China has opened the country on January 8th, and it has released the time as expected as early as the outside world. The market is optimistic about the Chinese economy to bottom out earlier. but suddenly letting go also leads to the rapid spread of the epidemic and impacts economic activities.How big is the Chinese economy rebound this year?What are the obstacles to the road of recovery? What impact will it affect the global economy?

After learning that China was about to dismiss the entry isolation a week ago, Singapore businessman Ji Huarong began to check the air tickets to Hong Kong in February. It is planned to visit partners in Hong Kong, Shenzhen and Shanghai in this long -lost trip to China.Essence

The environmental protection cleaner founded by Ji Huarong has a office in Shanghai. Before the outbreak, he flew to Shanghai almost every month.But in the past three years, he has only entered China once at the end of 2021 and participated in the Import Expo held that year at the cost of isolation at the hotel for 14 days.

Ji Huarong told Lianhe Zaobao that the Chinese market currently accounts for about 40 % of the company's business, and this year's estimated proportion exceeds Singapore."If you can go to China once a month as soon as the epidemic, I will have the opportunity to contact more business partners, and the business may grow faster."

China Sunday (January 8) has canceled the requirements for the detection and centralized isolation requirements for all -member nucleic acid detection and centralized isolation, and the opening of the country as early as March expected by the outside world.This has prompted a number of investment banks to increase the forecast of China's economic growth this year.Morgan Chase raised from 4 % to 4.3 %, and Goldman Sachs rose from 4.8 % to 5.2 %. The most optimistic Morgan Stanley was expected to increase by 5.4 % this year, higher than the previously estimated 5 %.

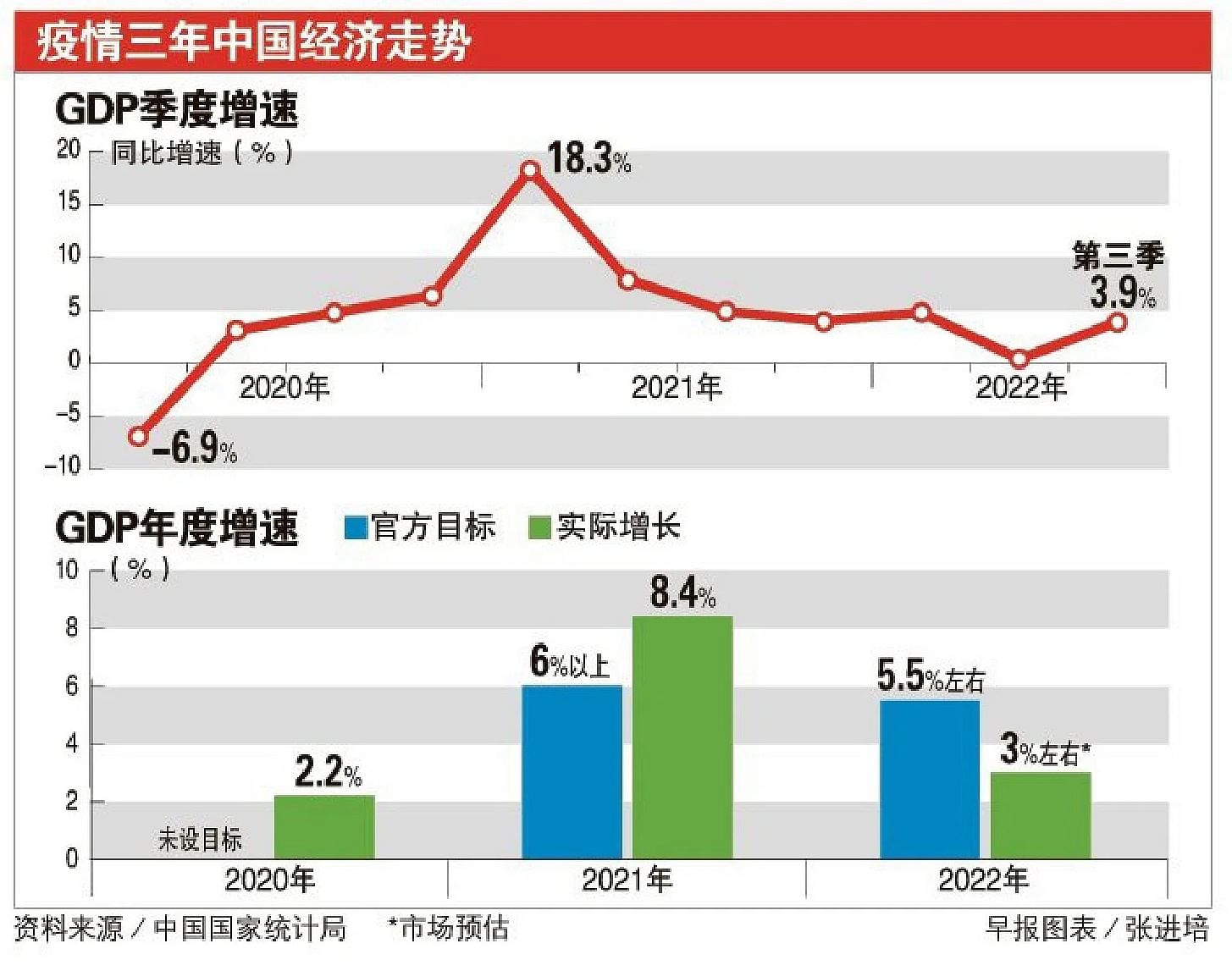

In the first three quarters of last year, China's GDP (GDP) has increased by 3 %. Economists are expected that the annual economic growth will also be around 3 %, which is far lower than the official growth target of about 5.5 % set at the beginning of the year.However, as the official continued to accelerate the relaxation of epidemic prevention policies from November last year, the market is generally optimistic about the bottom of the world's second largest economy to bottom out this year. The suspense is how fast it is and how high the rebound is.

Xie Dongming, director of the research director of the Greater China of Singapore Overseas Chinese Bank, analyzed in an analysis in the interview that the rapid peak model after the decryption of China was very rare in the world. At presentChina's economic rebound will be faster than other countries.

Xie Dongming predicts that the Chinese economy will rebound this year.Because the economic growth rate of the first quarter of last year was still 4.8 %, the first quarter of this year is expected to perform mediocre, but the second quarter may have a significant rebound of more than 7 %."If the Chinese economy is high and low last year, this year is just the opposite. Although the increase in the second half of the year may fall, the annual growth rate is expected to be higher than 5 %."

Tourism recovery drives consumption recovery

In the "troidee" that drives the economy, the weakest consumption sector last year is expected to usher in a significant rebound this year.The Chinese government issued an outline of the strategic planning of domestic demand last month. The CPC Central Committee's Economic Work Conference held at the same time emphasized that it is necessary to place restoration and expansion of consumption priority.According to the analysis, when the export of China faces the weakening of the wind, the official will introduce more consumption policies to maximize the role of domestic demand.

Although the specific consumption policy has not yet been released, epidemic prevention measures that have been relaxed in one month, such as cross -ground travel, no longer check nucleic acid certificates and health codes, and will be exempted from immigration isolation.To the dawn of dawn.

On December 26, Chinese official announced the exemption of entry isolation measures. On the night of the entry isolation measures, both outbound air tickets and hotel search volumes on Ctrip of the tourism platform reached a three -year high.Ctrip spokesman disclosed in an interview that the next morning, the orders for outbound air tickets in mainland China increased by 254 % over the day before, and the average price fell 12.9 %.It is already brewing. "

According to Ctrip statistics, the platform's New Year's Day cross -border ticket booking volume increased by 145 % year -on -year, and the number of cross -border ticket reservations in the Spring Festival increased by more than 260 % year -on -year.The tourism industry ushered in recovery, which means that the catering and transportation industries will also recover.

At the same time, foreign companies that are strictly entry to restrict the rejection of the country also look forward to returning to this huge market and bring more investment.

Joerg Wuttke, chairman of the Chinese EU Chamber of Commerce, welcomes China to open the country, believes that this will help boost business confidence, so that the headquarters of the European company headquarters in China in the past three years can be visited in China, thereby promoting to promoteinvest.However, he also pointed out that European companies may wait and see how China's epidemic will evolve in the next few weeks to make long -term decisions on investment in China.

Woodkek said in an interview that the trend of the Chinese epidemic was unclear, and companies were worried about the emergence of new mutant strains."In addition, the Chinese economy continues to face anti -wind, which means that many members of the chamber of commerce cannot decide whether to send more employees to China."

Infection surge in shock economy

Suddenly unblocking has caused the number of Chinese crown diseases to increase, and the aggressive epidemic has swept major cities within a month and spread rapidly to small and medium -sized cities and rural areas.A large number of people are sick in bed, which makes the bleak economic activities worse.

China's official manufacturing manager Index (PMI) fell to 47 last December, the lowest level since the outbreak of the epidemic in February 2020; non -manufacturing PMI has dropped from 46.7 in November to 41.6, which is also nearThe worst performance in the past three years.

JPMorgan Chase warned that if the infected person has caused a shortage of factories, China's supply chain may be disturbed in the short term.Julian Evans-Prituck, a senior Chinese economist at Capital Economics, believes that giving up clearing can not immediately alleviate China's economic predicament. Consumption activities may be from three to sixteen.It can be restored to "close to normal" after a month.

However, with the rapid peak of the epidemic, there have been signs of recovery in many major cities.Bloomberg data shows that as of December 28 last year, the degree of traffic congestion in 15 cities in China rebounded nearly 60 % from a week ago.

Chen Guangyan, a professor of economics at Nanyang University of Science and Technology in Singapore, believes that if the outbreak of China's epidemic leads to the emergence of new mutant strains, it will undoubtedly be the "black swan" of this year's economy.However, after a month of rapid dissemination, no new mutant strains have been found, and the market has reasons more optimistic.

Chen Guangyan pointed out that, like other countries, China must be impacted by multiple rounds of epidemic after letting go.However, from the experience of the United States and Singapore, as the adaptation of medical systems, enterprises, and the public has increased to the epidemic, the impact of subsequent epidemics will continue to weaken.

"This is like throwing stones in the lake. The first water sparkle is the largest. Although there are ripples, the ripple will become smaller and smaller.Essence"

Scholars: The decline in the European and American economy is expected to show its own way

Although China's door is closed in the past three years, it still depends on the world economy.In the early days of outbreaks of the epidemic in 2020, China became the only country in major economies to maintain positive growth.With the economic downturn in the European and American economy this year, China's economy is expected to stand out again and shoulder the heavy responsibility of promoting global economic growth.

Chen Guangyan, a professor of economics at Nanyang University of Technology, pointed out that among the "three driving troops" that driven the global economy, the US economy has shown signs of recession, and the EU has also been weak. Only China is still expected to accelerate."Although China's economic recovery is still facing multiple risks, its growth potential cannot be ignored. If China's economic growth can reach 6 % to 7 % this year, developing countries such as Southeast Asia, Latin America, and Africa will be able to effectively drive"

After China's open border, the first thing to release is huge consumption potential.According to CEIC data from the Financial Information Service Company, the accumulation of more than 4.8 trillion US dollars (S $ 6.5 trillion) of Chinese families during the three years of the epidemic is higher than that of the total GDP (GDP).The recent surge in infection has led many countries to tighten Chinese passengers' entry restrictions, while Southeast Asian countries such as Thailand and Singapore have not set up restrictions on Chinese passengers are expected to become the biggest beneficiary of international travel recovery.

Ctrip platform data shows that after Mainland China announced the release of entry isolation, Singapore, South Korea, Hong Kong, Japan, and Thailand ’s air ticket orders have increased the largest. Among them, the number of outbound air ticket orders from Singapore has the highest growth rate, which has increased six times from the previous month.

China's economic recovery may lead to global inflation

Thailand's National Tourism Administration predicts that at least 5 million Chinese tourists who travel to Thailand this year can increase significantly from 220,000 last year.The Economist of the Bank of Da Lama also predicts that if the tide of visiting visitors in China this year can bring about S $ 2 billion in additional retail sales to Singapore.

Singapore, which is closely related to China trade, will also benefit from China.The World Bank analysis shows that every one percentage point of China's GDP increases, it will drive Singapore's GDP to increase by 1.2 percentage points.Australia, Thailand, Malaysia and Indonesia's GDP will also grow with Chinese trade.

However, while supporting the development of the global economy, the inflation caused by the recovery of China's economic recovery will exacerbate the global inflation of global inflation, so that the central banks of various countries must also respond to the two challenges of economic recession and high inflation.May exacerbate world economic fluctuations.

Chen Guangyan pointed out that after China is reopened, the daily crude oil demand may increase by 1 million barrels, and the prices of commodities such as petroleum rising will rise, which will cause economic pressure on developing countries.

Xie Dongming, the research leader of the Greater China Research, warned that inflation is the "gray rhino" faced by China and the global economy this year.The inflation pressure in China in the first quarter, but it will gradually heat up later, and the inflation rate may exceed 3 % in the second half of the year.

"However, since the Chinese economy accounts for nearly 20 % of the global economy, overall, its support for the global economy is expected to be greater than inflation."

On the other hand, the decline in foreign demand caused by the decline of the multinational economy has also made it difficult for China to maintain its bright performance.Since October last year, China's exports have risen from rising to fall, ending the growth of more than two years; the decline in exports in November further expanded to 8.7 %, the lowest since March 2020.How to promote growth under the pressure of internal and external pressure is a question that China and the global economy will answer together in 2023.

boost confidence to improve the economy of the economy

Facing the continuously upgraded economic backwind, while the Chinese epidemic prevention policy has shifted rapidly, the decision -making layer has also changed significantly in specific fields.

The CPC Central Committee Economic Conference held in mid -month changed the tough attitude of "preventing the disorderly expansion of capital" in the past two years, and instead encouraged the development of the private economy and private enterprises.For the real estate market that is still worsening, while the meeting reiterated that "housing does not stir -fry", the meeting emphasized that it is necessary to ensure the stable development of the property market and prevent the risk of high -quality head enterprises.

During the three years of crown diseases, strict epidemic prevention measures and downstreaming economies of high -voltage industries and controls have closed down the economy, making market entities mainly private enterprises closed down, and the real estate industry has fallen into a crisis of capital flow.Whether the property market can bottom out in the new year, and whether private enterprises can regain their majesty have become the two key factor in the speed of China's economic recovery speed; this depends on how the official fixes frustrated market confidence and enhances the economic expectations of the downturn.

Xie Dongming, director of the Research Director of the Greater China of Overseas Chinese, pointed out that China is a highly policy -driven economy. The official policy will affect expectations and then affect market behavior.Whether the policy is consistent and whether the conduction is effective determines the support for the economy.This is why the Central Economic Conference is required to start with "improving social psychological expectations and boosting development confidence in development" when deploying this year's economic work.

However, recently rushing openness and policy turns have caused the market to question the consistency of the policy.Xie Dongming said: "If the policy is repeated, it will impact on the expected expectations, and the effectiveness of policy transmission will also weaken."

He used the property market as an example that the official has continued to relax real estate management in the past year, but the demand has not rebounded because of insufficient expectations.Platform companies have experienced concerns about whether they can continue to obtain policy support in the future."The market's expectations for macro policies are difficult to improve immediately. It takes a few months if it is fast, and it takes several quarters for a few quarters."

Over the past month, the official densely releases support signals for the property market and private enterprises.When the People's Bank of China held an annual work conference last Wednesday (January 4), it proposed to increase financial support for financial demand and supply system, insisting on all kinds of ownership companies, and supporting the stable and healthy development of the property market.The central bank will introduce a new regulation the next day, allowing cities with weak housing prices to independently adjust the interest rate of mortgages, and try to enter the laptop property market from the demand side.

A few days after the end of the Central Economic Work Conference, Yi Lianhong, Secretary of the Zhejiang Provincial Party Committee of the Communist Party of China, inspected Alibaba Group and urged this platform corporate giants to "show their skills in promoting development, international competition and benefiting the society."Ali's main Ant Group subsidiaries also approved 10.5 billion yuan (S $ 2.05 billion) in capital increase plan at the end of last year, driving the best "opening of the door" in history in the United States.

However, Bai Shizhen, the former dean of the Singapore Financial Authority and a visiting professor at the National University of Singapore, said in an interview that when he talked with several Chinese entrepreneurs who had recently moved to Singapore, he felt their disappointment with the policy."After private entrepreneurs have tried their suffering in recent years, they no longer buy the official speech easily. They not only depends on what the senior management has said, but also how much they have done.The times have passed. "

Bai Shizhen suggested that officials reduce administrative intervention in the market, and guide market development by creating fair, orderly, legal and healthy operations and competitive environments."Only by fundamentally reforming the system and treating all kinds of enterprises can restore confidence in private enterprises."