Zhou Maohua: At the time of the Sino -US trade friction, China has continued to reduce its holdings of US debt in recent months, but this is a market behavior, and the diversification of China's foreign reserve structure will be a trend.

According to recent data from the U.S. Treasury, China has reduced its holdings of US $ 7.5 billion in US bonds in April, with a total positioning of its positions fell to 1113 trillion US dollars, a new low since May 2017.There is a voice that China has continuously reduced its holdings of US bonds in recent months and Sino -US economic and trade frictions.The article believes that China ’s reduction of US debt is a market behavior; in the long run, the diversification of the US bonding of US debt and the diversification of foreign reserve structures will be a trend.

China ’s market behavior of reducing U.S. Treasury Treasury

Since the beginning of the year, European and American economic data has been weak, Trump has upgraded trade disputes and geopolitical risks, the global economic prospects are dimly promoted to the U.S. debt avoidance buying need, and the yield of 10 -year Treasury bonds in the United States has fallen to nearly 2.0%, falling belowThe federal fund interest rate is 2.25%to 2.50%of the lower limit. Such a low rate of return really reduces the attraction of US debt allocation. This explains why overseas investors have reduced US debt in April.

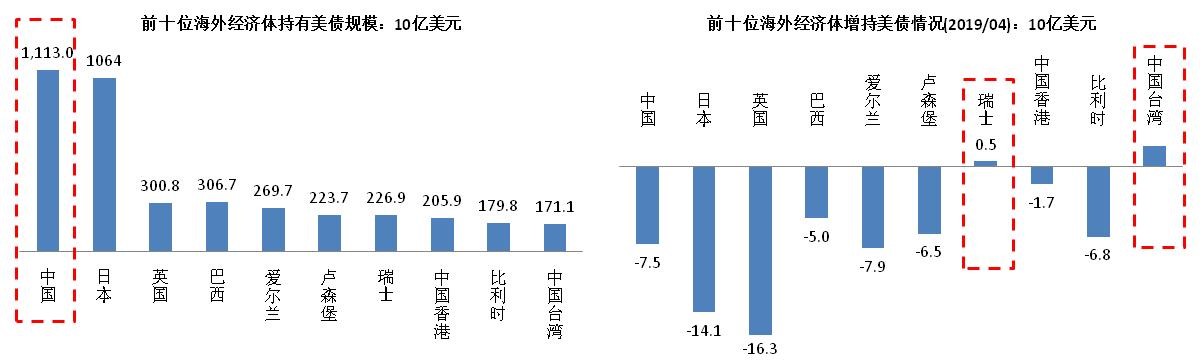

Data show that in April, among the top ten overseas economies in U.S. Treasury (U.S. Treasury), except for Switzerland and Taiwan, Japan, the United Kingdom, Australia, Italy and other economies have reduced their holdings of US debt to varying degrees.Among them, the scale of Britain and Japan reduced their holdings reached 16.3 billion US dollars and $ 14.1 billion, respectively. Since 2017, China's holdings have increased and decreased, and monthly data of other countries has fluctuated more.From the perspective of stock, China currently holds 111.3 trillion US dollars in US debt, ranking first in the world; from the perspective of traffic, from January to April 2019, China reduced its holdings of US $ 10.6 billion in US $ 0.95%of the stock.China's timely adjusting the asset portfolio according to the market trend is a normal market behavior, and several months of data fluctuations show any problems.

Why does China hold such a huge US debt?

This problem is related to the Sino -US economic development model and the international monetary system led by the US dollar.

First, the economic development model of China and the United States is determined.Since the 1990s, China has entered an industrialized country, with a high savings rate and high investment rate of economic models. The economy has rely on export dependence and trade is over. After the United States enters the stage of industrialization, high consumption and low savings will inevitably lead to frequent project deficit deficit.In order to balance international revenue and expenditure, US capital projects have maintained a surplus.It can be understood that China produces and exports goods to the United States to obtain US dollar foreign exchange, and then borrows US dollar funds to the US government, enterprises and consumers by purchasing assets such as US Treasury bonds and stocks.Data show that from 2000 to 2018, China's trade surplus to the United States increased by 10 times, from US $ 29.78 billion to US $ 322.45 billion in 2018. In addition to the trade surplus, China's high economic growth and factor advantages, the continuous appreciation of the RMB against the US dollar is also attracted to attractThe important reasons for foreign capital inflows, the scale of Chinese foreign exchange reserves rose from 16.557 billion US dollars to $ 4 trillion in 2000.

Secondly, the US dollar dominates the international monetary system.According to IMF statistics, the Global Central Bank's foreign exchange reserves in 2018 accounted for more than 60 % of the US dollar; more than 70 % of international trade was settled in the US dollar; according to statistics from the Global Bank of Financial Telecommunications (SWIFT)It accounted for 40.08%, far exceeding the pound (7.07%), the yen (3.3%) and RMB (2.15%). The US dollar occupied the dominant position in the global currency system.As China's third largest trading partner, the scale of Sino -US trade has risen from US $ 74.51 billion in 2000 to US $ 635.18 billion in 2018. China holds US dollars and its assets to facilitate bilateral economic and trade exchanges.And under the US dollar leading the international currency system, the use of economic exchanges between China and other countries to settle in US dollars will help improve trade efficiency, reduce the risk of exchange rate fluctuations to a certain extent, and facilitate trade.

China sells US debt more than profit

First of all, the US economic recession will also drag the world.If China sells U.S. bonds and has caused other economies to follow up, US debt yields have soared, which will inevitably suppress US investment and consumption.The recession will in turn affect the global consumption demand. Sino -US economy and trade are highly integrated. China is difficult to take it alone. After all, cooperation between Sino -US cooperation is still a general trend.

Secondly, the global financial market may fall into confusion.Because the US dollar and U.S. bonds still play an important role in the price of global financial assets, investment and financing, the U.S. debt market collapses, and the pricing of global financial assets may fall into chaos for a period of time, which may cause a global financial crisis in severe cases.

Third, Chinese foreign exchange reserve assets have shrunk.As of April 2019, China holds 1113 trillion US dollars of government bonds, accounting for about 36%of China's foreign exchange reserves assets, and US debt prices have plummeted, which will inevitably cause the overall market value of China's reserve assets to shrink.And compared to other assets, the liquidity of the US debt market is better as a whole. In China, China holds a certain amount of US debt. Under the impact of the short -term foreign exchange market fluctuations, the advantages of relatively high liquidity of US debt assets will be reflected.Holding a certain amount of US bonds can help respond to exchange rate risks or some external shocks.

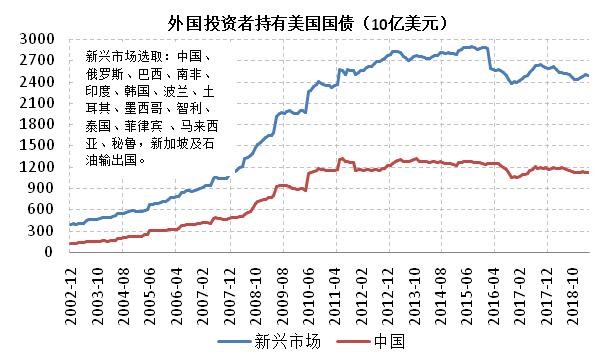

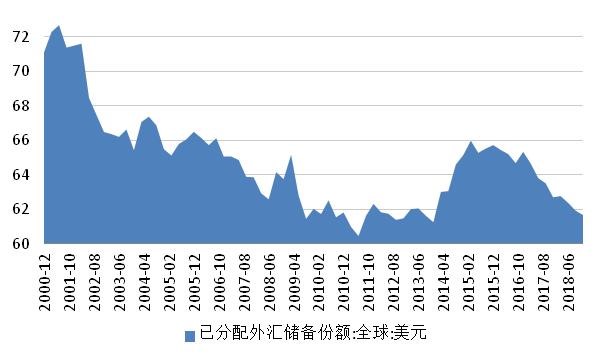

EMDE (EMDE) holds US bonds to decrease marginalized

Data show that in the past five years, emerging markets and developing countries hold the scale of US bonds to decrease. According to IMF data, the US dollar in foreign exchange reserves from global central banks has decreased from a high level in September 2000 to 61.7 currently 61.7%.The article believes that behind this reflects the changes in emerging markets and even the global economic pattern and the gradual reduction of single dollar dependence on emerging markets.

First, changes in emerging market economic structure.Since 2000, economic and trade interconnection between emerging markets has been significantly strengthened, demand potential has been released, economic resistance has increased external impact capabilities, and the degree of dependence on the US dollar has decreased.Data show that emerging market GDP accounted for global proportion of global proportion from 20.3%in 2000 to 39.7%in 2018. Based on the purchasing power level, emerging markets contributed about 56%to global economic growth. HoweverIt is still facing strong influence of American policy overflow. Some of them are vulnerable and are prone to suffering from the so -called US dollar curse and policy. Some emerging markets due to the imbalance of internal economic structures, the Fed's loose promotion to the inflow of US dollar capital into these economies, giving birth to assets and debt bubbles. Once the US dollar enters Canada CanadaThe interest cycle is prone to capital escape and currency depreciation. It is seriously susceptible to crisis. For example, since last year, Argentina and Turkey have been in a currency crisis. In order to avoid currency devaluation and capital escape from capital, the central bank often chooses to raise interest rates.Rating interest rates can easily drag domestic economic growth.

Secondly, US debt security assets are facing tests.US government debt sustainability deterioration and low yields weaken the attraction of US debt.Data show that as of May 2019, the US federal government debt has exceeded $ 2.2 trillion, accounting for about 105%of GDP. In the past 10 years, US government debt has doubled, and as the fiscal deficit expands, US government debt will still be rapidRising, according to the U.S. Congress Budget Office estimates, the US fiscal deficit was US $ 897 billion in 2019. By 2022, the US deficit will continue to expand to $ 1 trillion.New incremental and high -welfare expenditures are superimposed.In the future, the cycle of US debt is bound to be based on loose monetary policy and low interest rate environment.In addition, in recent years, the US dollar has frequently became the White House's sanction of other countries and the impact of the Fed's independence, which will weaken global credit.

Data source: Wind, China Everbright Bank Financial Marketing Department.

Data source: Wind, China Everbright Bank Financial Marketing Department.

What changes will China face

The article believes that with the changes in China's economic structure, China's holding of US bonds will also show a decreasing trend, and foreign exchange reserves will show a diversified trend.

First of all, China's often narrowed.With the transformation and upgrading of China's economic structure, domestic demand has become the first engine of the economy. China's frequent project surplus has continued to narrow. In the first quarter of 2019, China's frequent project surplus accounted for only 0.3%.With the continuous rise in China's per capita GDP, urbanization has continued to advance, the middle class teams have continued to grow, and consumption upgrades have accelerated. China is expected to become the world's largest consumer market. There is still a huge space for imports. China will gradually enter the global era and sell global era. ChinaThe continuous narrowing of the current project deficit will reduce the need to buy US debt.

Secondly, the global trade pattern is changing.In the past ten years, the potential for domestic demand in emerging markets in China has been continuously released, and the growth of traditional European and American market demand is weak, which will trigger the global trade focus transfer. Data show that the total retail sales of Chinese social consumer goods in 2018 is 5.76 trillion US dollars, close to 60,300 in the United States100 million US dollars, China has 14 population and about 400 million middle class. The potential for the development of China's consumer market has developed a huge potential. In the past five years, China has developed rapidly with related countries along the ASEAN and the Belt and Road.Dependence on the US market will promote foreign exchange reserves to gradually diversify.

Third, strengthen the independence of Chinese monetary policy.In 2018, the currency crisis broke out in Argentina and Turkey. The reason is that some of the internal economy and financial structure of some vulnerable economies are imbalanced, and excessive relying on exogenous financing such as the US dollar.Foreign shocks and internal economic goals are difficult.By optimizing the structure of foreign exchange reserves and reducing excessive dependence on a single currency by optimizing the structure of foreign exchange reserves, it will help enhance the independence of monetary policy, and diversified foreign exchange reserves will also help reduce the value of combined assets affected by the US economic fluctuations.

Fourth, the internationalization of the RMB will weaken the demand for the US dollar assets.From the middle and long term, with the continuous progress of China's supply -side structural reform, the potential of economic and market potential has been continuously released, and the economic structure tends to be balanced; China's financial reform and opening up is promoted, the Chinese capital market will be deeply integrated into the global system, and the RMB assets will become;China's foreign economy is more diversified, and the pace of internationalization of the RMB will accelerate. In turn, it will further reduce China's asset dependence on the US dollar.

It is worth noting that with the opening of the Chinese financial market and capital projects, the scale and frequency of short -term international capital flows will increase. How to guide the situation and digest this short -term international capital flow shock?In the future, China will work at least in four aspects. One is to comply with China's economic development law, promote China's economic supply -side reform, and promote a more balanced economic structure. The fundamental fundamentals are the stable anchor of the financial market; the second is to steadily promote the reform and opening up of the financial market.Qi financial supervision shortcomings and improvement of financial infrastructure, a financial market with toughness and compatible with the development of the real economy, will become a shock absorber that should be responded to foreign shocks; third, accelerate the reform and internationalization of RMB marketization.Generally speaking, with the continuous improvement of the reform of the market -oriented mechanism of a country, the role of elastic exchange rate in regulating international revenue and expenditure will be strengthened.Fluctuations will still impact the country's liquidity, the exchange rate, and interest rates of the local currency; fourth, China should control the scale of foreign debt and optimize the structure of foreign debt.Learn from the lessons of previous emerging markets (EMDE). Especially in the loose environment of Europe and the United States, the scale of foreign debt should be moderate, and the short and medium -to -long -term foreign debt must be matched with the solvency.

(The author is a macro analyst at the Financial Market Department of China Everbright Bank. This article only represents the author's point of view. Editor -in -chief email: [email protected])