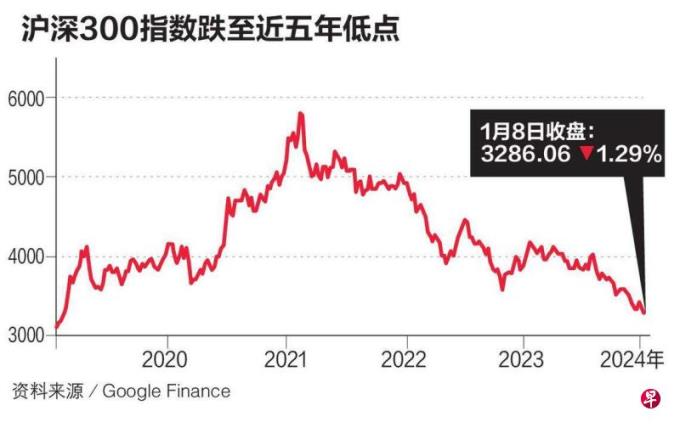

The Chinese stock market has accelerated its decline in the beginning of the year. The CSI 300 index has slipped to a low point on Monday for nearly five years, making investors looking forward to the rise of A shares in the new year.

The three major indexes of A -share were collectively lowered on Monday (January 8), and the whole day fell more than 1 %.Among them, the Shanghai Stock Exchange Index slipped 1.42%, and once again lost the 2900 -point mark, falling to a new low since April 2022; the Shenzhen Stock Exchange Index closed at 1.85%, and the GEM index fell 1.76%.

The CSI 300 Index, which is regarded as the representative of A -share blue chip stocks, closed at 1.29 % to 3286.06 points on Monday, which recorded the lowest level since February 2019.After three consecutive years of losses, the CSI still fell endlessly after the beginning of the year and Shenzhen, and the cumulative decline has exceeded 4 %.

On the opening of the stock market this week, the financial and geopolitical risk factors facing China are continuously fermented.China Shadow Banking Giants applying for bankruptcy and liquidation last week aroused investors' concerns about the property market's financial system.The Ministry of Commerce of China launched an anti -dumping survey on Bailan Dadi, which was native to the European Union last Friday (5th). The Chinese Ministry of Foreign Affairs announced on Sunday (7th) that it sanctioned five US military companies to counter the sale of military background in Taiwan.

At the same time, it is reported that the regulatory authorities have terminated the net stock restrictions on public funds issued a few months ago, which also impacts market sentiment.Li Bei, a well -known fund manager in China and the founder of Shanghai Banxia Investment, pointed out in the latest investment monthly report that the new regulations have led to the play between public funds and selling first, which has caused a market plunge, especially the fierce falling stocks of the fund.

However, UBS analysts (UBS) analysts are still optimistic about the Chinese stock market to bottom out this year, referring to the "worst time in time of A shares."

UBS Securities China stock strategy analyst Meng Lei pointed out at the UBS China Symposium on Monday that macro indicators such as industrial enterprises' profits, as well as assets such as goods and bonds reflect the stable situation of China's economy.Stocks are still confident.This may be due to the performance of consumption and new energy sectors purchased by institutional investors in the past two years, the consumption and new energy sectors such as "holding the group" have not performed well, impacting the confidence of the institution and forming a vicious circle, resulting in the "year of the institutional bear".

From the analysis of past experience, institutional investors have taken more than two years from high to low, and the peak period of the last "holding group" dates back to mid -2021.Based on this, this round of "holding a group" cycle is expected to end this year.

With the improvement of corporate profitability, the continuous efforts of macro policies, and the gradual stability of the property market, Meng Lei expects that the negative cycle of investors' views on A shares will be broken, driving the market to bottom out.According to UBS forecast, the MSCI China Index's profit has 10%of the upward space this year.

Lian Peihuan, director of the Greater China Research Department, attending the same forum, is optimistic that Hong Kong stocks will win A shares this year.He pointed out that the current selling tide since the second quarter of last year, the position of foreign investment in Hong Kong stocks is already very low; the US interest rate cuts will also promote some funds to flow into emerging markets, and Hong Kong stocks as the offshore market will be the first wave of benefits.

In addition, a number of Chinese leading Internet companies are listed in Hong Kong, making the Internet a heavy warehouse section of Hong Kong stocks.UBS predicts that 23 % of the profitability of the Internet sector per share will increase, higher than 10 % of the MSCI index.

The Hong Kong Hang Seng Index fell 1.88 % to 16224.45 points on Monday, and the cumulative decline in the beginning of the year reached 5.31 %.