Xia Chun: For most small and medium -sized enterprises in China, compared with institutional factors that are difficult to achieve scientific and technological innovation and difficulty changing institutional factors, they implement high -quality management practice.

50 years ago, on July 20, 1969, Apollo No. 11 carried three American astronauts on the moon, which not only marked the huge breakthrough of humans in space exploration, but also meant that the United States in competing with the former Soviet Union's space competition.Really achieved a complete leading position.In fact, this result is due to the pushes of Sputnik Moment on October 4, 1957.On this day, the former Soviet Union successfully launched the first artificial satellite Sptnik No. 1 to enter the Earth track, shocking the entire United States.Earlier, the United States has always believed that it is a leading position in the field of missiles and aerospace, but both test -fired artificial satellites have failed.In the cold war environment at that time, the technological breakthrough of the former Soviet Union faced the unprecedented challenges of the national security of the United States and its allies.

Since then, the United States has begun to formulate a detailed space exploration plan. In 1958, the National Defense Senior Research Program (DARPA) and the National Aerospace Administration (NASA) were established.After discovering that the scientists trained in the former Soviet Union were their own 2-3 times, the United States invested huge funds in science, technology, engineering and mathematics (STEM) education, research and development, and talent training.The National Science Foundation (NSF) is nearly $ 100 million over the previous year.On April 12, 1961, the former Soviet Union took the lead in sending astronaut Yuri#61598; Gagarin to the earth's track, which once again strongly stimulated the United States.The United States has further strengthened the cultivation of scientific research and talent training. The NSF's budget in 1968 was close to $ 500 million.

In December 1968, the weekly magazine used the US astronaut to catch up with the former Soviet astronauts and flew to the moon as a cover. Finally, the United States ran to the winner in the challenge of the former Soviet Union (the hidden figure of the movie described the three black female mathematicians wonderfullyContribution in it).In July of this year, Times Weekly re -engraved this cover. The astronauts became four, from the United States, Blue Origin Company, and SpaceX (set up by the founders of Amazon and Tesla, Bezos and Musk).And China.

On May 10, 2019, the US Congress increased from 10%to 25%from 10%to 25%to US $ 200 billion. Trump also threatened the tax rate on the remaining $ 300 billion in imports of Chinese imports.On May 15th, the US Department of Commerce announced that Huawei and 70 subsidiaries were included in the entity list equivalent to the blacklist of trade, and it officially took effect 2 days later.According to my observation, the shock of the U.S.'s implementation of the Huawei ban to China has exceeded the pressure of trade frictions that have been upgraded in more than a year.At the time of Huawei, which comes to Barbinik, although the term may appear and circulate after several years.

Even if the United States relaxes or revokes the Huawei ban at some time in the future, Huawei will always promote China's rethinking the road of economic development, strengthening the cultivation of original scientific research and development and talent training, and improving the competitiveness of enterprises and nationals.In fact, challenges and war are exactly the core force of British historian Arnold Bull; Tang Yinby interprets the rise and fall of human civilization.A civilization, if it can successfully deal with challenges, it will be born and growing; on the contrary, it will go to decline and disintegrate.The historical lessons of the American and Soviet competition are not far away. In the past 30 years, China has also successfully responded to a series of external challenges. For example, on May 7, 1999, the time when the Chinese Embassy in Yugoslavia was bombed by the US military.The moment of the South China Sea collision on the 1st is the turning point of the rise of Chinese defense military forces.

The purpose of this article is to provide Chinese companies with a new method of facing the time of facing Huawei and trade friction, which can continue to improve its competitiveness in a relatively short period of time, thereby improving China's national economic strength as a whole (this article does not involve the cure in the short term in the short termNo cure, various policies and measures that have been widely discussed in the market).

The meaning of competitiveness is extensive. Economics usually uses full factor productivity, that is, deducting productivity (referred to as productivity later) beyond the contribution of capital, labor and natural resources to GDP growth. As one of the key indicators to measure corporate and national competitiveness,That is, the contribution of technological innovation and institutional factors (including property rights, taxation, education, rule of law, cultural traditions, ideology, etc.) to GDP growth (limited to space, this article does not discuss how China improves the country's softness on the basis of its strong strength.To meet the challenges, interested readers can refer to the international political scientist Joseph Bull; Nai's discussion about these three concepts).

Failure to develop economics

As we all know, there is a huge productivity gap between the country and the country. For example, the income of a two -week work in an ordinary worker in the United States is equivalent to a one -year income similar to a worker in Tanzania.However, it is surprising that the various prescriptions of developing economics and international institutions represented by the World Bank in the past half century have basically failed to improve the productivity of developing countries.The poor country is still poor. After World War II, it does not fall into the middle income trap.

There are roughly three reasons: First, the suggestions of institutional innovation or imitation copying the developed economy system sounds simple and clear, but in addition to everyone's familiar posterior disadvantage theory, the fact is that the old system that is backward often has a hundred years or even thousands of years.Strong and persistent, it is difficult to transform into advanced new systems.Studies have found that the British and American law systems pay more attention to the protection of enterprises' property rights and encourage competition, making the company's productivity and technological innovation stronger. However, for countries that implement the law of the mainland, this discovery is not helpful.In addition, even under the same system, the productivity gap between enterprises is huge, such as the US, China and India's productivity in the top 10%of the company, which are ranked 3.3, 4.9 and 5.0 times in the last 10%of the enterprises (Xie Changtai, Peter, Peter, PeterKlenow, 2009), where is this gap?

Second, if the gap comes from scientific and technological innovation, narrowing the gap from this perspective is actually a prescription that is easy to do.It requires a series of systems such as huge amounts of funds and a series of systems such as intellectual property rights. Even if these two conditions are available, science and technology research and development and talent training also need up to more than ten or even decades to achieve breakthroughs.This is not only the reason why companies like Huawei in China in China, but also the key to Huawei's always shocking people at all times: the pressure of US high tariffs on China's economic downturn and unemployment rate is still controllable, but the difficulty of dealing with high -tech blockade challenges is even more difficult to change the challenge of high -tech blockade.big.In other words, it is recommended that China ’s many small and medium -sized enterprises use scientific and technological innovation to deal with the pressure and unswerving pressure.

Third, in essence, economists have insufficient understanding of productivity enough. Because the concept of the system is too huge and complex, which specific practice can help companies improve their competitiveness in a relatively short period. Economists have not did not haveFind a convincing answer.For example, economists have been paying attention to the impact of corporate chairman and CEO on business performance for a long time, hoping to find the characteristics of outstanding entrepreneurs, and then find qualified entrepreneurs to enhance the competitiveness of the enterprise.In reality, a large number of enterprises have also taken the practice of frequently replacing high -level managers and hoping to achieve rapid efficacy.However, the result is not ideal. First, the characteristics of outstanding entrepreneurs are difficult to find. It is usually a personal unique factor, so it is difficult to copy. Second, it is difficult for outstanding entrepreneurs to train directly through MBA education.Third, competing for entrepreneurs to increase their salary sharply, but they cannot bring the performance of the same enterprise.Even if entrepreneurs have a little golden technique, their competition for their competition will only cause the transfer of corporate competitiveness and will not improve the overall competitiveness of a country.

Where is China's economic growth?

Before I introduce the new discoveries that can increase corporate productivity in the short term, it is necessary to mention a period of episode.Due to the failure of China's rapid economic growth in the 40 years of reform and opening up, compared with the failure of the development of economics in the same period, some scholars have tried to establish a Chinese school and put the Chinese economy to the Chinese economyThe growth model was promoted to developing countries, but in fact, China's successful institutional background is difficult to copy in other countries.More importantly, there is no so -called miracle in the Chinese economy. High -speed growth mainly depends on the investment of capital, labor and natural resources. China's productivity is not high. Only a quarter of the United States, even weaker than Brazil, Mexico, Syria, Syria, Venezuela, Paraguay, Algeria, Indonesia, Thailand, etc. (Charles Jones, Paul Romer, 2010).

Scholars who praised the Chinese economic miracle seemed to have forgotten a period of past in the economics community: after World War II, East Asian countries experienced 30 years of economic high -speed growth, and the World Bank was in East Asian miracles in 1993.However, at the end of 1994, economist Paul Bull; Cruggman's myth in the Miracle of East Asia in Foreign Affairs Magazine pointed out that East Asia's economic growth mainly depends on large -scale capital accumulation and dense labor to invest in people. There is no real knowledge.Progress and technological innovation lack effective institutional support.This growth model is similar to the former Soviet Union and cannot bring sustainable economic growth.I clearly remembered that the domestic economics community was refuted that year, and it was so lively.However, the outbreak of the East Asian financial crisis in 1997 confirmed that Cruggman was the right party (of course, he acknowledged that he did not foresee the time and process of the financial crisis).

Management practice is a kind of soft technology

Return to the theme of this article. In the short term, it can effectively enhance the new method of corporate productivity. It and the previous article mentioned that the high -quality management functions implemented by entrepreneurs are only two words: high -quality management practice (the management process may be more suitable for domestic context).Please don't laugh at this simple answer. Economists find the process of the answer, just like I deliberately construct the structure of this article, making everyone feel that the process of revealing the secret is very long.Economists are accustomed to paying attention to grand narratives, and topics of corporate management practice. Compared with the system, it is never the focus of economists, leaving it for managers to study.Unfortunately, the Department of Economic and Management is divided into different colleges in most universities, and professors have no exchanges with each other. Managers have almost no attention to the topic of national competitiveness.In addition, the long -term cases and questionnaire survey methods adopted by managers have not been valued by economists who are concerned about big data, because the case has a choice deviation, and the real gap between successful companies and backward enterprises cannot be explained.Affected by various human interference factors.In fact, the Department of Management has never been explained by objective measurement of management practice to explain the gap between the country between the country and the enterprise.

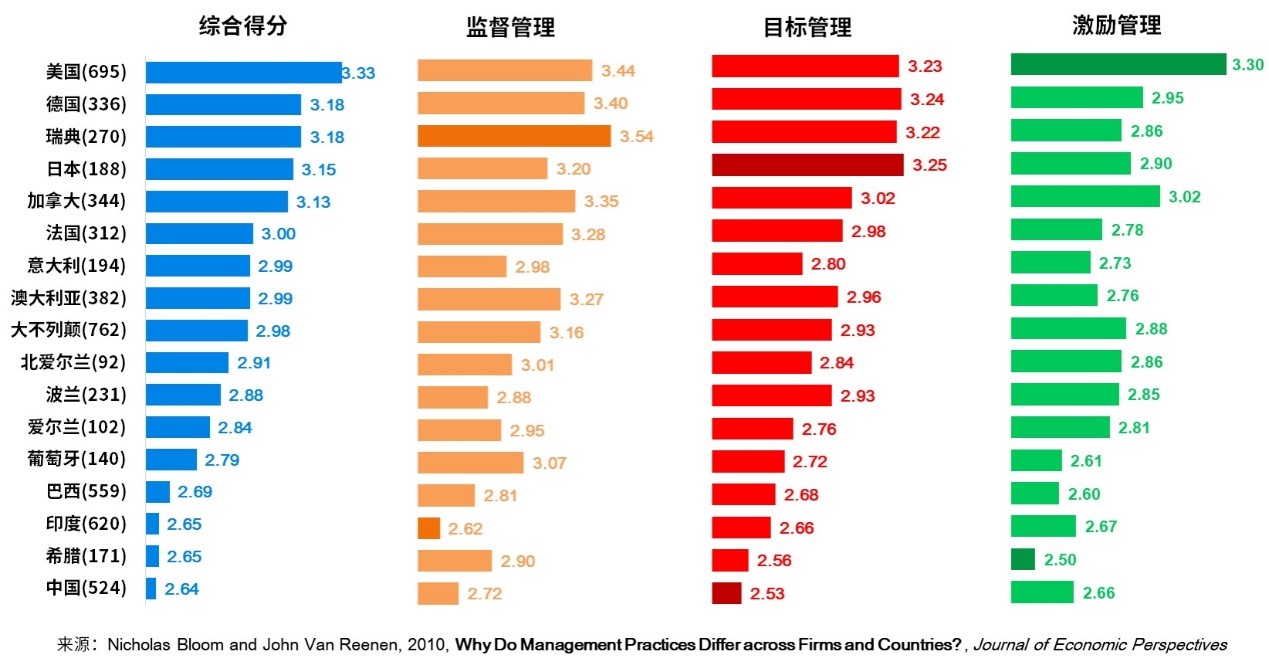

Nicholas Bloom, a professor from the University of Stanford University and has worked in the management consulting company. He and the collaborators adopted a double -blind questionnaire survey method, that is, the interviewed business managers did not know that they were in the questionnaire survey.Enterprises are only medium-sized (the number of employees is between 500-1000) and the popularity is not high. MBA students interviewed do not know that any financial information other than the name of the company will not be preceded to determine the management and practical ability of the interviewed enterprise.The questionnaires they designed are 18 standardized management practices (such as performance tracking, assessment, target management, prize and inferiority, talent attraction, management, promotion and reservation, etc.) of the three categories (such as supervision, goals and incentives).Clear scoring guidelines, from low to high to 5 points and five levels.The average score of each enterprise is a comprehensive score of 18 scores. Based on this, calculate the management practice score of the country where the company is located.The figure below shows the ranking of multinational comparison, and the number of digital representatives on the side of the country or region has been interviewed.

Unfortunately, the comprehensive scores and target management scores of 524 Chinese companies are ranked at the end.If the company shows a comprehensive score distribution according to the regional display, the gap between enterprises and enterprises will be larger. For example, the comprehensive score distribution of 695 companies in the United States is close to the positive state, and the proportion of 1 point and 5 points is close.most.On the contrary, China has hardly found companies with a comprehensive scoring of more than 4 points, and such companies have a certain proportion in Brazil, India, Greece and Portugal (Professor Bloom expanded the investigation companies to 35 regions in 2016, exceeding 11000 more than 11000Home, covering manufacturing, retail and service industries such as schools, hospitals, lawyers and tax firms. The average comprehensive score of 763 Chinese companies is 2.71, ranking 20th, surpassing Brazil, India, but still behind Greece in GreeceAnd Portugal).

Interestingly, the self -evaluation score of the CEO of the enterprise has reduced the comprehensive score of the company's self -assessment score. The highest average score is the last five in the figure above, and the lowest score is the United States.It can be seen that the CEO with poor corporate management performance is the best and most confident.

Compared with China's economic growth, the results of low scores of Chinese corporate management practice are surprising, but it is not so surprising to think about it.Popular saying Western companies rely on institutional management, and Chinese enterprises' management rely on people's management to emphasize the lack of Chinese enterprises in the management system.Compared with the 996 working hours of US companies, France ’s weekly work system, France’ s shorter working hours every week, the 996 working system that caused widespread disputes in China at the beginning of the year is also the low efficiency of Chinese enterprises in the management process (correspondingly, accordingly, correspondingly, accordinglyThe differences between management practice scores and per capita GDP are the same).In the past, when China's economy was growing at a high speed, enterprises did not pay enough attention to refined management, and even laughed at the investment of foreign enterprises in this regard. However, in the face of economic downward pressure, the gap between Chinese and foreign companies in management practice suddenly prominent, relying on institutional managementForeign -funded enterprises can layoffs to increase efficiency, while Chinese -funded companies are not easy to get the result of increasing efficiency.

After investigating financial data such as comprehensive scores, productivity, profit, sales growth rates such as productivity, profit, and sales growth in each region, they will find that there is a clear and statistical linear relationship between each other.In other words, instead of timely effort and effectiveness, the system imitates and translates from the national macro level to enhance the competitiveness of enterprises and the country.The limited number of homes.Of course, consistent with intuition is that education, competition, labor market systems, corporate shareholders structure, etc. will affect the management scores of the enterprise, such as the government, family -controlled enterprises with low scores, high multinational companies' scores;The company's score is higher than the company's concentration.

More importantly, Professor Bloom's research shows that adopting excellent management practice, enterprises can achieve significant results in the short term.For example, the experimental results adopted in Indian textile companies showed that companies that adopted 5 months of standardized management practice improved by 17%compared to the productivity of similar companies in one year, and the profit was 300,000 US dollars (theseThe average annual sales of the enterprise are $ 7.45 million).Even if enterprises need to pay a certain amount of fees for learning and implementing advanced management practice, one -time investment can be exchanged for long -term performance improvement, which is obviously worth it.

Stick up, to be stable and far away

The analogy mentioned the division of national hard power and soft power. If scientific and technological innovation is a hard technology that enhances corporate competitiveness, then corporate management practice is a soft technology that achieves this goal.Professor Bloom found that the difference in productivity between the country and the country, on average, 30%came from the gap between corporate management practice, and even more than 50%of the contribution in some countries.What I must emphasize is that Professor Bloom's series of studies on management practice not only caused the gap between economics and management to be broken, but also helping to help developing countries enhance competitiveness.One of the most important achievements of annual economic research is that in the environment of economic research increasingly difficult to achieve new breakthroughs, his achievements with collaborators are particularly admirable.

For most small and medium -sized enterprises in China, compared with the difficulty of scientific and technological innovation and institutional factors that are difficult to change, the implementation of high -quality management practices is easy to do.Despite economic downturnEnterprise management brings pressure, but this is also a good time to reform and adjust.Only when Chinese companies have experienced, can they usher in the moment of life and can truly achieve stability.

Looking at the history, on the 100th anniversary of the establishment of the Wall Street Journal, experts have invited experts to predict the best and worst countries in the next 25 years.It is China.By 2014, the Wall Street Journal had to admit that the expert's prediction was wrong.

When facing Sino -US trade frictions and Huawei moment, the market's emotions are pessimistic.I want to share this predicted story with entrepreneurs, and at the same time remind everyone that even after the United States, it took 12 years to catch up with the former Soviet Union after facing Sptnic.If we can face challenges with a long -term perspective, the difficulties will gradually resolve.The way of governing the Chinese economy is to abandon the institutional factors that hinder economic growth, actively cooperate with countries around the world to work in all aspects, to release the vitality of the private economy as the fundamental, and promote high -quality development into the direction of technological innovation.On the road to achieve these long -term goals, Chinese companies must learn and implement high -quality management practice, and cleverly combine hard technologies and soft technologies. Only the competitiveness of enterprises and the country can be truly strong and achieve the road of sustainable development.

(The author is chief researcher at Naoya Holding Group. This article only represents the author's point of view. Responsible editor email: [email protected])