< /P>

< /P>

The reorganization of Ziguang Group has just been settled, and the news of the former chairman Zhao Weiguo was taken away by the investigation.

Caixin.com quoted sources reported that Zhao Weiguo was taken away from Beijing's home in mid -July and is still in a state of loss.Different sources revealed that there are interest transmission between Zhao Weiguo's control of the company controlled by Zhao Weiguo and Ziguang. For example, there are problems such as equipment procurement and decoration projects that have not been bidded by public bidding. This may be why Zhao Weiguo was investigated.

figcaption> Ziguang Group's reorganization has just settledIt was reported that the former chairman was checked.(Internet)

figcaption> Ziguang Group's reorganization has just settledIt was reported that the former chairman was checked.(Internet) The entanglement between the former and the current chairman

The undergraduate and master's degree from Zhao Weiguo have been studying in the Department of Electronic Engineering of Tsinghua University.The acquisition made Ziguang into a giant semiconductor aircraft carrier, and the size of Ziguang's assets soared from 1.3 billion yuan (RMB, the same below, 267 million yuan) all the way to the peak of 297.8 billion yuan.However, the expansion of the "snake swallow" also made Ziguang carrying huge debt, and eventually declared bankruptcy reorganization in July 2021.

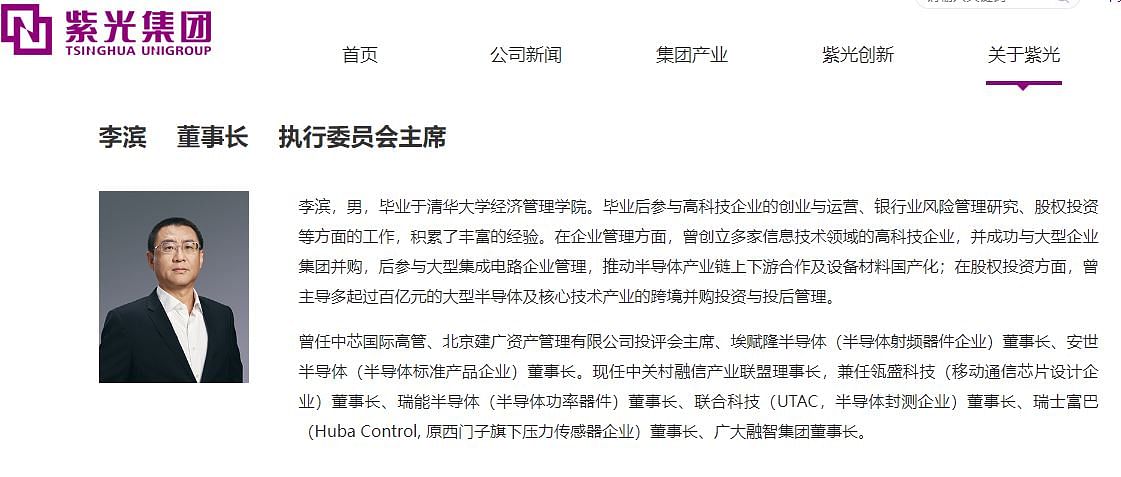

The current chairman of Ziguang is Li Bin, who graduated from the School of Economics Management of Tsinghua University.key people.After Ziguang Group entered the judicial reorganization procedure, Beijing Jianguang Assets and Zhilu Capital Consortium became a strategic investor for bankruptcy and reorganization.Li Bin is not only the actual controller of Zhilu Capital, but also a major shareholder of Jianguang Assets.

Tianyancha shows that after the penetration of Jianguang Assets, the major shareholders were the China -State Council, and the investors were the State Council of China, while Li Bin indirectly held 29.83%of Jianguang assets.

Although Li Bin and Zhao Weiguo are both alumni of Tsinghua, they are quite conflict on the reorganization of Ziguang Group.

Zhao Weiguo has always hoped that the government has been involved in the saving cash flow and corporate credit, which is endangered by the collapse, and tried to maintain the status and rights of personality in purple light.But in fact, after Ziguang was taken over, he was quickly overhead.In December 2021, the bankruptcy reorganization plan of Ziguang Group was released, showing that the fair price of Ziguang Group's assets was 121.478 billion yuan, and the matching was about 137.609 billion yuan in debt, and the debt was 16.131 billion yuan.

Zhao Weiguo was very dissatisfied with the reorganization plan, questioned publicly, and reported to the managers of Ziguang Group with a real name of the Discipline Inspection Group of the Central Commission for Discipline Inspection and the Discipline Inspection Team of the State Council.

Zhao Weiguo said in the letter that the draft reorganization has underestimated Ziguang's assets, causing 73.419 billion yuan of state -owned assets to lose.For example, the 25.91%of the Yangtze River storage shares held by Ziguang should be 41.456 billion, while the reorganization draft evaluation is only 12.4 billion yuan.

Zhao Weiguo named Li Bin in the statement: "73.419 billion state -owned assets, most of them will fall into Li Bin and others' private pockets.>

Zhao Weiguo is still dissatisfied with the reorganization procedure to exclude himself: "Such a big reorganization, as the main person in charge of Ziguang, was blocked and let me out.", Also allowed Tsinghua and Jiankun to leave the price, and even some soup water and bone scum will not be left. "

The manager of Ziguang Group stated that Zhao Weiguo scattered unrealistic information and attempted to interfere with the reorganization work.Measures are investigated for the legal responsibility of individuals and units.The manager also said that Ziguang was a non -debt on Zhao Weiguo's operation, causing losses.

In January 2022, the Beijing Intermediate People's Court ruled to approve the reorganization plan of Ziguang and declared Zhao Weiguo's defeat.

After half a year, Ziguang Group had just completed the reorganization, and the news of Zhao Weiguo's arrest followed.Ziguang's industrial and commercial change registration procedures were completed on July 11, and the original shareholders all withdrew, including Beijing Jiankun Investment Group, which was actually controlled by Zhao Weiguo.According to Caixin, Zhao Weiguo was arrested in mid -July, only about a week.

Zhao Weiguo's merit and skills

Zhao Weiguo is 54 years old. After graduating from college, he has contracted the business of the Cement Plant in Haidian District, Beijing, and has accumulated entrepreneurial experience.During his studies, Zhao Weiguo worked part -time in Ziguang Group and three years after graduation of the master's degree. In 1998, he served as the general manager of Tongfang Electronics and founded Jiankun Investment Group.

Ziguang Group had difficulty in operating in 2009. Zhao Weiguo obtained its operating rights with the support of Tsinghua University. From 2010 to 2013, he passed Jiankun Investment to obtain 49%of Ziguang's equity and served as chairman of Ziguang Group.The other 51%shareholders of Ziguang are Tsinghua Holdings, but Tsinghua Holdings does not participate in operation.

After taking the power of Ziguang Group, Zhao Weiguo made Ziguang into a giant semiconductor aircraft carrier through mergers and acquisitions.In 2009, Ziguang's asset scale was only about 1.3 billion yuan, and by the end of 2019, the asset scale reached the peak of 297.8 billion yuan.Essence

Ziguang Group acquired boiler communications for $ 1.78 billion (S $ 2.47 billion) in 2013, the latter is the largest independent mobile phone chip developer in mainland China.In 2014, Ziguang Group acquired Rydiko with $ 907 million, and finally integrated into Ziguang Zhanrui. The share of independent mobile phone chip manufacturers is second only to Qualcomm and Taiwan MediaTek.

Zhao Weiguo took the shot again in 2015. At the price of not less than 2.3 billion US dollars, the 51%equity of Huasan Tongxin Council was acquired from HP.ICT) one of the suppliers of solutions.In 2018, Ziguang Group established Ziguang Cloud, thus forming a complete layout from core to cloud.

Ziguang Group's acquisition is Wuhan Xinxin, and the Yangtze River storage is established on the basis of Wuhan Xinxin. Today is one of the most potential memory manufacturers in China.

Zhao Weiguo's successful mergers and acquisitions have basically ended.Although he has threatened to acquire companies such as Taiwan ’s technology giant TSMC, American chip giant Micron, and memory giants in Western data, it has been caught because of multiple obstacles.

Zhao Weiguo has proposed that Ziguang Group will take national strategies as the direction, international mergers and acquisitions as the path, capital operation as a means, and industrial integration as the purpose, with fast card positions as a breakthrough, thus super routine, super largeThe scale of the scale forms industrial clusters.

From the perspective of Ziguang's industrial group, Zhao Weiguo's merger acquisition has indeed achieved a certain purpose.

But the good times did not last long. In 2018, Tsinghua University decided to promote the reform of school -enterprise and plan to transfer the controlling stake in Ziguang Group.Ziguang Group, who lost Tsinghua University's "endorsement", could not continue to issue debt in the market after March 2019, which became the first "Domino card" to overthrow the excessive expansion model of Ziguang.

How big is Ziguang's debt?According to the previous information disclosed by Ziguang Group, as of the end of 2017, the end of 2018, the end of 2019, and 2020In the first half of the year, Ziguang Group's consolidated asset -liability ratio of 62.09%, 73.42%, 73.46%, and 68.41%, which were amazingly amazing.

In 2018 on the eve of the debt crisis exposed, Zhao Weiguo mentioned that "should be carefully managed to manage his ambitions and luck", but he was unable to stop the side effects brought by radical capital operations.In November 2020, the bond defaults in Ziguang Group had detonated the debt crisis.On July 16, 2021, under the application of creditors, Ziguang Group announced that it entered the bankruptcy reorganization process.

Now, the new Ziguang has been on the road.The past bankruptcy experience has proven that the strategy of relying on the "curve overtaking" of the capital is not good. It is the right track to accumulate technical strength. After all, capital mergers and acquisitions are just means, and the technology industry is the fundamental.