People familiar with the matter said that Nasdaq will once again strengthen the review of the first public offering (IPO) of the small public fundraising (IPO) in mainland China and Hong Kong, so as not to repeat the fierce volatility of several new shares after listing two years ago.

Bloomberg reported on Thursday (June 20) that several IPO applicants headquartered in Hong Kong and mainland faced a series of problems in Nasdaq.People familiar with the matter said that the problem is concentrated on the identity and independence of investors who sell listed shares in front of these companies.

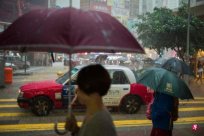

It is reported that despite the intensification of geopolitical tensions in the United States election, more and more mainland and small Hong Kong companies have shifted to Nasdaq to raise funds.The mainland has stated that supporting the listing overseas of technology companies has allowed some companies that have not been funded in China due to the long -term downturn in the market.Hong Kong's GEM has been closed for many years until a company was listed earlier this month, which made Nasdaq a attractive choice.

Several small -cap stocks from mainland China and Yingxi Group and other mainland China and Hong Kong have a maximum stock price of 32,000%in the first transaction in 2022, but plummeted in the next few weeks.At that time, the fierce ups and downs of these stocks caused a round of doubts in New York.

People familiar with the matter said that so far, no IPO has been stopped because of the increase in doubts, but the whole process has been extended for several weeks, which has increased the review that did not need to spend too much time.Uncertainty and cost.A person familiar with the matter refused to disclose any company name facing censorship.

This year, about 20 companies from the mainland and Hong Kong were listed on NASDAQ, raised a total of $ 195 million (S $ 263 million).