In the past six months, Biden has ordered the release of US oil reserves twice, including the release of 50 million in November last year.Barrels, 30 million barrels released in March this year, but have limited effect on low oil prices.According to the US Department of Energy, the United States currently has about 568.3 million barrels of crude oil reserves, which is the lowest inventory level since May 2002.

(Washington Composite Electric) White House announced on Thursday that the United States will release an average of 1 million barrels of strategic oil reserves a day in the next six months to deal with Russia's invasion of UkraineThe problem of rising gasoline prices and shortage of supply.The release of the release may reach 180 million barrels. It is the third time that the United States has used oil reserves since November last year. It is also the maximum release of the strategic oil reserve system for 50 years.

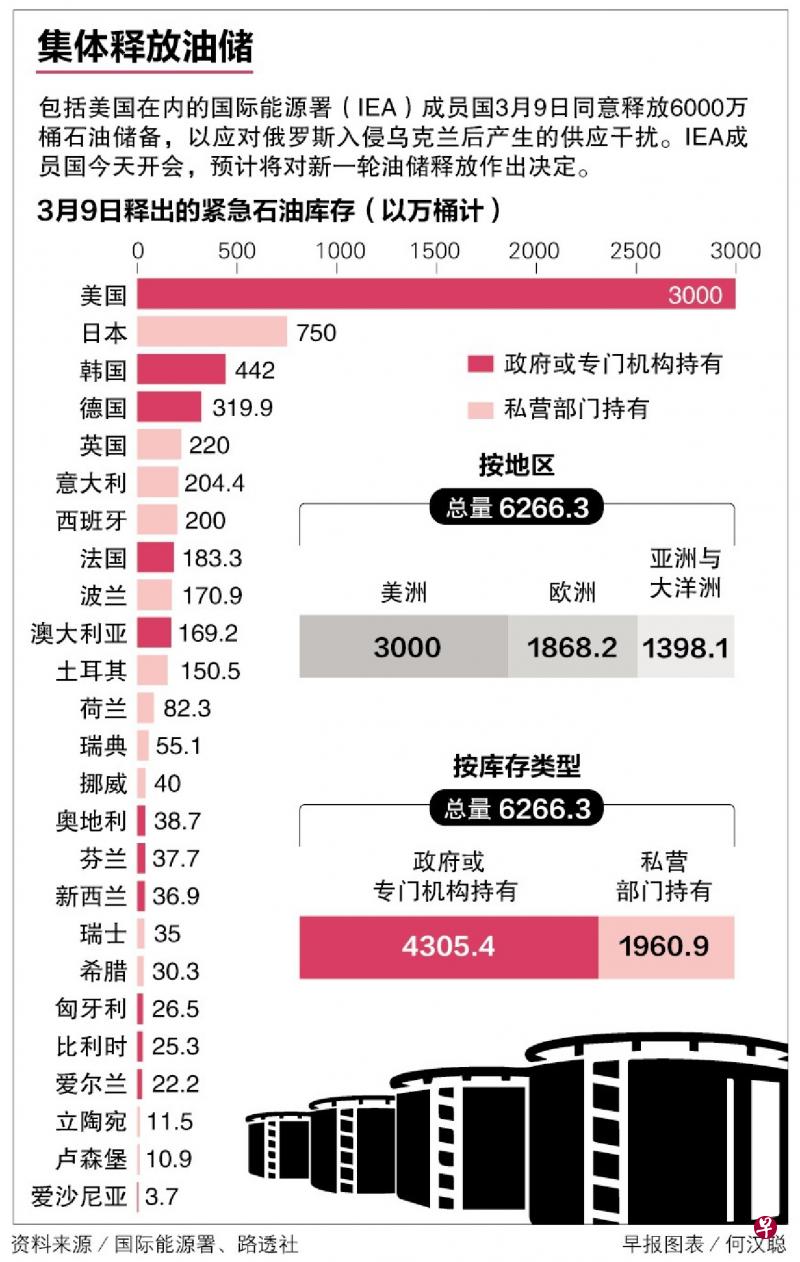

The United States has taken action with the coordination of global allies and partners this time.A member of the International Energy Agency (IEA) met on Friday to discuss the collective release of oil.However, analysts believe that the release of strategic inventory is expected to not be enough to appease the lack of supply of oil markets.

Bayeng delivered a speech at 1:30 pm on Thursday time on Thursday time (Singapore time on Friday at 1:30 in the morning), indicating that the US government is to reduce energy and gasoline to reduce energy and gasoline.The effort made by price.The White House issued a statement in advance, prediction that he would announce a new round of oil storage release operations.

Bayeng promised to reduce domestic gasoline prices last year, but the current oil price continues to rise, making him face great pressure, especially the United States is about to be held in November in NovemberMid -term election.

White House said that the release of the recorded oil storage will be the "bridge" before the increase in domestic production at the end of this year.

In the past six months, Biden has ordered the release of US oil reserves twice, including the release of 50 million barrels in November last year.Thousands of barrels, but have limited effect on low oil prices.According to the US Department of Energy, the United States currently has about 568.3 million barrels of crude oil reserves, which is the lowest inventory level since May 2002.

In order to stabilize the oil market, the United States has always worked hard to lobby members of the Organization of the Petroleum Exporting Countries (OPEC) to increase the output, but it is expected that the organization will still maintain a gradual increase in production on Thursday meeting on Thursday.Essence

After the United States intends to release the reserves again, global oil prices fell more than $ 5 per barrel.The White House said that US President Biden coordinated with allies and partners around the world, and it is expected that other countries will take action.

A spokesman for the New Zealand Energy Minister Woods said that the member states of the International Energy Agency will decide to release oil collectively at a meeting on Friday.The spokesman said: "The potential collective release has not been decided. The meeting will determine the total release amount and then allocate the amount of release of various countries."

Russia is one of the world's largest oil-producing countries. It exports 4 million to 5 million barrels of oil per day, accounting for about 10%of the global market.According to the International Energy Agency, affected by the international community's sanctions on Russia and buyers from buying Russia, from April, about 3 million barrels of Russian oil may not enter the market every day.

But analysts believe that the release of the supply gap in the oil market cannot fill the oil market."From the past experience, the asset management company BISON Interests chief investment officer," From the perspective of past experience, the release of strategic oil reserves will temporarily lower oil prices, and then the market price will rise again due to insufficient supply. "

Energy policy analyst Booker pointed out that in the long run, increasing commercial production is the key to re-balanced markets.He said: "Strategic oil inventory is limited, and the flow of commercial oil is not limited."

However, it takes time to increase oil production.The United States is the world's largest oil -producing country, but its output has fallen during the crown disease epidemic. It is expected that this year it will become a net importer, and it will be able to restore the position of net export country next year.