People familiar with the matter revealed that in order to further save the weak real estate industry, the Chinese financial regulatory department plans to relax the "three red line" assessment standards for real estate companies, including extended pilot transition periods and relaxation leverage restrictions.

According to Bloomberg News Agency on Friday (January 6), anonymous insiders reported that the regulatory authorities are planning to extend the "three red lines" pilot transition period at the end of June this year for at least six months.Enterprises provide more time to resolve debt risks.

People familiar with the matter also said that the regulatory authorities will also have a upper limit of the annual growth rate of the liabilities of housing enterprises in the period.And green -gear companies can use guarantee to replace the deposit with guarantee.

However, people familiar with the matter emphasized that these solutions are still under review, related measures may be adjusted, and the People's Bank of China has not responded to Bloomberg's comment request.

Public information shows that "three red lines" referThe asset -liability ratio of asset -shaped assets shall not be greater than 70%, the net debt ratio shall not be greater than 100%, and the cash short debt ratio shall not be less than doubled.

and the "three -line and four gears" are divided into four -gear management of real estate enterprises "red, orange, yellow, and green" according to the number of lines.At the existing level, the annual growth rate of "orange file" enterprises must not exceed 5%of the annual rate of liabilities, "yellow file" enterprises must not exceed 10%, and "green file" enterprises must not exceed 15%.

Bloomberg pointed out that although the assessment standard of the "three red lines" is in the current continuous and deep adjustment of the real estate industry, it is actually difficult to achieve for most real estate companies, but the regulatory authorities actively relax this iconic supervision of this iconic supervisionPolicies are still an important positive signal.This further confirms the change of decision -making layer on the attitude towards the real estate industry, as well as the determination to actively promote the improvement of the asset -liability statement of high -quality real estate enterprises and the pressure of mitigating developers.

Faced with the continuous deterioration of sales and debt risks in the real estate industry, the Chinese financial regulatory authorities have introduced a series of policy support including 16 financial measures since November last year.Among them, the latest measures include the establishment of the first set of housing loan interest rate policies on Thursday (January 5), which is announced by the Central Bank and the China Banking Regulatory Commission on Thursday (January 5), that is, allowing the sales price of new commodity housing to sell, Staged maintenance, lowering, or canceling the lower limit of local mortgage interest rate policies.

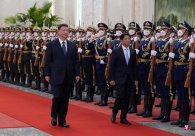

Liu He, Vice Premier of the State Council of China, also publicly stated last month that the real estate industry is the pillar of the Chinese economy. It is considering new measures to strive to improve the industry's assets and liabilities and guide market expectations and confidence to recover.