's next step to gain scale may be looking at distressed assets.

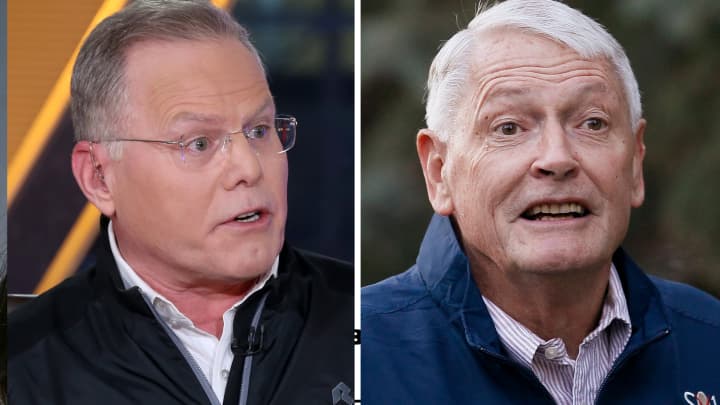

Chief Executive David Zaslav and board member John Malone both made comments this week suggesting the company is paying down debt and building up free cash flow to set up acquisitions in the next two years of media businesses suffering from diminished valuations.

The targets could be companies flirting with or filing for bankruptcy, Malone said in an exclusive interview with CNBC on Thursday. While U.S. regulators may frown at large media companies coming together because of overlaps with studio, cable or broadcasting assets, they'll be much more forgiving if the companies are struggling to survive, Malone told David Faber.

"I think we're going to see very serious distress in our industry," Malone said. "There is an exemption to the antitrust laws on a failing business. At some point of distress, right, then some of the restrictions, they look the other way."

Media company valuations have been plummeting amid streaming video losses, traditional TV subscriber defections, and a down advertising market. This has affected Warner Bros. Discovery as much as its peers. The company's market valuation recently fell below $23 billion, its lowest point since WarnerMedia and Discovery The company ended the third quarter with about $43 billion in net debt.

Warner Bros. Discovery is trying to position itself to be an acquirer, rather than a distressed asset, itself, by paying down debt and increasing cash flow, Zaslav said during his this week. Warner Bros. Discovery has paid down $12 billion and expects to generate at least $5 billion in free cash flow this year, the company said.

"We're surrounded by a lot of companies that are – don't have the geographic diversity that we have, aren't generating real free cash flow, have debt that are presenting issues," Zaslav "We're de-levering at a time when our peers are levering up, at a time when our peers are unstable, and there is a lot of excess competitive – excess players in the market. So, this will give us a chance not only to fight to grow in the next year, but to have the kind of balance sheet and the kind of stability ... that we could be really opportunistic over the next 12 to 24 months."

Still, Warner Bros. Discovery also acknowledged it will miss its own year-end leverage target of 2.5 to 3 times adjusted earnings as the TV ad market struggles and linear TV subscription revenue declines.

Malone has some experience with profiting from times of distress.

His acquired a 40% stake in over several years more than a decade ago, saving Since then, the equity value of the satellite radio company has bounced back from nearly zero to about $5 per share. Sirius XM currently has a market capitalization of about $18 billion.

"It made us a lot of money with Sirius," Malone told Faber.

While Malone didn't name a specific company as a target for Warner Bros. Discovery, he discussed as an example of a company whose prospects seem shaky. Paramount Global's market valuation has slumped below $8 billion while carrying

Malone noted that Paramount's debt was . "I think that they're running probably negative free cash flow," he said.

While Paramount Global shares have fallen precipitously since Viacom and CBS merged in 2019, there are signs the company is shoring up its balance sheet. CEO Bob Bakish said earlier this month Paramount Global's streaming losses will be lower in 2023 than 2022, and the company expects further improvement to losses in 2024. The company closed a sale for for $1.6 billion and will use the proceeds to pay down debt.

Paramount Global is one of the few assets that logically fits Malone's vision of a media asset that would have regulatory issues as an acquisition with potential distress concerns. 's NBCUniversal, another potential merger partner, will lose more than $2 billion this year on its streaming service, Peacock, but the media giant is shielded by its parent company, the largest U.S. broadband provider.

"Warner Bros. [Discovery] now is making money. Not a lot, but they're making money," Malone said. "Peacock is losing a lot of money. Paramount is losing a ton of money that they can't afford. At least [Comcast CEO] Brian [Roberts] can afford to lose the money."

Paramount Global's controlling shareholder Shari Redstone is open to a transformative transaction, CNBC . Puck's Dylan Byers that industry insiders have speculated Warner Bros. Discovery might pursue an acquisition of Paramount Global after the 2024 U.S. presidential election.

A combination of NBCUniversal and Paramount Global also has strategic logic, but the combination of two national broadcast networks — Comcast's NBC and Paramount Global's CBS — would present a significant regulatory hurdle. Warner Bros. Discovery doesn't own a broadcast network, making an acquisition of CBS easier.

Spokespeople for Paramount Global and Warner Bros. Discovery declined to comment.

While Malone said all legacy media companies should be talking to each other about merger synergies, he acknowledged valuations may have to fall farther to get regulators on board with further consolidation. Malone predicted that could happen in the same timeline Zaslav gave — within the next two years.

"Eventually maybe there'll be regulatory relief," Malone said. "Out of distress usually comes the reduction in competition, increased pricing power, and the opportunity to buy assets at a deep discount."

Disclosure: Comcast owns NBCUniversal, the parent company of CNBC.

Tune in: CNBC's full interview with John Malone will air 8 p.m. ET Thursday.