer and fewer in the issuance of new shares in Hong Kong, and their position has been replaced by Chinese brokers.The China Securities Times reported that last year, Mainland China brokerage CICC CICC served as a sponsor to listed 34 companies in Hong Kong, surpassing the sum of Morgan Stanley and Goldman Sachs.

Shao Zhiyao said: "The companies listed before were all the Americans, and now they have been replaced by Chinese -funded institutions."

This aspect is related to the requirements of the China Securities Regulatory Commission that Chinese companies must be recorded overseas. Chinese brokers have an advantage over international brokers when dealing with these affairs.

On the other hand, Chen Changhua believes that in the past, there were a number of private enterprises promoted by the market in mainland China. Foreign capitals were listed in Hong Kong in Hong Kong, which was involved in investment in the growth period and was welcomed by international investment banks.Nowadays, such companies are becoming less, but the heavy industry, technology and semiconductor companies promoted by more countries are making bigger and listed.Such companies often have a large number of government orders, which are also related to national security. International investment banks naturally avoid it.

Chen Changhua said: "If Western Capital evacuates, and new stocks in the Mainland are unwilling to go public, the status of the Hong Kong financial center is at stake."

The Hong Kong Stock Exchange actively expands the Southeast Asian market

Scholars and industry interviewed by the industry believe that the root cause of the downturn in Hong Kong stocks is that there is a problem with the Chinese economy, but heWe judged that the trend will not continue for a long time.

Liu Jin, a professor of finance at the Yangtze River Business School, analyzed the United Morning Post that the financial center could never be separated from the real economy alone; the difficulties of Hong Kong stocks reflected the challenges encountered by the real economic growth of mainland China.However, the foundation of the Hong Kong financial center is still there. If the mainland's economy is recovering benign growth, Hong Kong stocks will return to active.

Huang Liwen, a partner of Hong Kong Kewu Law Firm, believes that Hong Kong stocks will be active in the second half of the year.She expects a number of star companies, including the Ali Ant Group, will be listed in Hong Kong.This will attract more other IPOs and make market transactions active; funds that have left the market will also be attracted by good companies.

In the long run, Liu Jin said that even if the Chinese and Western industries are decoupled, Hong Kong is still connecting the bridge of mainland China and the "Belt and Road", and Southeast Asian countries. This is also a new space in Hong Kong as the financial center.

The Champions League of the Executive Officer of the Hong Kong Stock Exchange was promoted on August 16 that the Hong Kong Stock Exchange was actively expanding the Middle East and Southeast Asian markets.

However, Hong Kong also faces competition in the Southeast Asian market.Liu Jin pointed out that in the Asian market, Singapore has a similar system design with Hong Kong, covers better in Southeast Asia, and can maintain good relations with mainland China and the West at the same time, which will become Hong Kong's rivals.

Shao Zhiyao, as an employee, frankly said that in the past, Hong Kong has always eaten "Western rice" and has rarely promoted the Southeast Asian market.Today, in the face of European and American funds retreat, Southeast Asia has grown at a high speed, and the positioning of Hong Kong has changed. "It is necessary to transform from the financial centers in China and the West to the bridge between China and the Belt and Road and Southeast Asia markets."