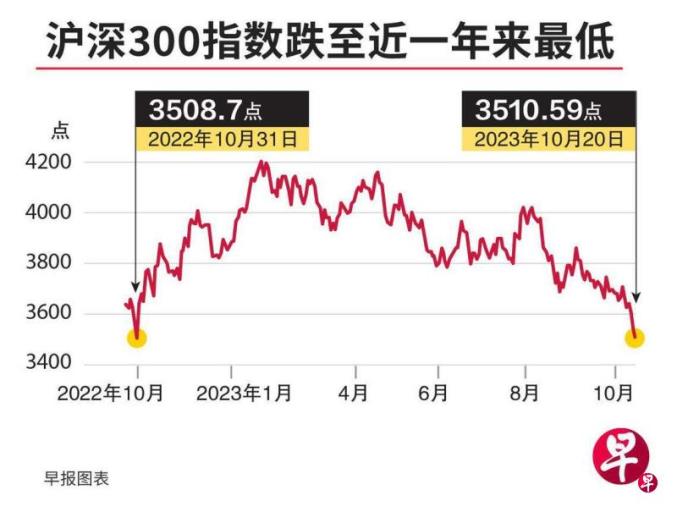

China's A -share shares fell to a new low in the past year, Pan Gongsheng, president of the People's Bank of China Pan Gongsheng, emphasized that the policy of promoting active capital markets and boosting investors' confidence will be implemented in a timely manner, and measures are taken in time in accordance with the market situation to prevent the stock market bond market exchange market.Risk infection.

The press release released by the China People's Congress on Saturday (October 21) shows that Pan Gongsheng reported on the financial work of the fourth quarter of 2022 at the meeting of the Standing Committee of the National People's Congress held on the same day, and introduced it from six aspects.Consider work in one step.

Pan Gongsheng pointed out that one of the focus of the central bank's next stage is to focus on maintaining the steady operation of the financial market.This includes the implementation of policies and measures that further promote the active capital market and boost investor confidence.

In addition, financial regulatory agencies must also securely resolve the risk of liquidation of large -scale real estate corporate bonds, strengthen the risk monitoring and prevention and prevention of urban investment bonds, maintain the basic stability of the RMB exchange rate at a reasonable and balanced level, prevent the risk of abnormal fluctuations in cross -border funds, maintain maintenance, maintain maintenanceThe foreign exchange market runs steadily.

Pan Gongsheng said that it is necessary to guide the stable financial market behavior and expectations, take measures in time according to the market situation, prevent risk infection in the stock market, bond market, and foreign exchange market, and ensure the steady operation of the financial market.

Although the Shanghai and Shenzhen 300 Index has fallen nearly 10 % this year, Morgan Stanley still suggested that investors should not buy it at everyday, because the market sentiment is still fragile, and foreign capital may continue to flow out in the short term. China's decision -making level recently introduced a series of measures to stabilize market emotions and boost confidence, including purchasing four large banks stocks from the China Sovereign Fund Fund, repurchase and additional shareholding shares of central enterprises, and restrictions on short -selling activities.wait.The central bank had just injected 289 billion yuan (S $ 54.8 billion) funds to the market last week to pass the mid -term lending convenience (MLF).However, none of the above measures have not reversed the stock market. Xie Dongming, director of the Research Department of the Greater China District of Overseas Chinese, accepted an analysis of the United Morning Post interview. Compared with the fundamental bond market, the stock market and the foreign exchange market are more vulnerable to emotional affected.Although the recent favorable policies have come out and the economic data has also recovered, A> is still an important factor in dragging on market confidence, and the increase in external risk factors, it is estimated that the risk of the stock market is the next central bank's focus on the target of the central bank. Xie Dongming pointed out that the central bank has stabilized the RMB exchange rate by regulating the spread of China and the United States; in terms of the stock market, unless the Central Bank of China decides to rescue the market by buying a large number of stock listing funds (ETF) like the Bank of Japan, it is difficult to completely control the market."What the central bank can do is to hold the bottom line, such as ensuring stable exchange rates, stable liquidity, and legal compliance with capital flow; the rest is to give the market more time and wait for confidence to recover." In response to the risk of the property market and local debt, Pan Gongsheng requested to guide the accurate implementation of differentiated housing credit policies in various places, increase the financial support for the preservation of property.He also demanded the implementation of policies and measures to prevent and resolve the debt risk of financing platforms, and guide financial institutions to support the resolution of local debt risks in accordance with laws and regulations. Morgan Stanley analysts believe that investors should pay attention to the stimulus measures of China's macroeconomic trend and the government's restoration of investor confidence, including the Politburo Conference, the Third Plenary Session of the Politburo, and the possible occurrence of China and the United States next month.The two heads of state met. Analysis: Weakened property market may drag down market confidence