At the age of 100, it has to be repaid housing, which is really shocking ancient and modern, Chinese and foreign.A mortgage age of a real estate in Nanning, Guangxi, China can be extended to 100 years old, which instantly attracts a lot of criticism.

According to the pictures circulating on the Internet of China on Wednesday (February 15), this poster that emphasizes heavy and favorable favorable characters emphasizes the loan age up to 100 years old, and uses small characters to explain the age of housing mortgage loan plus loan term.In the case of lending, the longest loan can be loaned to 100 years when the child is a joint borrower.

Even if it is not really allowed the 100 -year -old elderly to repay the mortgage in person, this upper limit of the repayment age that is much higher than the average life expectancy of China (78.2 years old), still let the netizens who see the news collectively broke the defense, and the buying house has become a century -long career. It needs to needLoan is passed down.

In the online marketing poster, the loan age is as long as 100 years old as a favorable favorable, causing controversy and criticism of public opinion.(Internet)

Housing repayment has become a century -long career?

When involving loans, there are two years of attention to pay attention. One is the age of the applicant in the application, and the other is the repayment period of the loan.The age limit of the mortgage of the mortgage refers to the sum of the two numbers, that is, the lender needs to pay off the money before how old.

At present, the age of the mortgage of most banks is not more than 70 years old, but this is not strict legal and policy regulations.

According to the interface news report, the developer of the centenary mortgage advertisement explained that the developer of the centenary mortgage advertisement explained that 100 -year -old refers to the 70 -year -old borrower who applied for a loan as a co -borrower, and the repayment period can be loaned at the highest repayment period.Thirty years, the older loan is the longest to be 100 years old.

However, in the subsequent interviews with multiple media, the staff of the developer denied the statement and said that the company had not produced a marketing poster.A Jianfa staff told Peng Mei News: The maximum loan can be 69 years old and the loan can be 30 years long.Those who can be extended to 100 years old, who you posted the poster, is it possible to find who you go to.

After the above response was issued, it was once again satirized by netizens, saying that the 69 -year -old and 30 years were equal to 99 years old, which was a full year as 100 years old.

The major commercial banks interviewed by the Chinese media also stated that they did not receive the notice of the age of loan that could be extended to 100 years old, let alone related products.Among them, the Bank of Industrial and Commercial Bank of China Nanning Branch currently allows the loan age to be up to 75 years old, while CITIC Bank issued a notice from last Friday (10th) to adjust the highest period from 70 to 80.

According to reports, CITIC Bank Nanning Branch issued a notice from last Friday (February 10) to adjust the age of mortgage from 70 to 80.Apply for housing loans.(Internet)

Many local banks also revealed that there are relay loans that provide loans with their children.In other words, if you count on your children, some banks may really apply for a business with a 100 -year -old loan age period, but I believe that after this public opinion storm, even if it can be handled, it will not be able to market the centenary mortgage as a gimmick market.Essence

Although the upper limit of the mortgage loan was extended to 100 years old, it was rumored, but some banks in Nanning did extend the age limit to 75 or even 80 years old.In addition to Nanning, some banks in Shanghai, Xiamen, Hangzhou, Ningbo, Beijing, etc. have reportedly raised the upper limit of the loan, ranging from 75 to 95 years old.

However, sorting out media reports and found that all plans that are over 80 years old are the joint loan relay loans that parents and young children are repaid together.

Loan Loan Quotation of anxiety

The relay loan of parents' main loans and children is not a new concept.According to China News Network, the banks have launched related products as early as 2006.However, due to many first -tier and second -tier cities in China, there is a purchase restriction policy, which can avoid the relay loan of restrictions on purchase restrictions and enjoy a preferential interest rate of housing. In most cities, it is a gray area. Guangzhou is strictly for supervision.

However, as the Chinese property market continues to be sluggish since 2021, many places have begun to publicize the allowances to handle relay loans in the second half of 2022, as well as business loans from children, and parents.Among them, the Beijing Housing and Urban -Rural Development Commission also launched a pilot in August last year, allowing elderly families to buy ordinary housing in specific areas, and allowed their direct children to apply for loans as joint borrowers.

In addition to allowing the two generations to loan together, in order to improve consumer purchasing ability and boost the desire to buy, many cities have also launched measures for one -person home gang to allow buyers to withdraw their housing provident funds to assist in paying housing or repay the mortgage.According to Chinese media statistics, as of October last year, more than 30 provinces and cities including Tianjin, Shenzhen, and Hainan have implemented relevant measures.

In addition, after the rotten tail building and the suspension of loan in the second half of last year, local governments also introduced policy promotional rescue cities.Promote the property market and gradually reduce or even cancel the lower limit of the interest rate of the first home loan.

It's just that this dense and favorable policy cannot immediately save the weak Chinese real estate market.

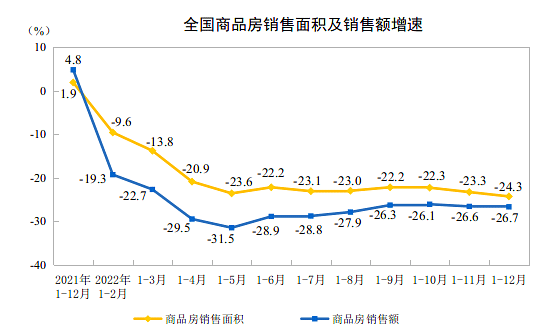

According to data from the National Bureau of Statistics of China, since the second half of last year, although the sales area and sales of commercial housing have slowed down, they still fluctuate at low levels. The annual sales area decreased by 24.3%year -on -year, and sales fell by 26.7%.It has declined for the first time since 1999, a decrease of 10%.

According to the China National Bureau of Statistics, the sales area of commercial housing in China in 2022 decreased by 24.3 % year -on -year, and sales fell by 26.7 %.(Official Website of China National Bureau of Statistics)

It wasn't until the latest announcement of the sales price of commodity housing in January this year of the National Statistics Bureau of China on Thursday (February 16) that the property market has stabilized and restored.The decline of the month -on -month slowdown.Data show that among the 70 large and medium -sized cities, there are 36 and 13 cities that have risen in new houses and second -hand housing, which are 21 and six from December last year.

Although the data reflects that the market has begun to recover, on the Chinese social media platform, netizens' willingness to buy a house is still not high.This group of young and middle -aged people does not buy the aforementioned relaxation of loan age restrictions and allow relatives to repay loans.

Some netizens believe that there is no need to empty the coffin book and the second half of their lives in order to buy a house (parent) coffin book, and the second half of their lives; and some netizens played the homophonic stalks, compiled the words of loan, and the ancestors' eighteen loans.The economic pressure and anxiety brought to the children.

An investment blogger also helplessly ridiculed on Weibo.

Who is good policy?

Some real estate experts point out that relaxation of mortgagesAiming restrictions are not young house buyers, but middle -aged buyers close to the upper limit of the loan.

Some real estate experts pointed out that relaxing the age limit of mortgage loans, not young house buyers, but middle -aged buyers close to the upper limit of the loan.The picture shows the elderly buyers who are watching the house on February 9th.(Internet)

Yan Yuejin, director of research director of the Shanghai Yiju Real Estate Research Institute, believes that the original intention of this type of relaxation of age restrictions is correct, to try to tap the demand for a middle -aged person in the age of 40 to 59.He pointed out that such people have strong payment capabilities and high demand for obtaining sufficient credit. If they can get sufficient loans, they have a positive effect on the release of just demand and improving the demand for house purchase.

He also pointed out that relaxing age restrictions means that high -age lenders can also obtain longer repayment periods, thereby reducing the monthly monthly supply amount and reducing the burden on the purchase of houses for middle -aged people.

However, Yan Yuejin also reminded that if a large -scale relaxation of housing loan policies in various places, it is easy to cause the illusion of allowing real estate speculation.Some real estate developers' over -fire marketing through 100 -year -old loan can also cause negative public opinion. Banks are responsible and obliged to restrict the legal compliance marketing of partners.

Pan Shuhong, a representative of Shanghai People's Congress, also proposed that adjusting the age of mortgage mortgage may help boost the property market and promote the economy.Efficient.

It is true that many of the starting points and ideas that boost China's property market policies are good, but it is inevitable to encounter problems in implementation.For example, even reducing the real preferential policies such as the first home loan interest rate, it also gave birth to a trendy repayment of high interest rate housing mortgage repayment in advance.

And such problems not only reflect the decrease in consumers' expectations for the real estate market, but also reflect that after experiencing the campaign of the epidemic, the public's planning for their own economic capabilities and wealth is conservative, and the confidence of the overall economy can recover quickly.Insufficient.

In order to boost the sluggish housing city, Chinese officials and commercial institutions can be described as omnipotent, and the favorable policies and promotions launched are also charm.However, in addition to understanding the pain points of consumers, in addition to understanding the pain points of consumers, to standardize publicity to avoid reflux of public opinion, it is also necessary to restore the market with multiple blows to avoid overcrowding and make rare housing prices a short -lived.