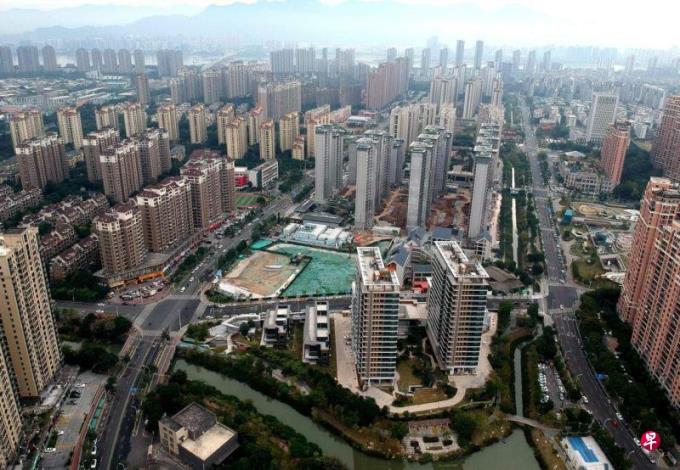

UBS Investment Bank Asian Economic Research Director and Chief Chinese Economist Wang Tao warned that real estate is still the biggest risk of China's economy this year. It is necessary for the government to provide more liquidity support for real estate companies, stabilize the property market and stabilize the property market and the market.Economic market.

Wang Tao predicts at the UBS China China Seminar on Tuesday (January 9) that the decline in China's property market this year has slowed down from last year, but the policy support may exacerbate the decline in the property market and further drag the economic recovery.

UBS predicts that China's economy will grow 4.4%this year, less than 5.2%lower than 2023.The real estate dragging effect on the economy gradually weakened after reaching its peak in 2022, and it is expected to be further reduced this year.Real estate investment and sales decreased by 5 % compared with last year, and the new construction area slipped by 10 % year -on -year. Real estate dragging down China's GDP (GDP) narrowed to 1 to 1.5 percentage points. In the second half of the year, the property market was expected to stabilize rebound.

Wang Tao pointed out that under the above benchmark hypothesis, real estate prices may decline slightly, and residents' confidence is still weak, but there will be no further significant decline."If the real estate is stable and the downlink is more, it may cause more deeper adjustment of house prices, and the confidence of residents will further fall, which is very unfavorable to the stability of the economy.

Affected by factors such as the continuous downturn of new construction and cautious land in housing companies, China's real estate development investment fell by 9.4 % year -on -year in the first 11 months of last year.Real Estate Research Institution, Ke Rui estimated that the annual real estate development investment decreased by 9.5 % year -on -year, and the investment scale fell to the level of 2018.Investment banks and securities firms generally expect that the Chinese property market this year will usher in unprecedented shrinking for the third consecutive year.

According to the worst situation predicted by UBS, if the market is fragile, high inventory and policy support, the new decline in real estate will reach 15 % to 20 % this year, and the decline in real estate investment and sales will also exceed 10 %.Drag the economic growth rate this year to below 3 %.

Wang Tao believes that the official toolbox has policies that can be used to boost the property market, such as further relaxation of purchasing measures for first -tier cities, reducing the proportion of down payment and mortgage interest rates, and increasing the construction of affordable housing and the transformation of villages in the city.In addition, the current commercial banks are still very cautious to lend loans for real estate companies. The liquidity of developers is close to depletion. The government should give more liquidity support. "This is not to save them, but to maintain real estate and overall economic stability."

One of the negative impacts of the downward settlement of the property market is that the local finances that are already nervous are even more stretched.Wang Tao pointed out that due to the reduction in land sales revenue, in order not to pay off the contract, the local government cut a large number of general expenditures last year, resulting in the difficulty of implementing fiscal policies formulated by the central government and hindering the process of economic recovery."We judge that the finances of the first seven or eight months before last year are all tight."

Looking forward to this year, UBS is expected to have more policy space in terms of finance, and it is expected that the fiscal deficit throughout the year is 3.5%to 3.8%.In terms of monetary policy, Wang Tao expects that the People's Bank of China will further cut interest rates at 10 basis points before the Lunar New Year, or 10 basis points at each interest rate reduction before and after the Lunar New Year.She suggested that the central bank reduced interest rates at the beginning of the year.

The Chinese official media Xinhua News Agency (January 8) quoted Zou Lan, director of the Bank of China Monetary Policy, said that The central bank will comprehensively use basic currency offices such as open market operations, interim borrowing convenience, re -loan retreat, reserve and other basic currencies to provide strong support for the rational growth of social financing and the rational growth of monetary credit.This indicates that the central bank may stimulate credit by reducing the deposit reserve rate.