The tension of chairman and president is arrested, ChinaReal estate company R & F Real Estate fell 14%deep on Tuesday.R & F Real Estate was a large bargain in 2017 to win 77 Wanda hotels. It is rumored that the first real estate company in China, Wang Jianlin, who was the first richest man in China.

According to a comprehensive report from Reuters, South China Morning Post and Bloomberg, the chairman and president of R & F Real Estate were arrested by the London police on November 30, facing procedures for extradition of the United States.Zhang Li was suspected of participating in bribing the United States public officials from 2015 to 2020, so California issued a temporary arrest order to want him.He was accused of paying a repayment to U.S. officials in order to obtain a license to a San Francisco construction project.The US prosecutor's representative Ben Lloyd revealed that tension is suspected of bribing in San Francisco officials in the United States to benefit R & F Group's related parties in the United States, a company called "ZL Properties Inc".

Who pays the high bail?

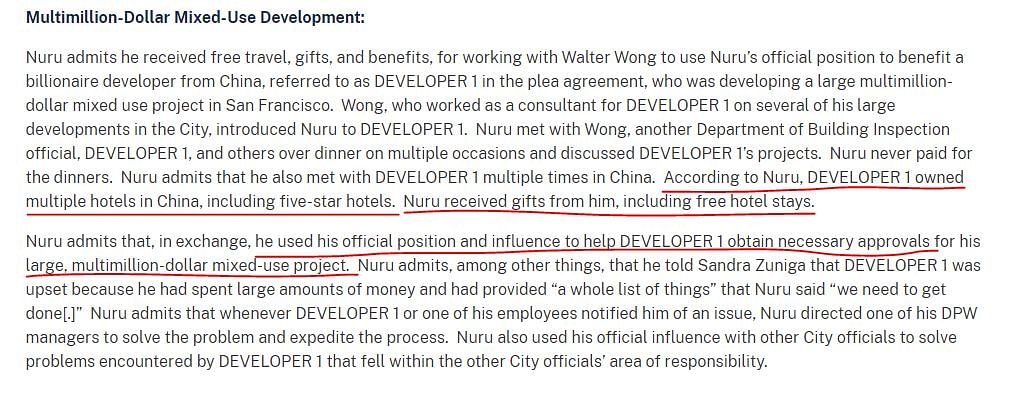

A paper announcement in R & F Real Estate on Monday night confirmed the news of the arrest of tension.The company stated that tension was accused of bribery because he "banquet in the public's public institute in the United States in China and provides hotel accommodation for him."R & F Real Estate emphasized that the charges of the United States are wrong, and the company is taking legal action.

After the tension was arrested, the judge approved him to obtain bail on Monday (December 12).The bail has been as high as 15 million pounds (S $ 24.957 million), becoming the highest joint bail ever in the history of British courts.

According to Reuters, Mark Summers, a lawyer of tension, revealed that R & F Real Estate would pay £ 10 million bail fees.Due to the provisions of the Hong Kong Stock Exchange, the amount can only be paid at most, and the remaining bail will be paid by the tension.

However, R & F Real Estate emphasized in a statement on Tuesday that the huge bail fee of 10 million pounds was delivered by the company ZL Properties.The company is owned by tension and its related parties. R & F Real Estate does not hold the company's rights and interests, and the case will not have a major adverse effect on R & F's business and operations.Nevertheless, R & F Real Estate experienced double -kill in stock debt on Tuesday, and the stock price once fell 14%deeply.

After being released on bail, tension will be under house arrest in an apartment in a high -rise building in London, and the Internet will not be allowed to use the Internet.The apartment is located on the 43rd floor of the building. It has five bedrooms, monitored by CCTV, and a 12 -hour duty of former British military personnel.The cost of security project alone is up to 200,000 pounds per month.

or because of the dismissal of US officials,

Some Chinese media found that R & F Real Estate acquired a place called a subsidiary in San Jose, California, USA in 2015.555 Fulton's high -end apartment project.However, the California Ministry of Public Division has since been exposed to corruption.

A head of the Public Division of California, Mohammed Nuru, was arrested for suspected corruption.This person's indictment mentioned the bribery of a real estate agent in China.

The documents published on December 17, 2021, the official website of the U.S. Prosecutor's Office, shows that a local Chinese businessman in California, as a leader, introduced a real estate agent in China and metObtaining license approval.Mohammed Bai was invited to travel to China in 2018 as a U.S. public office and lived in a five -star hotel.He also visited the private mansion of the founder of the developer in China and received a bottle of wine worth $ 2,000.

After the US official accepted these bribes, it helped this Chinese real estate developer solve a series of troubles in the development of the above project, such as quickly obtaining a development project permit.At present, the aforementioned Chinese businessman and this supervisor of the California Ministry of Public Division have pleaded guilty.

The US Department of Justice did not disclose the name of the Chinese developer, nor did it mention the real estate development project involved, but the incident occurred in San Francisco.In line with some details of the arrest case.Therefore, some media speculated that R & F Real Estate was involved in the case of the US official.

The tension of abandonment of business

The tension of 69 is one of the founders of R & F Real Estate.The annual report of R & F Real Estate shows that Zhang Li was once an official in Guangzhou, China.He has served as the secretary of the Youth League Committee of the Second Light Bureau of Guangzhou and the chief of the production section of the Baiyun District Township Enterprise Administration in Guangzhou. Until 1993, he decided to join the business community to engage in real estate business.

After the tension conversion track, the following year, Li Silian, a Hong Konger who was a trader, founded the R & F Group.After more than 20 years of development, R & F Group has become a comprehensive group that focuses on real estate development, and at the same time in the fields of hotel development, commercial operations, cultural and sports tourism, Internet production and trade, medical recreation, and design and construction.In 2005, R & F was listed on the main board of the Hong Kong Stock Exchange.

China's hot real estate market has made tension a lot of wealth.In February 2010, he was selected into the Forbes Global Billionaire List, ranking 556th.In 2013, the list of new wealth China Rich in China ranked 15th with 22.30 billion yuan (RMB, the same below, the same, S $ 4.3 billion).In 2022, the tension, Zhang Liang's father and son ranked 296th in the 2022 Healthy Hurun Rich List of Hengchang Burning Square with a wealth of 19 billion yuan.

The glory and dilemma of R & F Real Estate

R & F Real Estate is well known to the Chinese people and began in 2017 and Wanda Group's "World of World Trading".At that time, Wanda was trapped in a financial predicament. R & F Real Estate acquired 77 hotels under Wanda under the price of 19.906 billion yuan.The acquisition is called Wang Jianlin's "strong man broken wrist" because the net asset value of these hotels is expected to be no less than 33.176 billion yuan.

It is reported that the cooperation conference held by Wanda Group and Sunac China and R & F Real Estate in Beijing at that time was one and a half hours later than the original plan.The VIP lounge where Wang Jianlin was located came out of the sound of the wine glass, and the name of R & F was deleted on the on -site exhibition board.These actions attracted public opinion that R & F was still priced at Wanda before the press conference.

After winning Wanda's assets with a smile, R & F also acquired Nine projects in Hengji Zhaoye in Shenyang, Anshan, Tieling, Dalian and Guangzhou at the price of HK $ 8.6 billion.A number of real estate projects in London, England.However, R & F obviously made the same mistake as Wanda, and continued to expand into a subsequent debt crisis to laid a foreshadowing.

R & F started capital pressure in the second half of 2019, and announced the suspension of land acquisition.The Chinese government implemented the new regulations of the "Three Red Line" in 2020. The "Three Red Line" all stepped on R & F Real Estate, becoming an earlier wave of mines.As of the end of 2021, banks and other borrowings with a total principal of 29.883 billion yuan have defaulted or crossed the contract.

Fortunately, R & F's asset transfer and debt reorganization are more active, making it the first mainland housing company in China to successfully exhibition in China.But this also means that R & F's overseas debt repayment pressure this year and next was postponed to 2025.Affected by the debt exhibition period, in 2022, Fuli sold a cliff -like decline, until the end of October 2022The total sales revenue of R & F Real Estate was about 35.22 billion yuan, a decrease of 66.09%year -on -year.

Today, Wanda has been reborn, and R & F is still moving forward.At the critical moment when the debt vortex is about to get out of the debt, the helm of R & F Real Estate has been changed, and it is undoubtedly a huge blow to R & F Real Estate.