After the China Securities Regulatory Commission released a series of favorable capital markets such as a half -stamp duty on Sunday (August 27), the three major stock indexes of China A shares opened on Monday (August 28) collectively opened up, and the Shanghai Index and ShenchengFingers, the entrepreneurial board finger rose more than 5%.

However, after ten minutes of opening, each section began to fall, and the three major indexes fell 3%.By the closing of Monday, the Shanghai Index rose 1.1%, the Shenzhen Index rose 1.01, and the GEM index rose 0.96%.

The market has different responses.Under the topic of "A -share" on the Weibo Search List, many netizens spoke to tease the policy, or left a message saying that "it means that the stock market is not a policy that can be rescued."Some netizens said that the policies are good, but it should be more patient with frozen three feet. It should be more patient.

Four -tube approach policy intensity exceeds expectations

Among the content released by the Securities Regulatory Commission Sunday, the most direct favorable policy is the reduction of the implementation of the stamp duty of securities transactions.

Stock trading stamp duty is the tax paid by the selling party at a certain percentage of the selling price in the A -share market.Before the adjustment, the stamp tax rate was 0.1%, and the tax rate after adjustment became 0.05%.The Wall Street Journal quoted Citi Bank analysts that stamp duty is the largest expenditure of Chinese stock traders. The reduction will reduce the cost of A shares by 35%to 40%.

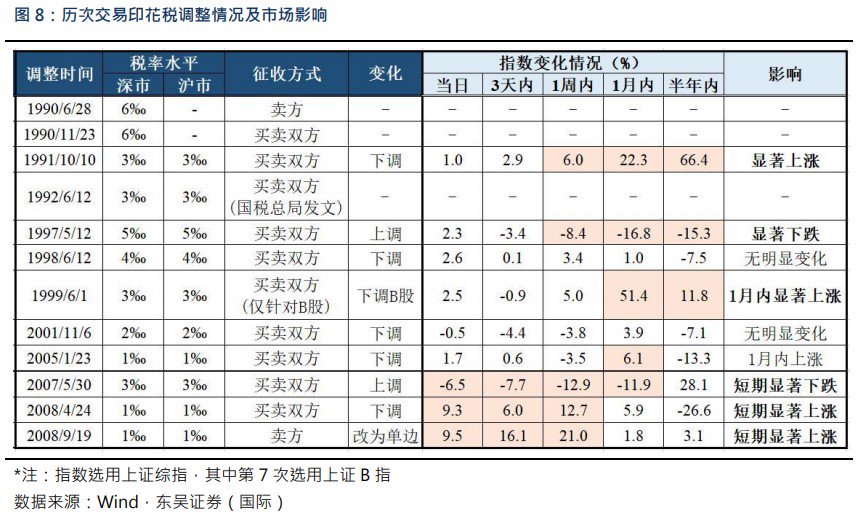

Cost -down can drive the transaction volume.According to the statistics of Huachuang Securities, the stamp duty of Chinese stock transactions has been raised twice in history, and seven times have been reduced.Among them, the three -time downgrade triggered a bull market, that is, the stock index rose by more than 20%, and the four -time down reduction allowed the market to rise for one to two weeks, and returned to the decline.

But of the three bull markets, the shortest time lasted for one month, and the longest one maintained for nine months, showing that the decline in stamp duty can exert the stimulus effect of boosting confidence in the short term, but the effect of medium and long term is not significant.The symbolic significance of policy is greater than the loose significance of capital.

The CSRC also regulates executive reduction behavior on Sunday, stipulating that the listed company has fallen below the issue price, the stock price has fallen below the net asset value, or the cash dividend has not been carried out in the past three years.Holding the company's shares.Huatai Securities pointed out that the restrictions on restrictions have prevented about 250 billion yuan (RMB S $ 47.18 billion, the same below), which has brought great benefits to the liquidity of the stock market.

The CSRC also stipulates that the rhythm of the IPO is tightened in stages and promoted the dynamic balance of both ends of investment and financing.This is equivalent to responding to the market's complaint about "new IPO sucking funds".

The proportion of financing margin to the securities exchanges means that investors can buy securities with a higher leverage rate to buy securities companies.

Bloomberg quoted the report by CICC analysts that the strength of the Chinese government's policy tools is increasing, and the scale, strength and speed of the Securities and Futures Commission's measures have exceeded expectations.

Frozen three feet is not a day cold

Since this year, the capital market has fallen into a downturn due to its weak economic growth and weak real estate markets.In the past six months, the Shanghai Index fell 6.45%, the deep index fell by 14.1%, the GEM index fell 15.7%, the Hong Kong stocks Hang Seng Index fell 21%compared with the beginning of the year, entering the bear market.

Market analysis believes that the lack of confidence in China's economic growth has affected a series of economic activities such as investment and consumption. Chinese officials expect to boost confidence through active capital markets.

The China Securities Regulatory Commission stated at a press conference on August 18: "Active capital market, boosting investor confidence" is the new requirements of the CPC Central Committee for the capital market work.Pay attention to and earnest expectations, which fully reflects the significance of stable capital market expectations to maintaining the stability of the overall economic and social situation. "

The Securities and Futures Commission also guided medium- and long -term funds to the market with the principals of the main leaders of the National Social Security Fund and some major bank insurance institutions to stabilize the stock market fluctuations with the National Social Security Fund Council and some large bank insurance institutions.

Driven by supervision, various financial institutions have also moved to announce their own purchase.According to the China Securities Journal, 21 public funds have announced their own purchase in August, with a total amount of 1.29 billion yuan.Many listed companies have also begun to repurchase shares.According to Caixin Weekly, more than 100 listed companies have announced their repurchase shares since August, and the science and technology board has repurchased a total of 5.608 billion yuan.

But for nearly half a month of symposium, conference, and policy combination, the market performance on Monday has made the traders who are full of confidence waiting for the opening.

After the Shanghai Index and the Shenzhen Index and the Shenzhen Index fell to the lowest 3064 points and 10130 points during the year, the closing of Monday only rose 1%weakly, and there was a large distance from the out of the trough.

At the same time, global investors continue to sell Chinese assets.According to the real -time data of the Oriental Wealth Network, on behalf of the foreign institutional investors, it traded the north -directional funds of stocks in China through the Shanghai -Shenzhen -Hong Kong Stock Connect mechanism. It sold 8.2 billion yuan on Monday and sold a total of 48.246 billion yuan in August.In mid -August, the Northbound Fund was sold for 13 consecutive trading days, creating the longest record for the longest consecutive sales days in history.

Bloomberg said that the price trend on Monday showed that foreign investors need to see specific measures for the recovery economy before returning to the Chinese stock market.

The market needs not only technical measures and slogans.Caixin.com quoted an anonymous market person, "The original intention of the policy can be understood that the current market confidence is seriously insufficient and the supervision hopes to cheer the market. However, in the current overall background, technical measures and some inspiring people's hearts are difficult to buy the market."

The capital market is a barometer for economic operation, which also affects the expectations and confidence of all parties. It is important to save the market.But whether logically or in reality, the development of a country's economy determines the development of the stock market, not in turn.A package of stimulus policies can give market confidence, but the market is even more expected to be the development of the real economy, thereby driving the capital market on a healthy operation track.