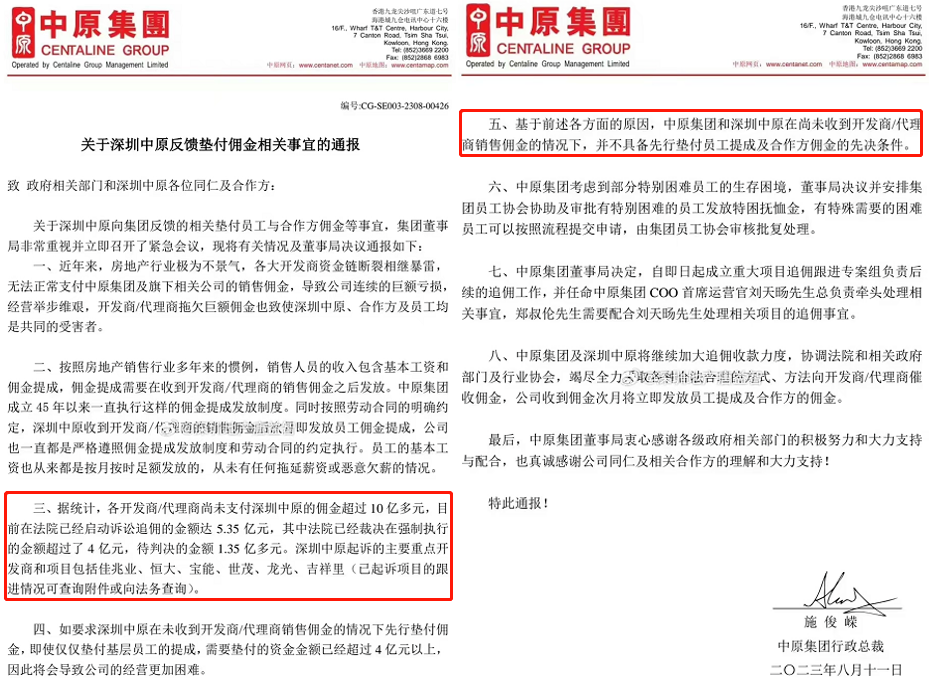

受中国房地产行业持续萎靡影响,知名房地产中介深圳中原据报被包括恒大、宝能在内的多家开发商拖欠佣金,总额超过10亿元(人民币,下同,约S $ 190 million).

Comprehensive reports of the Daily Economic News and the First Financial Saturday (August 19), a document entitled by the report entitled to Shenzhen Central Plains feedback cushion commissions circulated in China.

The document said that due to the downturn in the real estate industry in recent years, the developer's capital chain is broken, and the sales commissions of the Central Plains Group and its related companies cannot be paid normally, which has led to the company's continuous losses and difficult operations.

The document states that according to statistics, the commissions of various developers/agents have not paid more than 1 billion yuan in the Shenzhen Central Plains, and the amount of litigation commissions in the court has started 535 million yuan.Among them, the court has ruled that the amount of forced execution exceeds 400 million yuan, and the amount to be judged is more than 135 million yuan.

According to the documents, the main developers and projects in Shenzhen's prosecution include Jiazhaoye, Evergrande, Baoneng, Shimao, Longguang, Jixiangli, etc.

Shenzhen Central Plains said in the document that according to the convention of the real estate sales industry over the years, the income of the sales staff includes basic salary and commission commission.After the sales commissions were issued, it was said that in the 45 years since the establishment of the Central Plains, it has always been issued on time and on time on time, and has never delayed salaries or malicious wages.

But for the problem that the employee did not receive the commission, the document said that if Shenzhen Central Plains paid the commission without receiving the sales commission, even if only the commission of the grass -roots employees was paid, the amount of funds required exceeded more than more than the amount of funds.400 million yuan, "it will make the company's operations more difficult."According to Shenzhen Central Plains, the company does not have the prerequisite for the prerequisite for employees without receiving sales commissions.

The document also said that the Board of Directors of the Central Plains Group decided that a major project chasing commission followed up the task force from now on the establishment of a major project to follow up, responsible for the follow -up commission of the universityImmediately issue employee commission and commission of partners.

The above documents are looking up as "to the relevant government departments and colleagues and partners in Shenzhen Central Plains", and the payment is "Shi Junzheng, Chief Executive Officer of the Central Plains Group", which is August 11, 2023.According to the First Financial report, an insider of the Central Plains Group confirmed the authenticity of the document.

Public information shows that Shenzhen Central Plains belongs to the Central Plains Group and is a large professional real estate agency company in Shenzhen. Since 2001, the number and sales of agency real estate in the secondary market have accounted for the main share of the Shenzhen real estate market.According to the official website of the Central Plains Group, there are currently more than 55,000 employees and 2,500 direct -operated shops. They have established branches in 60 cities in the world.

According to reports, the data disclosed by the Shenzhen Real Estate Intermediary Association in July this year shows that the average transaction volume per person per month in Shenzhen in the first half of this yearIt can only be sold for 1.08 suites in the year.

The Shenzhen Real Estate Intermediary Association pointed out that since the second quarter of the Shenzhen second -hand housing market, the monthly trading volume continued to explore, and it returned to the embarrassing situation of less than 3,000 units of the monthly period during the epidemic period.Later, market confidence has not been completely restored.