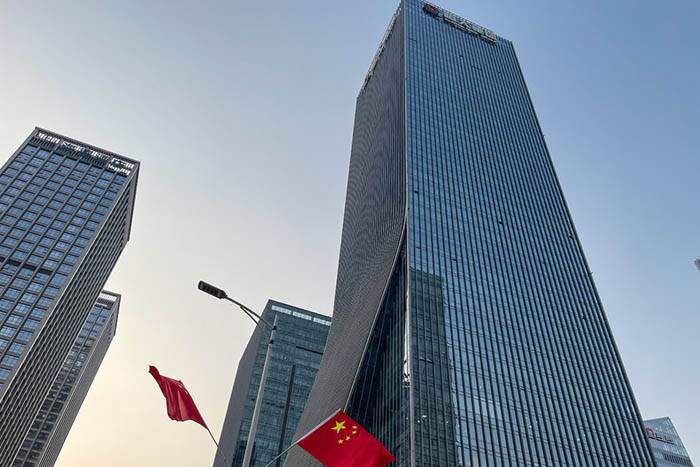

In January of this year, more than 100 people's working groups were stationed in the Guangzhou Headquarters of Evergrande Group in China. The real estate giant with a debt of more than 2 trillion yuan had debt default at the end of 2021.The audit institutions of the Evergrande listed company have just resigned, and buyers from all over the country have aimed at Evergrande.

The police stood outside the headquarters building, paying attention to the movement of the owner.The new audit team was permitted to enter the building.The auditors released the Evergrande's performance report after six months. The company's net loss in the past two years was as high as 812 billion yuan, far exceeding people's expectations.

But the auditors still have a problem.Some of the information they asked Evergrande did not record a complete record.Some numbers are gone.Important accounting errors or errors may have not been found.Evergrande was one of the most successful companies in China. How could its situation become so bad?

China once has a prosperous real estate market, and its scale is unprecedented in the world. Evergrande has become China's largest real estate developer by relying on greedy expansion, stimulating its development system, and foreign investors who have invested heavily.When the Chinese real estate market bubble burst, no company suddenly collapsed in a stunning way like Evergrande.

When Evergrande had a breach of contract in 2021, people had blamed the company's unable to repay the debt on a policy and instruction from Beijing. In order to cool down the real estate market, the government began to restrict the developers' loans, so that the company with a tiritable debt lost the company that lost the company's tiring company.Cash required for operation.

However, through interviews to understand Evergrande's people and re -sort out public documents, Evergrande's collapse has another explanation: problems with problems and poor company supervision have led to the disappearance of 664.3 billion yuan.disaster.

The scale of Evergrande's expansion is incredible.For 30 years, it has been in the town in Beijing and thousands of miles away.The company's success has made Xu Jiayin, the founder and chairman of the company as one of the richest people in the world.Wall Wall Street Bank.

The influence of Evergrande's collapse was stunned.The company pre -sold hundreds of thousands of apartments that have never been built to home buyers.It took tens of billions of yuan from ordinary families and company employees, and some of them were missing.It owed the wages of construction workers, paint workers and real estate agents.

Today, Evergrande is still in a default state and is unable to repay the debt, but has not been officially settled.The trading price of the stock is only a few cents.On Monday, the law of compulsory Evergrande's liquidation was delayed: a judge extended a hearing of a lawsuit proposed by a large -scale company, and they hoped to formally clear the loss through Evergrande.

Evergrande officials and representatives did not reply to interviews or comment requests made by reporters many times.

The real estate market with excessive price, excessive construction, and borrowing on a large amount of debt is prosperous.

The prosperity of the Chinese real estate market began in 1996 from Xu Jiayin's founding of Evergrande Group in Shenzhen.Shenzhen is a special economic zone for the CCP's experimental capitalism.

With the large -scale urbanization of China, Evergrande's business has expanded to the place outside Shenzhen, and the company plays a core role in the world's largest rural population in the world.Xu Jiayinba settled in some senior officials of senior officials.In 2002, he settled Wen Jiahong to Evergrande's board of directors. Wen Jiahong's brother was Wen Jiabao, then Vice Premier of China.

When Evergrande Group was listed in Hong Kong in 2009, the company had faced questions about its crazy expansion.Foreign investors (many of them are US private equity funds, hedge funds, and Wall Street Banks) a few years ago, they invested a lot of funds to Chinese real estate companies a few years ago to increase their debts.Xu Jiayin originally wanted to raise $ 1.5 billion in funds through listing, but the company finally raised $ 722 million through new shares.

At that time, the world was still in a global financial crisis, and the crisis began in the United States' housing prices plummeted.After a short -term and sharp economic recession, the Chinese government took out a 4 trillion investment plan to stimulate economic growth through highways and railway construction, allowing China to get rid of the crisis in other countries.By listing in Hong Kong, Evergrande can raise funds for buying land from overseas.Dozens of real estate developers are doing the same thing.Three of them MDASH; MDASH; Jiazhaoye Group, Yuzhou Group, and Mandarin Holdings Group mdash; mdash; also raised funds from overseas during the weeks of Evergrande.These companies later defaulted.

By 2010, China's real estate market had shown signs of overheating.The rate of rising house prices is much higher than the growth rate of the average family income.Soon, economists warned that China's real estate market is too high, excess supply, and excessive borrowing of developers.

But Chinese buyers continue to swarm until the construction project.After the city is covered with a new apartment building, the developer has turned its sights on a farther satellite city and more rural areas.

The developer took the people who wanted to buy a house to visit the exhibition hall and the model room, and then asked them to sign the house purchase contract.Buyers buy a promise of one -third (sometimes or even higher percentage), they buy a housing house.For families with almost no investment channels, it is difficult to imagine that there is a problem with the presence of real estate.

But there are indeed problems.In the past ten years, although the authorities have been trying to control the scale of borrowing, the real estate company has found all the methods that bypass all restrictions, sometimes cut corners in apartments, and sometimes transfer debt from the balance sheet.In the end, a policy in 2020 increased the difficulty of borrowing and began to push developers to the edge of the cliff.

For vacant estimates, numbers are different.He Xun, former deputy director of the National Bureau of Statistics, recently claimed that the current number of vacant houses is enough to accommodate 3 billion people.He said in a video released by China News Agency that this estimation may be a bit much, but 1.4 billion people may not be filled.

The biggest bubble in history.

In the months of 2021, Evergrande's close to breach made the stock markets around the world nervous and restless, and people's concepts that some Chinese companies were so big that the authorities would not let them down.Foreign investors continue to buy bonds from real estate developers. Although one of the biggest beneficiaries of China's real estate prosperity, real estate tycoon Wang Jianlin warns that the Chinese real estate market is the largest bubble in history.

On December 9, 2021, that is, Evergrande failed to pay some bond interest on schedule three days later, a credit rating agency announced that Evergrande restricted breach of contract, which caused investors, home buyers, suppliers, and banks how to recover Evergrande owed ownership of Evergrande owed.Starting the money.

Evergrande's collapse caused Domino brand effects.Since Evergrande's default, there has been another46 foreign developers breach contracts, leaving an unin -completed site, an angry buyer, and an architect who owed the money.The authorities have quietly forced these companies to continue building buildings because they are worried about social turmoil.In 2022, Evergrande completed the construction of 300,000 apartments while discussing the issue of debt repayment with creditors.

However, as Evergrande has become more and more difficult to raise funds, the bad corporate governance and bad behavior over the years have gradually exposed to the public.

After three months of breach of contract, Evergrande said the bank had detained $ 2 billion.A later internal survey showed that high -level managers have formulated a plan to avoid borrowing restrictions at the end of 2020, using Evergrande subsidiaries as a mortgage to obtain loans through third parties.The conclusions obtained by the survey are that the plan violates Evergrande's disclosure and compliance obligations.Nevertheless, the investigation quoted some employees' words that they had no right to question what senior managers were known and promoted by senior managers.

Evergrande's executives including the chief financial officer and CEO have resigned.A internal report signed by the founder Xu Jiayin stated that the behavior of some people at the time was lower than the company's expected standards.

In January this year, PricewaterhouseCoopers, who has been auditing for the Evergrande listed company, resigned, saying that he could not complete the work.The Hong Kong Accounting and Financial Reporting Committee has announced two reviews of Evergrande's accounts.The unknown Shanghui Baicheng Accountants was hired to do this job.

Shanghui Baicheng said in July this year that Evergrande lost a total of 812 billion yuan in 2021 and 2022.In contrast, Evergrande announced a net profit of 8 billion yuan in 2020.The clue in the new audit shows that Evergrande has always regarded the money obtained by the sale of apartments as income, although the apartment has not yet been completed when receiving the money.

After the results of the new audit came out, Evergrande agreed to change the income processing method of revenue, requiring the documents that the apartment was built for the income of the income.

Evergrande's wealth service department has sold short -term high -interest products to buyers and employees when funding is tight, but in August this year, it was informed that the company could not pay the monthly redemption.

Police have detained the staff of the wealth service department for a few weeks.According to Chinese media reports, former presidents of Evergrande, former chief financial officer, and former chairman of Evergrande Life Insurance Department have been taken away by the police.

The company's management team in Hong Kong has made progress with foreign creditors and private lenders behind the scenes.Later, Evergrande stated on September 24 that he needed to re -evaluate assets and canceled the reorganization transaction.A few days later, Evergrande announced that Xu Jiayin had been controlled by relevant parties.

Chinese social media is full of comments on how Xu Jiayin has become the enemy of the Chinese people.People turn anger to foreign investors and Evergrande's application for bankruptcy protection in the United States.Well -known entrepreneurs exaggerate their words, saying that foreigners will take the part of the buyers from Evergrande's remaining assets.

According to the documents submitted by Evergrande, since the company was listed in 2009, Xu Jiayin paid about $ 7 billion in dividends to himself and his wife.According to two people who directly understand the company's situation but have not been authorized to be interviewed by the media, Xu Jiayin told the outside world that he had divorced his wife for at least two years.The documents submitted by Evergrande this year showed that he and his wife had divorced.Assets that have been transferred to their ex -wife will trigger disputes.

What is still uncertain after Evergrande's breach of contract for two years is how to liquidate the company, how much assets are it left, and who will get these assets.