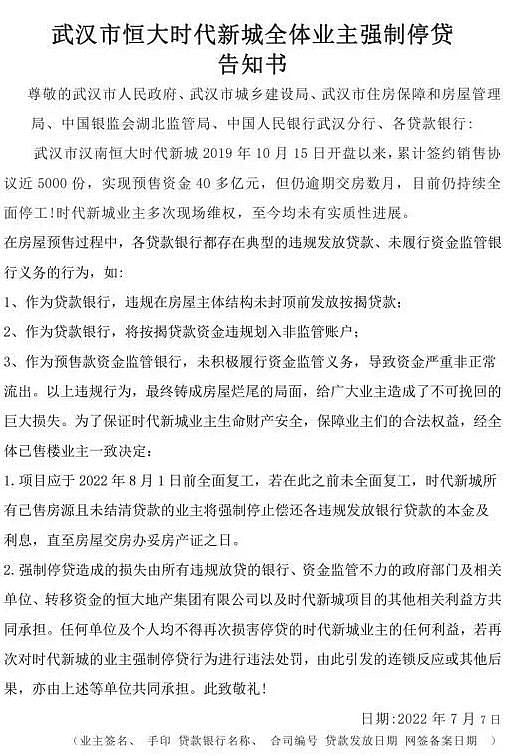

OneThe "Notification of All Owners of the New Town in Wuhan Times New City" recently circulated on the Internet.According to the notice, the Wuhan Hannan Times New City Project has been overdue for several months, and the owners still have no substantial progress on the spot rights on the spot. Thousands of households have decided that if the project will not fully resume work within the limited time (August 1 this year), They will force the stop of the bank's monthly supply.

The "stop loan" notification of similar contents of the new city in Wuhan Times has frequently appeared in the past two weeks, and on the evening of Tuesday (July 12), "at least 14 rotten tail owners announced forced loan".The topic of the topic is also on the hot search.

As the owner's suspension of loan rise, the Chinese official media Securities Times published a comment article on Wednesday (July 13), saying that if this trend spreads, it will spread, and it will spread.It is not conducive to the stability of the financial system, and it is called to prevent the risk spread from the risk of the rotten tail.

The tide of loan stop and the whole country

According to Chinese media reports, all owners of Hengda Longting, Jingdezhen City, Jiangxi, the compulsory loan notification letter issued on June 30 this year, is considered thisThe starting point of the rotation tide.

/>

/> After the owner of Evergrande exit out of this first step, the owners of Wuhan Greenland Optical Valley Xinghe painting, Nanchang Xinlicheng, Zhengzhou Mingmen Cuiyuan and other projects also held a group to announce the mandatory suspension of loan.

According to statistics, since the end of June, the owners of nearly 30 real estate projects across the country have issued a notice of compulsory loan suspension, covering Henan, Hunan, Jiangxi, Liaoning, Shaanxi, Anhui, Hubei and other 7 provinces.City 17.

Evergrande Real Estate, which has always been at the forefront, has the most suspension projects involved in. Olympic gardens, Xinyuan, Xinli, Sunshine City, Shimao, Greenland and other well -known housing companies are also being listed in loan. Among themSome star real estate.

The aforementioned Wuhan Times New City Project has completed 3264 units in one year, winning the two -year sales area and sales of the number of sales in the first half of 2020.It is such a "champion" real estate, originally planned to deliver the first period in March this year, but now faces bad tails.

According to the Daily Economic News report, Ms., the owner of the project, said in an interview that their husbands and wives in October 2020 for the total price of 750,000 yuan (RMB, the same below, about 150,000 yuan), The down payment of 300,000 yuan, a monthly supply of more than 4,000 yuan, bought a new house of 98 square meters.

Ms. Zhang bluntly said that the news of the suspension of the project was "stunned."According to her description, she had no one when she went to the construction site.

Ms. Li, who purchased the new city of Wuhan Times in January 2020, said in an interview that due to the lack of construction for a long time, many places in the construction site were even overgrown.Ms. Li said that she has repeatedly asked the development progress of the developer, all of which have been pushed for various reasons.

Another owner, Mr. Li, said that they have communicated many times with relevant government departments and corporate communication, but they have not made specific progress.Regarding the owner's group to stop loan, Mr. Li admitted that they saw that the owner of the Jingdezhen Longting project also stopped loan due to stopping work.It's really big.

Can you stop lending forced to resume work?

After the decision to stop loan during the Wuhan Times New City project, Gong Jie, the person in charge of the project, said in an interview on July 10, "The current project is in a normal resumption state. The first phase of the project is expected to be in December this yearPay the house. "

However, the so -called" normal resumption "of the developer, in the view of Mr. Li," the number of recovers is far from the actual situation of the project. "

Yan Yuejin, research director of the Think Tank Center of the Easy House Research Institute, pointed out that although the part of the (project involved in loan) was resumed, it was a "performance resume" and did not really enter the stage of complete construction.

If the resumption cannot be achieved, then the owner unilaterally announces whether the suspension of loans can be supported by law?

According to Ja Ruiguo, a lawyer of Beijing Fangli Law Firm quoted by the Blue Whale Finance, said that a house purchase loan mainly involves two legal relationships.The loan relationship between the borrowing is also the loan relationship.

The rotten house involves the relationship between the owner and the developer. If there is no special agreement in the loan contract, there is no direct relationship between the rotten tail and the bank.Due to changes in house conditions, the owner's unilateral stop repayment will also cause breach of contract for banks.

In other words, although "forced loan" is a helpless move, the owner's collective suspension notice notification has no legal effect, and it may also affect the owner's credit reporting problem.

However, a paper judgment of the Jiaxing court in Zhejiang in February this year seems to provide a line of hope for these sufferings.

Mr. Xu from Shanghai when he bought a property in a real estate in JiaxingThe mortgage loan was 3.92 million yuan, but the real estate was bad, and the developer also declared bankruptcy.Mr. Xu stopped repay and asked to cancel the loan contract.The court of second instance believes that the unable to deliver the house in the house caused the sales contract of the commercial housing to be lifted, and the developer should bear the responsibility of the remaining loan repayment.

This is the first case of China's first home buyer who does not need to repay bank loans after the house is rotten, but it should be noted that this case has its special features.It is the owner's proposal to lift the buying contract.The current demands of the owners such as Wuhan and other places are to force the project to be restarted to the rotten tail building project in a way to stop loans.

The pre -sale fund supervision is difficult to blame the bank?

The right of rights protection of the owner of the Chinese real estate market is not uncommon, but unlike the past, the owner would aimed at the banks that lended loans, not an open -minded bank.

It is understood that a number of real estate owners involved in the suspension of loan said that the banks were lending in violation of regulations during the pre -sale process.The owner of Evergrande Long Ting accused of the notice that the banks who issued the mortgage loan issued a loan to themselves without obtaining the online signing and filing, "a typical illegal issuance loan."

The owners of Zhengzhou Mingmen Cuiyuan also pointed out that during the pre -sale of houses, Industrial and Commercial Bank of China, Huaxia Bank, Zhengzhou Bank, etc. have different degrees of illegal issuance of loans and failure to perform fund supervision obligations.

The Huaxia Times quoted Wang Yuchen, director of the Beijing Professor Firm, pointed out that many projects have a direct relationship with developers' misappropriation of pre -sale funds. At the same timeThere is also a certain relationship between supervision in place.He said: "In many rotten tail projects, it is difficult for banks to leave loans in violation of regulations."

Pre -sale funds supervision refersThe construction of this project shall not be taken or used at will.

As early as 2010, the Ministry of Housing and Construction of China issued a notice, which clearly required the establishment of a pre -sale fund supervision system for commercial housing, and urged real estate developers to complete the delivery task after the sales house.

In the second half of 2021, with the upgrading and increased regulation and the increase of thunderous housing companies, in order to prevent developers from using the "pre -collection" to repay the debt or continue to increase the rotation speed under the pressure of liquidity pressure, from the central to the local area to the local areaThe competent authorities have strengthened the supervision of pre -sale funds.Paradoxically, this action has become the last straw that crushes developers, which further accelerates the outbreak of the liquidity crisis of most private housing companies, leading to the emergence of more rotten tail buildings.

The Chinese property market crisis is further upgraded?

In the industry, real estate has become a rotten tail building, the delivery of the house is far away, and the reduction of personal income caused by the epidemic is the main reason for the suspension of loan.The pre -sale system is related.

Analysis pointed out that in this system, housing companies are in the cycle of land acquisition, building, repayment, and debt repayment with high leverage and high turnover.Essence

However, under the multiple regulations such as the "three red lines" and pre -sale funds, the capital chain of housing enterprises broke, the rotten tail building continued to appear, and the owner was still the owner who was finally injured.

However, as the Securities Times commented article pointed out that in this tide of loan, it was not only the owner who was hurt, but also the entire property market and financial institutions.Although financial institutions have real estate mortgage, real estate that is not delivered can only become bad debts. When bad debts increase, it may cause systemic financial risks.

Bloomberg quoted the analyst in the report, Griffin Chan, etc. In the report, Kerri, which was mentioned in the report, claimed that as of 2021, the real estate delayed in 24 key cities reached 186,000 units, equivalent to 9%of the sales volume of new houses in 2021.

The report also quoted the Citi report that the owner's collective suspension of loans will lead to the increase in non -performing loans, including China Construction Bank, China Postal Savings Bank, and Industrial and Commercial Bank of China.risk.

It is reported that buyers refused to pay the mortgage at the risk of influencing personal credit reporting, highlighting the storm of real estate has already affected a large number of middle class and pose a threat to social stability.

Yan Yuejin also said that the (stop loan) incident sounded the alarm and once again explained that the problem of real estate is easy to evolve into social issues. Governments of various local governments should take positive attention and accelerate the introduction of response measures.

Hu Xijin, editor -in -chief of the Chinese official media, bluntly said: If this kind of thing is more, it will form a systemic risk effect, which is worth a high degree of alertness.

Hu Xijin posted on Wednesday afternoon calling that the local governments need to take measures to promote the re -survive of rotten real estate, saying that "this is the root of the problem."

The real estate industry, which was once regarded as the pillar of China's economic growth, has experienced drastic changes in the past two years, with the first series of debt crisis caused by the largest real estate developer Hengda, as well as the unfavorable environment for the overall economic downturn.The market fluctuates continuously.

All parts of China have also introduced policies such as "one person to buy a house", hoping to boost the market.However, as mentioned in the aforementioned analysis, the most critical issue is the end of financial institutions and government supervision.If the stimulus policy introduced is only for short -term benefits, the cure is not cured, and the entire society will eventually pay for the long -term price.