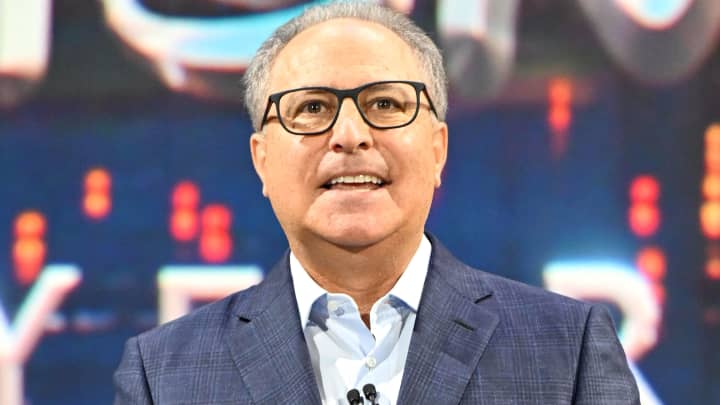

It's rare for Chief Executive Bob Iger to acknowledge his company has had creative missteps. So when he does, it's probably wise to pay attention.

"As I've looked at our overall output, meaning the studio, it's clear that the pandemic created a lot of challenges creatively for everybody, including for us," Iger said last week during Disney's earnings conference call. "I've always felt that quantity can be actually a negative when it comes to quality, and I think that's exactly what happened, we lost some focus."

Iger followed his comments with a new mandate: Disney will be making fewer films. It's a similar strategy to one Iger took when he first became Disney CEO in 2005. At the time, Disney's animation and live-action studio divisions had struggled with a string of failed movies, including including " ," and " " and " ."

Iger's solution then was to cut and slash its annual movie production output in half, releasing only about a dozen films each year. He also , giving Disney an immediate infusion of quality movies and a brand of storytelling that rubbed off on Disney's traditional animation studio.

Iger appears to be re-running the playbook for 2024. After flooding Disney+ with movies and other new content for several years, Iger is strategically cutting back to accelerate free cash flow generation and profitability. Disney in June — the first significant cuts in about a decade — as part of a larger round of job reductions. After releasing four Marvel Cinematic Universe movies in 2021 and three in 2022 and 2023, — "Deadpool 3." There hasn't been a Star Wars movie since 2019's "The Rise of Skywalker."

In 2006, acquiring Pixar quickly improved Disney's film quality and box office results. The animators' blend of technology and storytelling rubbed off on Disney's traditional animation unit, eventually leading to hits including "Frozen" and "Zooptopia." This time, Disney will need to improve organically, putting pressure on Iger and studio head Alan Bergman to show results as threaten to pressure management and the board.

"I feel good about the direction we're headed, but I'm mindful of the fact that our performance from a quality perspective wasn't really up to the standards that we set for ourselves," Iger said last week. "And so working with the talented team at the studio, we're looking to and working to consolidate, meaning make less, focus more on quality. We're all rolling up our sleeves, including myself, to do just that."

Iger noted the Disney animation studio's next release, "Wish," which stars Ariana DeBose and debuts in theaters on Wednesday, could begin a run of sustainable hits for Disney. Early ticket sales suggest "Wish" is tracking at $55 million for the Wednesday to Sunday period including Thanksgiving. That trails previous Thanksgiving openers from Disney movies including "Ralph Breaks the Internet," "Coco," "The Good Dinosaur" and "Tangled" but is higher than the $18.9 million brought in from "Strange World" last year and the $40.6 million from "Encanto" in 2021, according to data from Comscore.

In 2024, Disney will release Marvel's "Deadpool 3," Pixar's "Inside Out 2," and "Mufasa: The Lion King," the prequel to 2019 remake of "The Lion King." All three have blockbuster pedigree, based on the box office performances of their earlier films. "Deadpool 2" earned $785 million in global box office. "Inside Out" earned $859 million. "The Lion King" took in $1.6 billion in 2019, overtaking Disney's "Frozen" to become the highest-grossing animated film ever – the computer-generated animals as animation.

Still, there's no denying the studio has struggled in recent years. Other than last year's "Avatar: The Way of Water," acquired as part of Disney's , Disney hasn't had a movie gross $1 billion since the last Star Wars movie in 2019. Sony produced and distributed " ," which made $1.9 billion, although Disney's Marvel Studios did serve as a co-producer.

For context, among 2019 releases, Disney had seven of the nine movies that grossed more than $1 billion globally.

1. Avatar: The Way of Water: $2.3 billion (Disney, 2022)

2. Spider-Man: No Way Home: $1.9 billion (Sony, 2021)

3. Top Gun: Maverick: $1.5 billion (Paramount, 2022)

4. Barbie: $1.4 billion (Warner Bros., 2023)

5. The Super Mario Bros. Movie: $1.3 billion (Universal, 2023)

6. Jurassic World: Dominion: $1 billion (Universal, 2022)

Source:

While " " and " " were successful theatrically, Disney's recent track box office record has filled with misses. "Lightyear" and "Strange World" were duds in 2022. This year, " " and " " have bombed for Disney. "The Marvels," after the for a Marvel Cinematic Universe movie, is on its way to being a major disappointment. "The Little Mermaid" and "Ant-Man and the Wasp: Quantumania" failed to meet analyst expectations for ticket sales.

"We're proud of the box office successes we've had over the past couple of years, but there have been certain titles that haven't lived up to our own high expectations," Bergman told CNBC. "We've reduced the quantity of our output and are incredibly focused on the quality of our upcoming slate and it is incumbent upon us to execute as we move forward. I believe we're in a strong position for the future given our world-class brands, filmmakers, talent and creative teams."

Disney houses its studio business in a division it calls "Content Sales/Licensing and Other." This incudes Disney's theatrical business along with home entertainment and selling film and TV content to other third-party TV and subscription streaming services.

In its , Disney reported an operating income loss in that division of $149 million, which it attributed to "the performance of 'The Haunted Mansion.'" In its fiscal third quarter, Disney claimed a "Content Sales/Licensing and Other" operating loss of $243 million. A quarter before that, Disney lost $50 million, and $98 million in the quarter prior.

The last time Disney reported an operating income gain in "Content Sales/Licensing and Other" was its of 2022 — an earnings report delivered in May of that year, when Iger wasn't at the company and Bob Chapek was CEO. In that quarter, Disney reported operating income of $16 million, down 95% from a year earlier.

"At the time the pandemic hit, we were leaning into a huge increase in how much we were making," Iger said. "Returning the studio to basically the level of success that we became used to before the pandemic [is] one of the the building blocks of the company."

Disney is holding a town hall on Nov. 28 with Iger and his four division heads — Co-Chairs of Disney entertainment Bergman and Dana Walden, Parks and Experiences head Josh D'Amaro, and ESPN boss Jimmy Pitaro. The quartet under Iger are the four most likely people to ultimately succeed him as CEO. Disney as a likely time to name someone as Iger's heir apparent, CNBC reported earlier this year.

With Iger shifting Disney's focus from quantity to quality, the pressure will be on Bergman to ensure Disney pumps out movies worthy of the company's esteemed brand. Bergman has served in senior leadership roles in the studios division since 2001 but isn't a creative executive by background, having started as the unit's chief financial officer. He frequently clashed with Chapek and then-head of Disney's media and entertainment division, Kareem Daniel, over the company's decision to strip budget power from studio executives – a decision Iger reversed earlier this year.

Bergman built a solid track record of hits through his years as the division's president, including "Avengers: Endgame," "Star Wars: The Force Awakens," "Frozen," "Frozen 2" and "Toy Story 4." He will continue to rely on many of the same creative leaders that have produced those hits, including Marvel's Kevin Feige, LucasFilm's Kathleen Kennedy, Walt Disney Animation Studios creative chief Jennifer Lee and Pixar's Pete Docter.

Still, Alan Horn, formerly chairman of Walt Disney Studios, departed in 2020 -- coinciding with Disney's slump.

If Disney's shift away from quantity toward quality doesn't deliver stronger box office numbers, Iger may start facing investor and collaborator pressure to make leadership changes.

That could put Bergman on the hot seat.

–CNBC's contributed to this article.

Disclosure: NBCUniversal is the parent company of Universal Pictures and CNBC.