China Financial Technology Giant Ant Group is the first new year in the new year.Zhou announced a major change, announcing that his founder and former Chinese richest man Ma Yun will no longer hold the substantive control of the group.

According to the Ant Group's announcement on Saturday (January 7), although Ma Yun, who is 58 years old, retired from Alibaba in 2019, he had previously held direct and indirect shares, as wellThe unanimous action agreement of shareholders actually controls the voting right of 53.46%of Ant Group, and is the actual controller of the group.

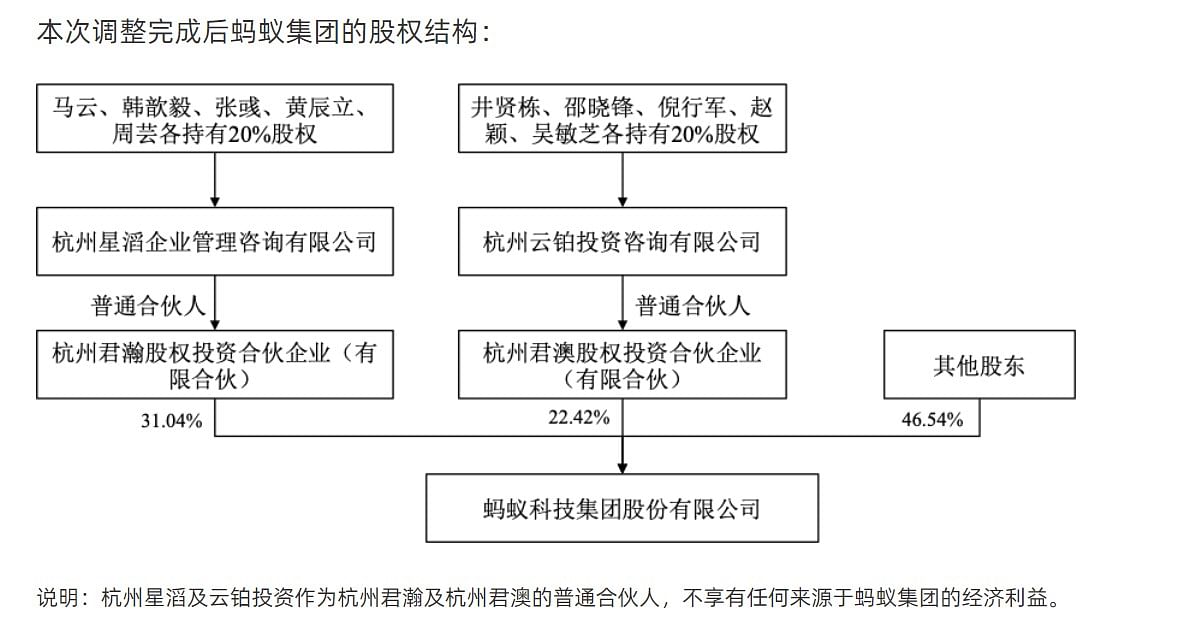

In this adjustment, Ma Yun terminated the previous consistent action agreement, and withdrew from the previously controlled investment company.After that, Ma Yun will only hold the voting right of 6.2 % of the actual shares, and the Ant Group currently has no new actual controllers, and no longer has any direct or indirect shareholders' single or joint control of Ant Group.

The Ant Group also announced that the relevant management members of the group will no longer serve as Alibaba partners to further enhance the transparency and effectiveness of corporate governance, strengthen the isolation with the shareholder Alibaba GroupEssence

In the announcement, Ant Group said, "After this adjustment, Ant Group's share voting rights are more transparent and scattered. This is a further optimization of the company's governance structure.Promoting the role. This adjustment will not affect the daily operations of Ant Group and its subordinate companies. "

This heavy news comes out, some people care about where Ma Yun will go, and some people discuss whether the ant set is available.The restart has been put on the market for more than two years.

Where did Jack Ma go?

As the news comes, there are many guessing and discussions.Some netizens believe that Jack Ma is "rushed" to the company he founded, and he feels worthless for him to end; some netizens speculate that Ma Yun grew up with the interests of the group and voluntarily abandoned the control of control.Further scan the obstacle.

Two days before the Ant Group issued an announcement, Ma Yun, located in the center of the topic, was just photographed to watch boxing competitions in Bangkok, Thailand, and took a photo with the shopkeeper in a street snack bar.I don't want to publish any comments on the incident.

In fact, since the Chinese regulatory system and bank "pawnshop thinking" have been publicly criticized at the second Bund Financial Summit in Shanghai in October 2020, Ma Yun rarely appearedIt's in front of the public.Most of the views believe that it was Ma Yun's criticism at the time that Chinese officials urgently suspended the Ant Group's listing plan in November and caused subsequent interviews and rectifications.

After the Bund Financial Summit incident, Ma Yun's rare public activities are basically related to public welfare.For example, his last public appearance was on December 30 last year, attending the Laba rural teacher online activities organized by the "Ma Yun Public Welfare Foundation" through the form of video connection;In the activity.

In the election of the Zhejiang Chamber of Commerce Federation in December last year, Ma Yun, who served as the first chairman since 2015, also stepped down as a consultant and changed to a consultant. It seemed to gradually fade out of the front line.

In addition, the British Financial Times also reported at the end of November last year that Ma Yun was traveling overseas and had lived with his family for nearly six months in Tokyo, Japan, and would regularly go to the United States and Israel.

In this way, Ma Yun's retirement seems to be quite good, and the outside world has speculated that he might move to overseas for a long time to avoid various domestic disturbances.

However, the South China Morning Post held by Alibaba Group quoted people familiar with the matter and said that Ma Yun did not plan to live overseas permanently, but planned to put advanced agricultural technology from the Netherlands, Japan, and Southeast Asia.Bring back to China, I hope to create a huge potential for China's agricultural modernization through the combination of new technologies.

It is necessary to point out that although Ma Yun resigned from the post of the chairman of Ali's board of directors, he is still one of Ali's permanent partners, and he still has certain control over the group.The commercial empire has nothing to do.

For Ma Yun, whether it is proactive or forced to abandon the control of Ant Group, it will undoubtedly weaken his influence in the business community, but it will also reduce his concerns and the supervisory agency's accountability.The risk may be a good thing for achieving his "agricultural dream".

The evaluation of the People's Daily Online was also cited by many netizens, describing Jack Ma, who was slightly sighing in the eyes of the outside world at this moment: "There is no so -called Jack Ma era, only Ma Yun in the era."

Where is the next step of ants?

Compared with the complicated emotions of Ma Yun, the outside world's next operation of the Ant Group is full of expectations: announced that Ma Yun's withdrawal means that the official rectification of the Ant Group also comes to an end. Previously, it was previously being by the previous.Is it possible to restart quickly?

In fact, Ma Yun's exit is not without a sign.As early as April 2021, Reuters quoted people familiar with the matter and said that Ant Group was discussing a plan for Ma Yun to disperse his shares in Ant Group and abandon control.The Wall Street Journal also quoted anonymous sources in July 2022 that Ma Yun might transfer some voting rights to Ant Group executives to abandon control.

But the regulatory authorities of China stipulate that after the company's control rights are changed, they need to wait for three years to list them in the domestic A -share market in China.The waiting time for the Shanghai Stock Exchange's science and technology board is two years, and the Hong Kong Stock Exchange is one year.In other words, the Ant Group will have to be listed at the Hong Kong Stock Exchange as soon as one year.

Relevant personnel of Ant Group also confirmed this when answering the Chinese media inquiry; related people revealed on Sunday (January 8) that the group is still focusing on rectification and business upgrades.plan.

However, look back at the rectification requirements put forward by the Bank of China, the CBRC, the CSRC, the CSRC, and other financial management departments in December 2020.It is to meet the requirements for "improving corporate governance", and it is still working hard for listing.

The remaining rectification requirements also include: return to payment of the origin, enhance transaction transparency, and strictly prohibit improper competition;Legal compliance operate personal credit reporting business to protect personal data privacy; set up financial holding companies in accordance with the law, strictly implement regulatory requirements, ensure sufficient capital and related transaction compliance; good company governance, strictly rectify illegal credit, insurance, and financial management in accordance with prudent supervision requirementsWuling in financial activities; carry out securities fund business in accordance with laws, strengthen the governance of securities institutions, and conduct asset securitization business compliant.

In addition, in order to meet the rectification requirements such as legal compliance licensed business credit reporting business and other rectification requirementsThe Chongqing Ant Consumer Finance Company established in 2021 in 2021 has undertaken the "borrowing" and "Hua Tao" business peeted from the group., Also released an active signal of the official recognition of the results of the Ant Group's rectification.

Affected by the many good news mentioned above, the stocks related to Ant Group have continued to rise recently. According to Reuters, Langxin Technology, Ji DazhengThe stock price of Yuan, Jinqiao Information, Obi Zhongguang, and Hang Seng Electronics rose after the opening on Monday (January 9), and Alibaba's stock price listed in Hong Kong also rose more than 8%.

It is not the only uncertainty in the listing of Ant Group. According to Bloomberg, the People's Bank of China first needs to accept and approve the application of the Ant Group to set up a financial holding company, and whether the Ant Group needs to further split its payment business led by Alipay and other departments.The launch will eventually not be determined in what kind of structure will be listed.

In addition, the Ant Group will eventually be listed as a technology company or a financial company, which will also affect its regulatory strength, and its market valueEssenceCompared with technology companies, the growth and profit margins of financial companies similar to banks are generally low.For example, Fidelity Investments (Fidelity Investments) fell to Ant Financial's expectations from US $ 235 billion (about S $ 313 billion) to less than one -third of the US $ 70 billion before the suspension of Ant Financial.

Platform companies pass the bottleneck period?

In terms of macro, the current situation of Ant Group is an important vane for Chinese Internet companies.Since the launch of the Ant Group's listing in 2020, the Chinese regulatory authorities have begun to vigorously rectify the high -speed development of Internet platform companies.And if ants can complete rectification and go public, it will inevitably boost confidence in this industry and even the entire private business community.

Since the CPC Central Committee's Economic Work Conference in December last year, officials have continuously eased their attitudes towards private enterprises.The Economic Work Conference emphasized that it is necessary to encourage the development of the private economy and private enterprises, and propose to vigorously develop the digital economy, improve the level of normalized supervision, and support platform companies to show their skills in leading development, employment, and international competition.Chinese President Xi Jinping also said in the meeting, "I have always supported private enterprises."

According to the Chinese official media Xinhua News Agency reported on Saturday (January 7), Guo Shuqing, chairman of the China Banking Regulatory Commission, also revealed thatThe regulatory authorities have basically completed the special rectification of 14 platform enterprises' financial business. A few leftover problems are solving quickly, and normalized supervision will be implemented in the future.Guo Shuqing did not mention the name of the company, but according to previous foreign news reports, 14 platform companies that have been rectified include Ant Group, Tencent, and Baidu's Daoman Finance.

From the perspective of the favorable signal released by the official, the rectification of Ant Group may soon end with Ant Group.

Jack Ma's letting go may be considered an opportunity for Ant Group to "re -get new life"; for the larger Chinese private enterprises and Internet companies, this adjustment and the future development of Ant will also become important.The vane.As for Ma Yun himself, maybe not as lonely as watching. After all, in 2015 when he was founded and the limelight was in 2015, he said: "I am not interested in money."