(Washington Composite Electric) The chief economic adviser of the US President Biden said that the US economy is landing and developing softly. In 2024, the US economy will continue to maintain stability.

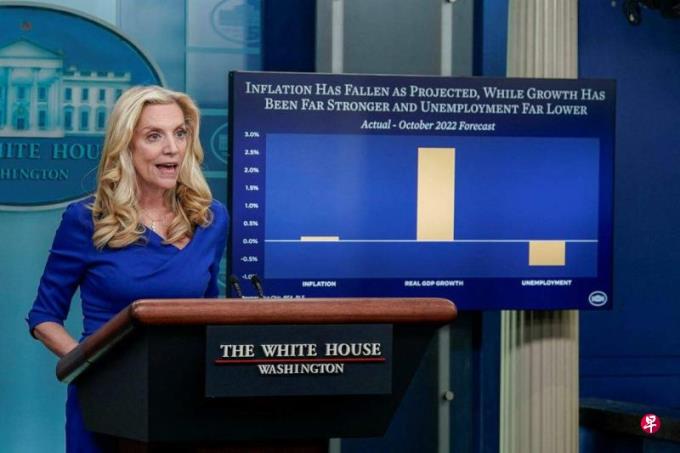

The White House economic adviser Lael Brainard told reporters in Washington on Friday (December 15) that recent data showed that "the runway of soft landing has become wider" and said that immigrants assist the US labor to rebound.

Brener said that the Fed has seen quite positive signs, indicating that inflation has indeed decreased, and it may continue to decline.

American voters' concerns about the economy and put pressure on Biden's election.The polls conducted by Reuters / Iposo this month show that about 45%of the American adults believe that former President Trump has a better performance in handling the economy;It means uncertain.

Brened said the Bayon government is still considering all options to reduce costs.Economists believe that if a national decision maker implements a tightening policy better, the economic speed of excessive rapid growth has been steadily decreased to a suitable ratio. Without large -scale contraction and unemployment, it can be called soft landing.

Brener said: "Immigration, or the proportion of people born in foreign countries in labor force, is also an important factor in a large rebound of labor force last year ... This is of course part of the overall policy consideration."

Powell, chairman of the United States Federal Reserve, said at a press conference on March (13th) that the historic measures that tighten monetary policy to tighten monetary policy may end due to the faster decline in inflation.The market predicts that the Fed will reduce interest rates as soon as March next year, which has driven US stocks to rise significantly.

However, Breonard pointed out that although the financial market reflects more positive views on economic development, people need some time to feel more secure in finance.

New York Federal Reserve: Early at the time of paying interest rates in March next year

John Williams, the president of the New York Federal Reserve Bank, also said in an interview with American Consumer News and Business Channel on Friday that it would be too early to consider the interest rate at March next year.This is considered to pour cold water for the Federal Reserve ’s interest rate cuts at the beginning of next year, suggesting that the market response is over.

Williams said in an interview that interest rate cuts are not a topic discussed by the Fed."We are not really discussing interest rate cuts now. We are very concerned about the problems in front of us. As Chairman Powell said, whether our monetary policy has fully tightened to ensure that inflation falls to 2%."

Williams said that the Fed will continue to determine the direction based on the data. If the trend of inflation is relieved, the Fed is ready to tighten the policy again.

Williams was the first Federal Reserve official after Powell held a press conference. Analysts pointed out that the Fed will generally arrange for the New York President to come forward to "clarify" information.In other words, the Federal Reserve does not grasp the interest rate at March next year.