A number of many ChinaThe media reported on Thursday (July 28) that Ding Wenwu, the head of the Electronic Information Department of the Ministry of Industry and Information Technology and the general manager of China Integrated Circuit Industry Investment Fund Co., Ltd. (referred to as the Great Fund), was investigated.

The Discipline Inspection and Supervision Team of the Ministry of Industry and Information Technology of the Central Committee of the Communist Party of China and the Beijing Municipal Supervision Committee issued a notice two days later (July 30) to confirm the above news.Chinese public opinion believes that the "anti -corruption storm" of the Chinese chip industry is entering the climax.

Ding Wenwu, 60, graduated from Electronic Science and Technology of Electronic Science and Technology of Hefei University of Technology; in August 2008, he became the deputy director of the Electronic Products Department of the Ministry of Information Industry at the time.

In August 2011, Ding Wenwu was promoted to the Director of the Electronic Information Department of the Ministry of Industry and Information Technology; the Great Fund was established in 2015, and Ding Wenwu became the general manager.

Ding Wenwu is not the first anti -corruption target for the chip industry.As early as November last year, Gao Songtao, the former vice president of Huixin Investment, the company manager company, had been investigated.In the past month, at least five senior officials in the chip industry were investigated, of which four of them and Ding Wenwu and the large funds he managed had a wrong relationship.

The relationship between Ding Wenwu and the Da Fund

On July 15th, the website of the State Commission for Discipline Inspection issued a notification, the former deputy director of the China National Development Bank National Development Fund Management Department, and the former deputy director of the China Development Fund Management Department,The former deputy general manager of the National Kaijin Development Fund Co., Ltd. and the former president of Huaxin Investment, Lu Jun, was investigated for serious disciplinary violations.People who were sensitive to the market thought at the time that China's "chip anti -corruption" was kicking off.

Public information shows that since the establishment of Huaxin Investment in 2014, Lu Jun has served as directors and managers and participated in a large amount of investment operations of the large fund.

When Ding Wenwu served as the first general manager of the Great Fund in 2015, the second largest shareholder of the Great Fund Guojie Financial Co., Ltd. was the Lu Jun.

On the same day as the Lu Jun was taken away, there was Wang Wenzhong, a partner of the Great Fund Shenzhen Zitai Fund Investment Management Co., Ltd.

According to Caixin reports, Wang Wenzhong and Lu Jun are classmates. Before entering the large fund Shenzhen sub -fund, there was no large or well -known investment institution.

Let's look at Zhao Weiguo, former chairman of Ziguang Group, who was taken away on July 25th.Different letters have disclosed that Ziguang Group has an interlocking relationship with the Great Fund.After half a year after the establishment of the Great Fund, the first large -scale investment -off is Ziguang Group.

Another executive of Ziguang Group and former president Diao Shijing were also investigated on July 29. He had worked with Ding Wenwu in the Ministry of Industry and Information Technology.

What is the "big fund"?

The large fund, known as the "national team" of the Chinese chip industry, was opened by Guobai Finance, China Tobacco, Yizhuang Guotou, China Mobile, Shanghai Guosheng, China Electricity Department, Ziguang Communication, Huaxin Investment and other companiesInitiative, 22.3%of State Financial held 22.3%of them is the second largest shareholder except the Ministry of Finance.

The purpose of the establishment of the Great Fund is to improve the construction of the supporting system of the Chinese integrated circuit industry supply chain, focusing on the integrated circuit chip manufacturing industry, and take into account industries such as chip design, packaging testing, equipment and materials.

It is worth mentioning that one year before the establishment of the Great Fund, Huaxin Investment was established, China Kai Financial contributed 45%, and then the then Vice President of Guokai Financial, Lu Jun, served as the president of Huaxin Investment.Subsequently, Huaxin Investment became the only manager of the Great Fund.

The first -phase investment scale of the Great Fund exceeded 130 billion yuan (the same, about 26.4 billion yuan), which was basically completed in 2018.Investment targets accounted for 67%, 17%of design, 10%of the seal testing, and 6%of the equipment and materials categories. The invested companies include SMIC, Shanghai Huahi, Yangtze River Storage, and Ziguang Zhanrui.

The second phase of the fund was established in October 2019, with a scale of more than 200 billion yuan; the equipment that focuses on pay attention to the etching machine, film equipment, testing equipment, etc.

The success and defeat of the Great Fund

Some media analysis pointed out that since the establishment of the Great Fund, it has been successful in investment.The industry's investment evaluation of the Great Fund is positive, and the listed companies have also brought a good financial return to the fund.

However, it is more like a stock trading tool rather than a institution that promotes basic national research.Critics believe that although the large fund has driven trillions of investment, it does not create domestic -produced chips and materials.

Liu Yadong, the former editor -in -chief of the Science and Technology Daily and Dean of the School of Journalism and Communication of Nankai University, pointed out that the large fund can be said to be successful in commercial investment and stock trading cash.Technical, we didn't seem to see it obviously. "

Some people in the industry also believe that as a form of realization of state -owned enterprises, the big fund is facing almost all the problems faced by all state -owned enterprises, that is, how to ensure that state -owned assets will not be lost.

China Capital Movement

The Great Fund has invested in the chip industry over the years, but many chip manufacturers have not been completed for two or three years, let aloneSpeaking of solving China's "core" problem.This has nothing to do with China's sports development chip industry in recent years.

In 2020, with the continuous upgrading of Sino -US trade frictions, China Telecom technology giant Huawei was "disconnected" chip by the United States.Enter the climax.

In this movement, the planning of integrated circuit industry in various places is more than 100 billion yuan. The semiconductor industrial park has blossomed everywhere. Local governments are scrambling to set up investment funds and provide a large number of subsidies and rewards.

According to incomplete statistics, in the first half of 2020, there were more than 140 semiconductor projects in 21 provinces, and projects with only statistics disclosed, with a total investment of over 307 billion yuan.

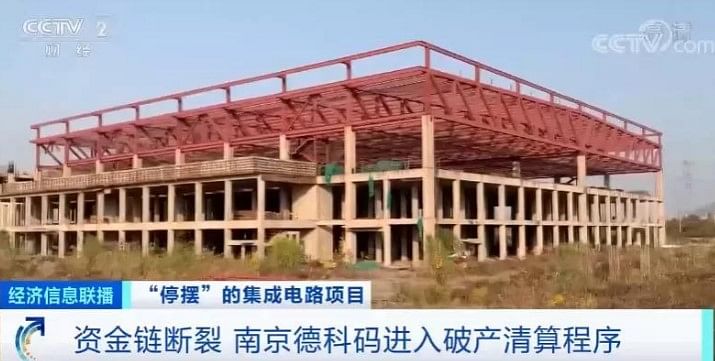

The core movement under the air outlet quickly exposed problems.From 2019 to 2020Du Gexin, Wuhan Hongxin, Jinan Quanxin, Huai'an Dehuai, Huai'an Times, Nanjing Deco Code, and Shaanxi Kun's seven wafer manufacturing companies have rotten.

These projects have similar development trajectories: first introduced government funds from the sponsor painting project "Big Cake", set up a company, and play the gimmick of "filling the domestic gap";Building a large fund investment, and using the brand effect of the large fund to drive social risk capital investment.

Once the Great Fund is not entered as scheduled, the social risk capital stops outside the bureau to wait and see, which will cause the capital chain to break and the project stops.

Take Wuhan Hongxin, which was established in 2017 as an example. This project claims to invest 100 billion yuan. According to the original plan, the company focuses on the advanced packaging of the wafers and has a seven -nanometer process.Don't be afraid of being stuck around the neck.It took more than three years, and Hongxin was on the verge of bankruptcy before the factory building was built. The company also mortgaged the only seven -nano ASML light machine it had to the bank.

Where is the Chinese chip industry?

The vigorous "core" campaign did not change the reality of relying on imports by Chinese chips.Data show that the global semiconductor output value last year was US $ 558.5 billion (S $ 768.2 billion).According to Chinese customs data, China imported $ 400 billion in chips, about two -thirds of the world.

When the Chinese chip industry set off a anti -corruption storm, the United States just passed the chip bill.Bloomberg quoted people familiar with the matter and said that many American equipment manufacturers received official notice in the past two weeks and were asked not to provide China for equipment manufacturing for 14 nanometer or below chips.

The Chinese official media has published a social comment on Sunday that the American public opinion used Chinese chip anti -corruption to question whether the investment in China's chip field was effectively questioned.It was deliberately stirring muddy water.

With the support of the Great Fund, the situation of "lack of cores" in China has not fundamentally changed, but there are still breakthroughs in some areas.Bloomberg quoted sources in March this year that Apple is looking for new suppliers for the memory chip used in its iPhone, and is testing NAND flash chip samples produced by the Yangtze River storage.

However, as the Huanshi Review reminds, the chip industry needs to counter the capital cycle, especially in the short -term speculation.After this shuffling in this Chinese chip industry, does it solve the problem of the stuck neck in solving the problem of the stuck neck, or change the soup without changing the soup, continue to engage in sports development, and pursue short -term returns?This choice is critical to the success or failure of the most critical battle in the Sino -US scientific and technological war.