(Berlin/New York/London Composite Electric) The Red Sea crisis continues to affect maritime transportation. Electric vehicle manufacturers Tesla and Volvo Motor Company have successively announced that some factories have been discontinued, and international oil prices have also soared due to more oil rings.

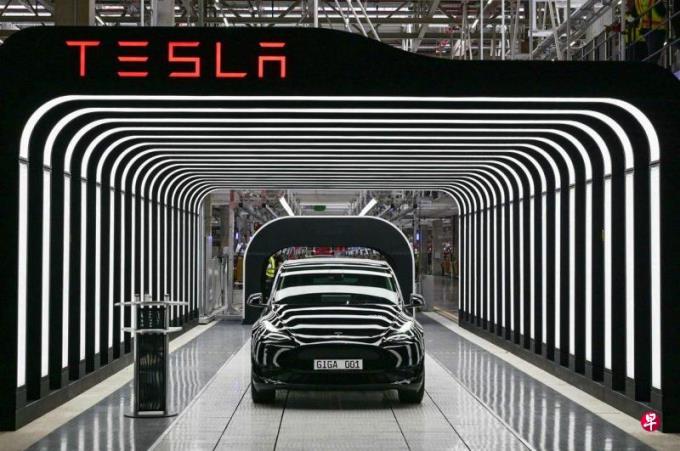

Tesla Thursday (January 11) said in a statement that due to the armed conflict of the Red Sea and the corner of many ships bypassing the southern end of Africa, the sea transportation time was significantly prolonged, resulting in a gap in the supply chain. Tesla was located in the supply chain.Germany's Green Heide factories will suspend most car production from January 29 to February 11.

Green Heid Factory officially started at the end of March 2022. It hired about 1500 employees and produced about 250,000 cars per year.The factory will resume production from February 12.

On Friday (12th), Volvo Motor Company, Geely Holdings, also announced that the company's Belgium Special Factory will suspend production for three days next week due to the delay in the delivery of gearboxes.

This is the first obvious signs of the Yemenhasu Armed Forces in the Red Sea to launch attacks on past ships that affect manufacturing companies.The car supply chain tracking platform warns that other car manufacturers may also experience a shortage of shortage.

In addition, large companies such as the Swedish home company IKEA and the US chain supermarket Target are expected to face the risk of delay in delivery of goods.People in the industry said that if the interference of the Red Sea lasted another two to three weeks, supermarket shelves in April and May this year may have a shortage of product.

Red Sea situation Tightened merchant ship bypass costs one million yuan

The situation of the Red Sea continues to eat tightly. Many merchant ships and cargo ships are safe. They have avoided this waterway connecting the Suez Canal, and the corners of the routes between Eurasia are longer.10,000 US dollars (about 1.33 million yuan).

As the United States and Britain began to combine the Hassy armed target of Yemen, the outside world is now more worried about the expansion of regional conflicts, the global trade will encounter long -term interruption, and the freight rate of oil tankers and bulk ships may soar, increasing a new round of global inflation inflationrisks of.

At present, the container freight of the global major trading routes has risen.Freight analysts said that the longer the Red Sea crisis lasts, the greater the interference caused by global sea transportation, and the related costs will continue to rise.

The situation has become increasingly unstable, and more of the oil shipbuilding has begun to be uneasy, and has chosen to database one after another.Earlier, most of the tankers insisted on sailing according to the original route, and recently at least 17 oil and natural gas transport ships have been returned, and the shipping twists and turns led to the international oil price soared by 4%on Friday.

Before the impact of the United States and Britain, the commodity giant Tocker Group estimated on Thursday that the oil rotation flow through the Red Sea Water was reduced by 15%to 30%.

However, Marcer still concentrated on attacking container ships.