The Singapore Financial Authority and the People's Bank of China are conducting pilots, allowing Singapore and Chinese travelers to use Chinese Digital RMB (E-CNY) to pay during travel in New China to facilitate passengers when traveling overseas.

The Financial Management Bureau announced a series of new measures for digital finance and capital markets on Thursday (December 7) to deepen financial cooperation between China and China.

Other measures include the Singapore Exchange and the Shanghai Stock Exchange's exchanges (ETF) products (ETF) products are officially launched. The two parties signed a memorandum of understanding in May this year.In addition, the New Stock Exchange and the Guangzhou Futures Exchange signed a memorandum of understanding, and conducted information exchanges, mutual visits and joint research on the development of related products and business in green development.

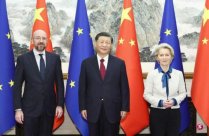

The above -mentioned measures were discussed on the same day, the Joint Council for Bilateral Cooperation (JCBC) held in Tianjin.

Deputy Director of the HKMA (market and finance development) Liang Xinsong said: "This year is the year of financial cooperation and results in New China.New funds flow between financial centers and deepen the trade and economic relations between our economies.

The statement of the Financial Management Bureau said that the ETF ETF ETF of Dongyinghua Taiberi and the Southern Dong -Ying New Stock Exchange Pan -Southern Asia Technology ETF was listed on the New Stock Exchange and the Shanghai Stock Exchange on December 1.The first result of the interoperability of the Shanghai Stock Exchange ETF products brings more cooperation opportunities to the fund managers of the two markets, and at the same time improve the ETF products in the respective markets of investors.

In addition, local banks and China UnionPay International will be discussed in the initial feasibility discussion of the initial feasibility discussion of the initial feasibility of the linkage between Singapore and China UnionPay in accordance with the laws and regulations of their respective judicial regions, in orderCross -border payment and remittance with cost -effective.

At the same time, the 18th JCBC established a new China Green Financial Working Group, and the first meeting was held in April this year.Under the working group, the HKMA and the People's Bank of China are formulating measures such as green corridors and transformation financing products.