The supply chain is disturbed by the interference, causing global chip wastes to continue for more than two years. Recently, it has also faced the challenge of macroeconomic anti -wind wind and geopolitical risks.Semiconductor operators are concerned that the tension between China and the United States rapidly heat up will interfere with the global supply chain for a long time, so it will continue to have a diversified layout of the operating strategy.

At the end of July this year, the US Congress passed the chips Act (Chips ACT) and 52 billion US dollars (about 72 billion yuan) subsidies to improve local chip manufacturing capabilities.The new bill also restricts the acquisition of funds for significant transactions in China or any other concerned country in the next 10 years, thereby significantly expanding production capacity.This ban may form a judicial thunder area to the industry, affecting their business in China.

Hong Weisheng, executive director of the Singapore Semiconductor Industry Association (SSIA), said in an interview with Lianhe Morning Post that Sino -US competition, Russia and Ukraine war, and crown disease have continued to interfere with the global semiconductor industry supply chain.Toughness to deal with these risks.

Overall, Hong Weisheng emphasized: "(global) the supply chain of the semiconductor industry is complicated, and each country is interdependent. Providing huge subsidies to the United States to benefit the entire supply chain, including Singaporean companies."

Flexxon, a semiconductor manufacturing company that specializes in storage and network security products, is currently surveyed in the United States to find new bases and R & D facilities for appropriate places.

Chen Meiling, the founder and CEO of Fengli, said in an interview with this newspaper: "The passing of the American chip bill coincides with us because of the past few years., Institutions and customers establish a deep connection. "

NAND Flash produced by the company (NAND Flash) is widely used in multiple fields, including transportation, finance, medical care, investigation and military.Chen Meiling pointed out that the company has implemented a diversified strategy from product services to market bases, which helps enhance the toughness of its risk of supply chain and to alleviate the challenges of chip shortage as much as possible.

Singapore Semiconductor Industry Association: The US chip bill will accelerate industry growth

In response to the introduction of the US chip bill, Hong Weisheng believes that this will not affect the transnational company's expansion plan in Singapore and regional expansion, but will accelerate the global growth of the entire industry.

my country has attracted the investment in several top semiconductor companies in the past year.GlobalFoundries in the United States and Taiwan's Lianhua Electronics (UMC) invest in US $ 4 billion and $ 5 billion, respectively to build new wafer factories locally. It is expected to be put into production from 2023 to 2024.

In addition, the market also reported in May that the world's largest wafer pyrone (TSMC) intends to spend billions of dollars in setting up a new 12 -inch wafer fabal factory locally.Essence

The semiconductor industry is facing downward risk

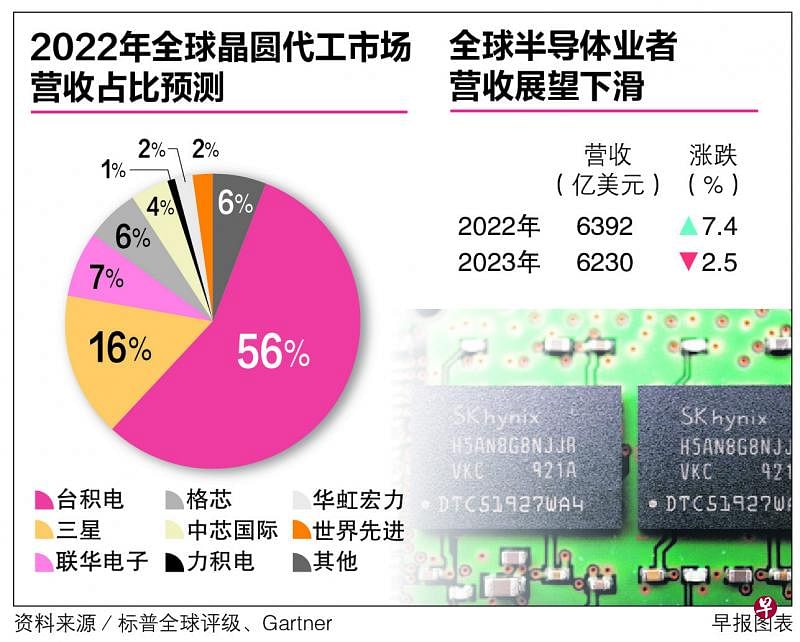

The recent weakening of macroeconomic prospects affects corporate customers and consumers. The global semiconductor industry is currently facing downward risks. After the operator's revenue increased by 26.3 % last year, it is expected to slow down this year, and it may even shrink next year.

The market research agency Gartner issued the latest report to revise the revenue forecast for global semiconductor companies this year, from the original year -on -year increase of 14 % to 7.4 % to US $ 639.2 billion. It is expected to shrink by 2.5 % to $ 623 billion next year.

Gartner Executive Vice President Richard Gordon believes that the rising inflation, tax rates and interest rates, as wellThe expenditure of electronic products such as mobile phones.

The weak consumer demand affects the consumer electronics market and contributes to the revenue of semiconductor companies by 5.4 % year -on -year this year.In contrast, the data center and the automotive market for semiconductors are still strong, and the revenue contribution of these areas to semiconductor companies continues to maintain toughness.

Gordon pointed out that the automobile industry is transitioning to electric vehicles and autonomous vehicles, and the number of semiconductors used will increase. He is optimistic about the contribution of the car market to the revenue of the semiconductor enterprise in the next three years.

In addition, with the expansion of the fabral factory event, it is expected to start production at the end of this year. Analysts are also worried that customers in the field of semiconductors will adjust their inventory. The chips of mature markets will face greater risks.

SP Global Ratings credit analyst Xu Lide pointed out that those who specialize in the production of 28 nanometers may have overcapacity next year, especially Lianhua Electronics and SMIC.

On the other hand, the prospects for the demand for terminal application of the Internet of Things and artificial intelligence are still good, and the supply of advanced chips will continue to be relatively scarce, which gives the wafer plant leader Yangtai Power and Samsung to expand its market share.