The weekend morning, who should have been sleeping, but someone got up early and took the high -speed rail crossing the city to the bank for deposit.Ten to the bank's door, dozens of people are lined up and other deposits, including foreign deposits.

Recently, many places in China have traveled to the people in other cities for deposits, and they are nicknamed "deposit special forces" by public opinion.

Like the "Tourist Special Forces" that have become popular on social platforms earlier, most of the "deposit special soldiers" are young people.The purpose of their boat and car to other cities, the purpose is not to play the most attractions in the shortest time and at least, but to save money into a foreign bank.

Why do these young Chinese people choose this method for deposit?

Spend more hours for crossing the city just to save money

A woman with a surname of Hai, who is under 30 years old and lives in Shaoxing, Zhejiang, gets up at 5 am on June 3.Although it was Saturday that day, not a normal working day, in order to go to a bank in Shanghai to apply for deposit, she went out at 6 o'clock to rush to take Shaoxing to Shanghai's earliest high -speed rail.

According to the Economic Observation Daily, the woman named Hai was close to 9:30 in the morning when she arrived in the bank.He is the same cross -city deposit.

Xiang Lin, who is 28 years old and working in a private company, is drove from Jiangsu Taizhou to Shanghai on the morning of May 12th in order to deposit money in the deposit interest rate within the time limit.

Xiang Linran told Peng Mei News that she and her husband did not go to the bank immediately on the same day, because it was already night when they arrived in Shanghai, and the bank closed. "So on the 13th on the 13th, we took a taxi to this bank.There are already many people in line, most of them are young people ... Later, the bank opened the door and a few young people came. When I asked, I knew they also came from outside."

According to Qianjiang Evening News, at the end of April, Xiao Xu and girlfriends in their 20s departed from Suzhou, Jiangsu at more than 6 am.EssenceHowever, as soon as she arrived at the outlet, Xiao Xu was shocked by the team that could not be seen in front of her. She counted it, and about 50 people were in line.Among them, there were young people who came from outside the field like her.

There are several things in common in these three cases: first, all of them are to do the boat and car, and spend a lot of time from the place of residence to another city.Third, according to their observations, many young people are cross -city deposits.

Under the topic of the topic of the Weibo "Special forces for deposit special forces to make interest on the city", some netizens wrote puzzled: "How much does it cost?Can the cost of the deposit in the local and foreign countries? "

But some netizens believe that the interest of banks has dropped again, and cross -city deposits are not difficult to please."Although the interest is not much worse at first glance, the sand accumulated into a tower, and it is still a small number after years." "When the money is good, you may not be able to see more interest. When the money is difficult to make,It is considered to be saved, not to mention that this income can be available out of thin air. "

"Special Forces Stocking" Reasons for Blushing

The fund practitioner Jiang Guangxiang wrote that the reason for people to go across the city for deposits is simple, that is, the bank interest rate difference brought by a regional difference.

He wrote: "Even if it is the same bank, because the branch is different, the interest rate given is likely to be different. There are naturally considerations of the branches of various branches behind this, such as different areas of different areas, such as different areas in different areasThe difference between the upper limit of the deposit interest rate, or the difference in the local supply and demand relationship, let different branches 'inner rolls'. "

The report of the Economic Observation News also quoted Dong Ximiao, chief researcher of Zhailian Financial Finance, analyzed: First of all, the floating range and limit of the deposit of the deposit of the market interest rate self -discipline pricing mechanism in different regions may be different; secondlyDifferent, customer investment preferences are different from savings habits, affecting the price of deposit interest rates; in the end, different branches of the same bank have differences in asset -liabilities and market competition strategies, and they are not completely consistent with the demand for deposit and pricing.

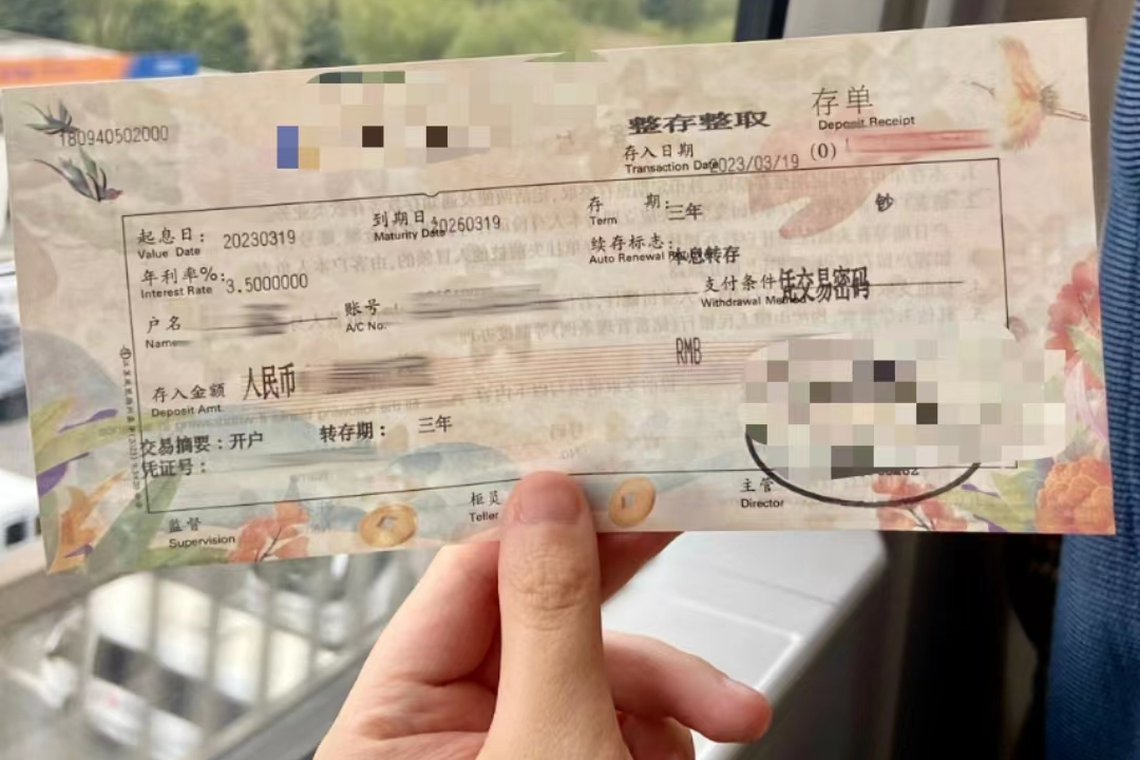

The person with a deposit of the sea deposit from Shaoxing from Shaoxing said that with a deposit of 100,000 yuan (RMB, Same, ST $ 19,000) as an example, the three -year interest in Shaoxing's local deposit is 9,000 yuan, and a bank in ShanghaiThe three -year interest is 10,650 yuan, and the interest difference is 1650 yuan.

Cross -city deposits have been closely related to China's bank interest rates since the second half of last year.

Multiple banks in China have lowered deposit interest rates

In the near future, China's major banks have ushered in another round of interest rate cuts.China Industrial and Commercial Bank of China, Construction Bank, Agricultural Bank, Bank of China, Bank of Communications, Postal Savings Bank, and other six Chinese state -owned banks, collectively announced on June 8 to reduce the listing interest rate of RMB deposit.

According to the announcement issued on the day of the six major banks, starting from June 8th, the interest rate of the monthly deposit interest rate was reduced by five base points to 0.2%compared with previously.Among the regular deposits and entire products, the second -year listing interest rate was reduced by 10 basis points to 2.05%; the three -year listing interest rate was reduced to 2.45%, the five -year listing interest rate was reduced to 2.5%, and the decrease was 15 basis points.EssenceThe three -month, six -month, and one -year listing interest rate remains unchanged.

The last time the Chinese state -owned bank lowered the deposit interest rate was September 2022, less than one year before.

According to the First Financial Report, many national joint -stock banks in China have also followed the pace from Monday (June 12) to reduce the deposit interest rate, including 11 banks including China Merchants Bank, Ping An Bank, and CITIC Bank.

The deposit interest rate continues to be reduced, what is the reason?

Mo Kaiwei, a researcher at the China Institute of Financial Research, published on June 7 in the Red Star Press entitled banks to reduce the deposit interest rate again.

The article states that the bank has frequently reduced the deposit interest rate since the second half of last year. There are two main reasons: first, it is a follow -up remedy that has not been followed up in time.The increasing embarrassment pattern of loan net interest margin is implemented to implement rescue measures.

Mo Kaiwei also said in the article that in addition to these two direct reasons, there are three deeper reasons.

First of all, under the current economic situation, the road of survival and development of small and medium -sized banks is not easy. In order to survive, we have to work hard on liabilities.

Second, the days of lying on the loan spread to make money are over, and banks, especially small and medium -sized banks, have to implement strategic transformation.

Third, the current tendency of bank deposits and the choice of deposit of public investment, which also creates conditions for banks to reduce deposit interest rates, and also allow banks to reduce their deposit interest rates.

Mo Kaiwei pointed out that due to the impact of the three -year crown disease, the consumption of Chinese people has become conservative, and the remaining funds are deposited into the bank to promote the significant growth of bank depositsObviously, the proportion of long -term deposits is getting higher and higher.

The latest financial statistics released by the People's Bank of China showed that the renminbi deposits increased by 1.5.39 trillion yuan in the first quarter of this year; of which, residents' deposits increased by 9.9 trillion yuan, an increase of 2.08 trillion yuan from the same period last year, accounting for an increase in deposit increase64%.In 2022, household deposits increased by 17.84 trillion yuan, a record high.

Interest interest rates to encourage consumption?

The interest rate of bank deposits continues to be reduced, which is also related to the Chinese economy.

According to data released by the National Bureau of Statistics on June 9, the Chinese residents' consumer price index (CPI) in May this year rose only 0.2%year -on -year, slightly higher than 0.1%in April.At the same time, industrial producers' ex -factory price index (PPI) decreased by 4.6%year -on -year to the lowest since March 2016.This is concerned about the outside world that the Chinese economy is facing a large risk of deflation.

Some views believe that the reduction of deposit interest rates can encourage consumers to use money for expenditure instead of depositing, and then boost the Chinese economy.

However, this is not necessarily inevitable.Xing Zhaopeng, a senior Chinese strategist of Australia and New Bank, pointed out in a report released by May that the impact of deposit interest rates has limited impact on consumption because family interest income has also declined.He also believes that people may decide to repay debts with cash instead of consumption.

The aforementioned Hai surname depositors said in an interview with the Economic Observation News that after three years of epidemic and unemployment, the mentality of young people will change.

"Obviously, we can find that more and more young people around them are starting to be keen on" money -save money -saving money ". The daily cosmetics also replaced from big names to replacement, and Taobao shopping converts to Pinduoduo."

The Wall Street Journal quoted Chen Zhiwu, a professor at the School of Economics and Management of the University of Hong Kong, said that in the past year, confidence has dropped sharply.He refers to the confidence of Chinese individuals and enterprises.He said that when people were uncertain about the future, their first reaction was to save money.

Save money is helpless?

The article published by Jiang Guangxiang in May said that in the impression of most people, whether it is regular deposits or large deposit orders, the target group is mostly old -age elderly stores, because fixed deposits or large deposit customers, basically basicallyThose who belong to absolute risk aversion, rather than sacrifice the liquidity for several years to ensure the absolute security and a certain yield of the principal.

He pointed out: "Most of the young customers are looking at. And now they are willing to participate in this market, indicating that they have not obtained the results they want in other investment fields."

This sentence also reflects the struggles of young Chinese in reality and ideals.On the one hand, they still want to make the money in their hands rolling more and more, after all, the economic outlook is unclear; on the other hand, they are worried that putting the money on the return rate is high, but there are risky platforms.P2P network financial borrowing of thunderstorms in P2P networks a few years ago, as well as the "difficulty of withdrawal" storm of Henan Village and Town Bank, which broke out in May and June last year, made many people feel worried, which exacerbated such concerns.

Da Fei Zhouzhang's cross -city deposit is obviously not for fun.In the environment of China's economic downturn and weak employment market, young people have increased their sense of restlessness in the future, and the risk tolerance has become less capable. In addition, high -quality investment channels are very lacking.A few hundred yuan, as many as thousands of yuan, are more income.For "deposit special soldiers", this may be insurance but helpless choice.