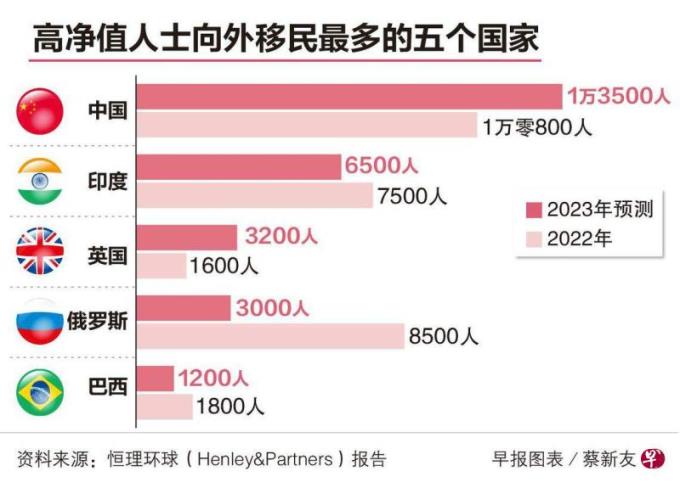

(London / Beijing Comprehensive News) A latest report predicts that with the slowdown of China's economic growth, there will be 13,500 Chinese rich immigrants in 2023, and the number is the highest in various countries.

A private wealth migration report released by Henley Henley Partners Henley Partners on Tuesday (June 13) states that China's high net worth individuals will continue the trend of immigrants in the past 10 years. This year, it is expected thatThere are 13,500 such richest people who immigrate to abroad.

High net worth people in the report refers to more than 1 million US dollars (about 1.34 million 1950 yuan) of people who can invest assets.

Bloomberg reported that the Chinese government's "common prosperity" policy and sealing measures during the epidemic situation allowed Chinese entrepreneurs to pour more popular places such as Singapore.

According to the report of Hengli Global, the number of people from high net worth flows ranked second in India. The loss of high net worth individuals in the UK has doubled due to Brexit and other reasons.Before Brazil.

Globally, the report is expected to have 12,200 rich immigrants this year, a new high since 2019.Australia, the UAE and Singapore are the countries where the highest net worth people have flowed into the country.

The rich Chinese ran away, and wealth also flowed out with them.According to the report, although China is estimated to have 8203,800 high net worth individuals, immigration trends may cause millions of dollars to flow out.

AndrewAmoils, director of New World Wealth Research, said in the report: "In the past few years, China's overall wealth growth has slowed, which means that the recent outflow may be more destructive than ever."

On the other hand, investors in China prefer overseas securities, which has also caused Chinese asset outflows.

According to Bloomberg report on Wednesday, with the Fed's interest rate hikes and China's interest rates decreased, Chinese investors have invested more funds to bonds, savings and other wealth management products with higher funds overseas.

Bloomberg data shows that as of Tuesday (June 13), the number of funds issued by China ’s qualified domestic institutional investors (QDII) this year jumped to 26, setting a new semi -annual record; and in the first four months of this year, China, China, China, China, China, ChinaThe banks launched 144 foreign currency wealth management products, which are mainly US dollars, an increase of 177%compared with the same period last year.

Chinese personal investors are financial institutions that have "qualified domestic institutional investors" to invest in overseas financial markets.These institutions need to apply for quota.The approval form issued by the China Foreign Exchange Administration on May 23 shows that 182 institutions including local and overseas agencies have obtained a total of $ 162.7 billion in overseas investment quotas.

Bloomberg pointed out that the increasing trend of overseas investment stems from the rare interest rate differentiation in China and the United States.Market participants analyze that China will reduce long -term interest rates, and the Fed will maintain a high interest rate, which will further promote overseas investment trends and will also have an impact on the unsatisfactory Chinese stock market.