2023年最后一个交易日,沪指星期五(12On the 29th), it fell first and then rose 0.7%.Although it has risen for three days in the last week of this year, it has not exceeded 3,000 points.

The Chinese stock market has experienced huge fluctuations in the past year, and the three major indexes have fallen. Among them, the GEM and the Shencheng Index have fallen by more than 10%.EssenceMany investors laughed at themselves and bet on stocks in 2023. It is better to hold cash.

In the last week of 2023, the stock market showed signs of rebound.On Thursday (December 28), the Shanghai Index rose 1.38%, the first increase of more than 1%after the National Day this year, and the net purchase of the northbound capital was 13.558 billion yuan (RMB, the same below, the same, the new $ 2.585 billion).More than 10 billion yuan.

This rebound is an opportunity for shareholders, but they can't help worrying that how long can the rebound last?Is the Chinese stock market bottomed out?Is it necessary to defend 3000 points in 2024?

2023 transcript first, then

Most institutions are confident at the end of 2022.After three years of crown disease, China is open, and the depressed travel and consumption needs need to be digested urgently.However, the actual recovery is not as good as expected. In the second quarter, China's economic data was accused of showing the risk of shrinkage.China's domestic real estate crisis overlay high local bonds and restrict local government expenditures. The foreign dollar rate hikes have dragged down the stock market.

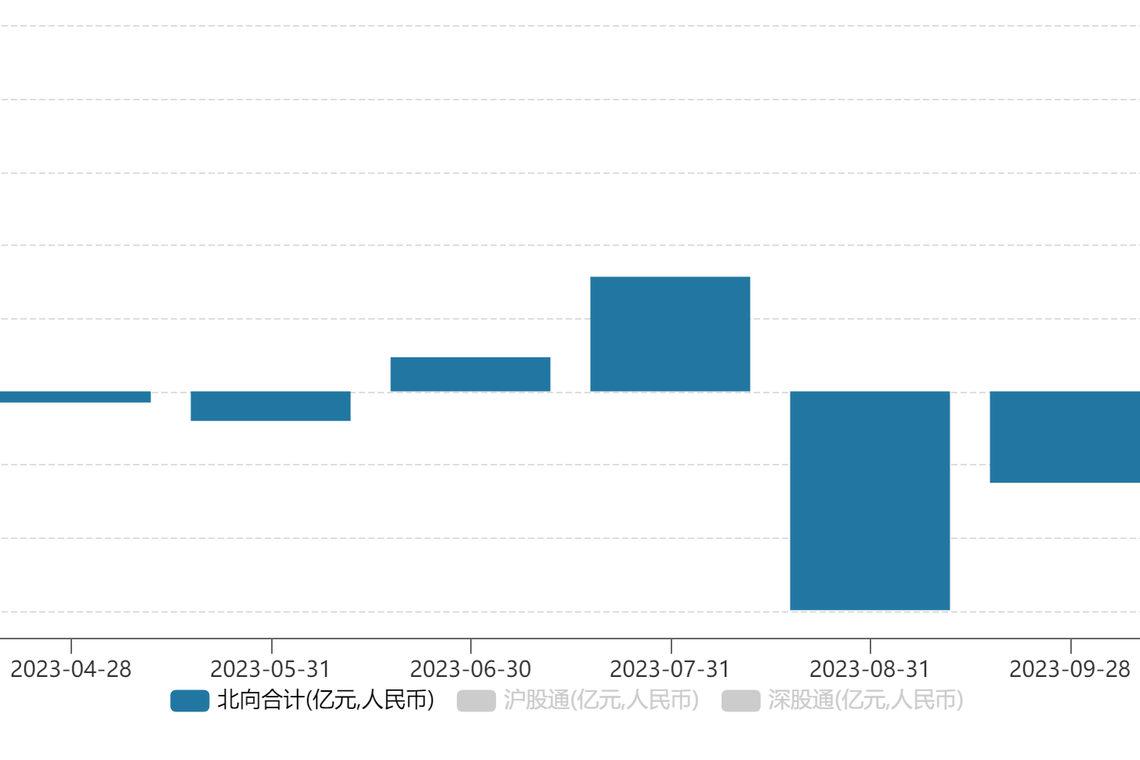

The flow of foreign capital is basically consistent with the above rhythm.The northbound capital flow at the beginning of the year, and the small stability increased in the second quarter. It reached the highest point of the cumulative net purchase amount in early August. Since then, it has continued to turn to net for five consecutive months.Record.

Although the north -cord capital is still buying a net, the net purchase amount is 43.7 billion yuan, which is a new low since the opening of the Shanghai and Shenzhen Stock Connect.

Although the proportion of funds in the north is not high, it is considered to be the "smart money" in the A -share market, and its great outflow greatly affects the confidence of the market.The Shanghai and Shenzhen fingers also shocked down from August, and both fell below 3,000 and 10,000 points in late October.

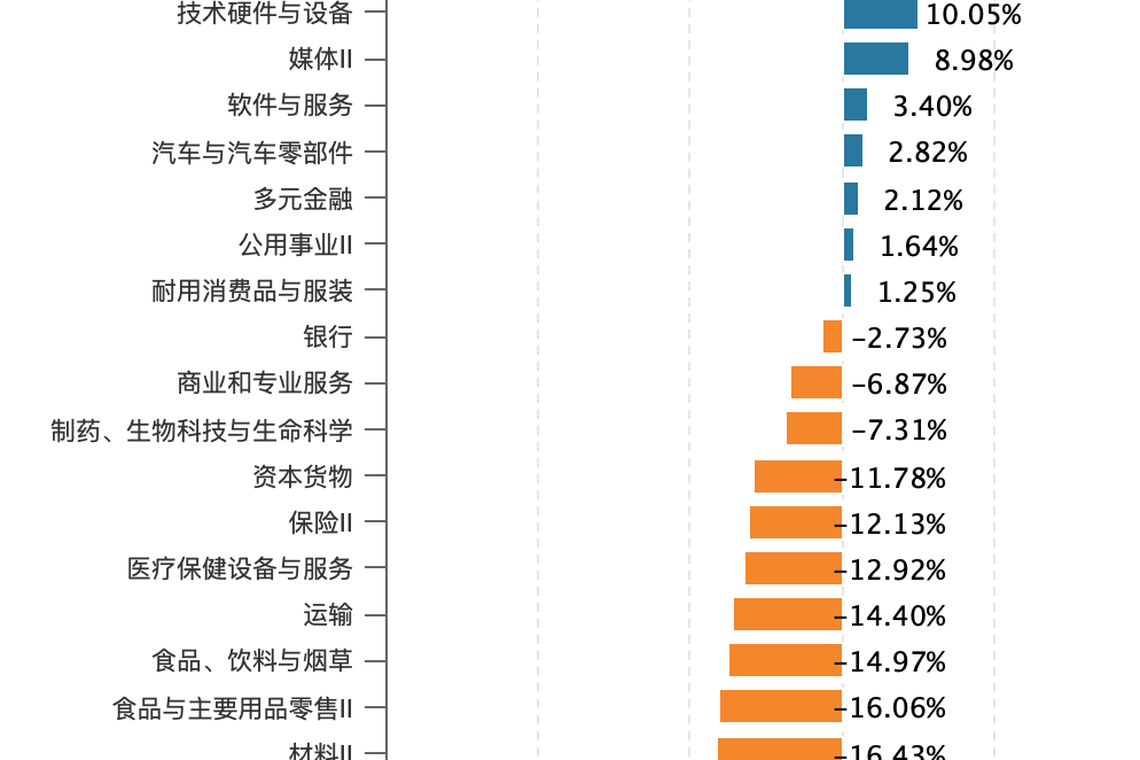

From the perspective of the industry, real estate, retail, new energy and tourism are the largest losers.

In terms of fund, public funds for public offer funds are negative throughout the year.According to Caixin.com, as of December 25, 2023, the overall losses of the public funds of the equity public funds of assets such as stocks and other assets were negatively lost by 15.85%.The overall loss for two consecutive years.

Comparison is that funds that invest in overseas securities, such as the Guangfa Global Selection Stocks of American Stocks, and other American stocks, etc., are ranked at the forefront of the public fund income list with more than 50%of the income.

2024: Optimism and caution

Looking forward to 2024, most Chinese brokerage agencies expressed caution and optimism.The optimistic consensus is that the current A -share has been built, and the US interest rate hike cycle is expected to end. The interest difference between China and the United States is narrowing, and it is expected to ease the pressure of capital evacuation.

CICC expects that the Chinese stock market will rise in 2024.China Merchants Securities predicts that the profit of A shares will usher in a high profit at the second half of 2024.

As for the cautious part, each family has given different reasons, including lack of market confidence, no new funds, the real estate crisis has not yet cleared, and external risks.

The Securities Times quoted Jing Wanhongyuan's research strategy chief analyzed master Jingtao, said that in 2024, a fierce competition was faced with fierce competition. The new energy and semiconductors invested by the United States, Japan and South Korea in the second half of the year entered the accelerated release period of production capacity.Enterprises formed challenges, which will be the largest time period for external circular competition.

The forecast of foreign institutions is not exactly the same.Goldman Sachs predicts that the Shanghai and Shenzhen 300 Index will rise by 16%in 2024, and the scale of foreign capital inflows is 100 billion yuan. UBS expects that the MSCI China index will have a 15%room for increase.Morgan Stanley analysts said that the CSI 300 Index will rise only about 7%to 3850 points, or even less than 4,000 points, which is really optimistic.

According to Bloomberg, Allianceberns acknowledged that the asset price was low, and it is expected that the profit growth of Chinese enterprises in 2024 will exceed developed markets.However, the chief investment officer of the agency still pointed out that although the cost -effectiveness is very attractive, they still lack enough confidence in geopolitical risks and long -term economic challenges to increase their holdings.

Determination of development and reform

The Wall Street Journal pointed out that in addition to the Chinese economy itself, investors' concerns also include policy changes that may occur at any time.It is reported that a draft of China ’s introduction in December to limit online game consumption quota has allowed game companies Tencent and NetEase to evaporate more than $ 60 billion (more than 79 billion yuan) market value.

Report also said that Wall Street economists believe that China needs a large -scale fiscal stimulus plan to truly boost the economy, but the government has been reluctant to put water in finance.

On the one hand, investors have questioned the policy of swinging back and forth: Is Chinese official determination to develop economy?On the other hand, from the perspective of the policy of the capital market, the official importance to the capital market is beyond doubt.

In July of this year, the Politburo meeting of the Communist Party of China proposed "active capital markets, boosting investor confidence", and August the CSRC issued a package of policy measures, including reducing rates, restricting major shareholders' sales, etc. 10The Central Financial Work Conference held at the end of the month once again proposed the "active capital market".

Li Bei, the founder of Banxia Investment, a well -known private equity fund, analyzed on the WeChat public account on Friday. At present, more than foreign capital, domestic private equity funds, insurance capital, and public offerings have no enough positions in A shares.Buy industrial capital and national teams.

This means that the main funds are retracted in the downturn and retail redeemed, which is a rational choice, and the official forces must support the capital market, which has a "political task" taste.

Li Bei believes that the Chinese policy package is sufficient. The policies for building government bonds and urban villages for a long time are bullets.State debt."As the follow -up policy is packed, the effect will exceed many people's expectations."

Conditions of the bull market

In rationally, in addition to being affected by market emotions, the essence of financial asset pricing is the essence of financial asset pricing isAs a result of future cash flow and the relationship between supply and demand, the profit trends of enterprises and the inflow of new funds will affect the stock price and valuation.

Wu Zhaoyin, the director of the Macro Strategy of AVIC Trust, published in an article published in the "Qinshuo Friends Circle" of the media, pointed out that the calendar of Chinese A sharesHistory shows that the bull market does not have to correspond to a strong macroeconomic.

From the perspective of capital inflowing, he continued the loose monetary policy in 2024, but the economic growth was not strong, there would be no large -scale inflation, and the currency required in the real economy was less.Currency will enter the capital market to provide incremental funds for the capital market.

As residents' deposits have not changed significantly since the second half of 2023, Wu Zhaoyin also predicts that with the decline in deposit interest rates, the dividend of the stock market has risen.Raise a living force.

Indeed, for most Chinese people, stock trading and buying a house are the main financial management methods.As of the end of 2022, there were more than 200 million shareholders in China. If they believe that the market has reached its low and started repair, the inflow of funds into the stock market is a natural result.

However, the atmosphere of policy fluctuations and the downturn in the stock market has made the market particularly sensitive and disgusted with extreme risks. The flow of deposit funds predicted by experts is not a result.For the Chinese stock market in 2024, the worst is not fluctuations, but that they dare not invest, just want to preserve, thinking that "investment is worse than lying down."